Weekend market update: As the US FDA approves the Pfizer vaccine for emergency use in record time, the development success shows what can be achieved when vast amounts of money and talent are thrown at a scientific problem. There's still plenty of cash available for tech and IPOs as the spectacular debut last week of delivery service DoorDash demonstrated, giving it a higher market value than either Kraft Heinz or Ford.

On Friday, the S&P500 was flat while NASDAQ lost a little. The US market is impatiently awaiting a stimulus deal as if it has a right to demand it and lost 1% over the week. Australia eked out a small gain, holding the six weeks of positives pushed higher by iron ore prices and consumer confidence. Commodity prices helped the $A to reach above US75 cents.

***

It's already become a cliché to say 2020 was a terrible year to be consigned to the rubbish bins of history and the 2021 return-to-normal will be welcome by all. And indeed, the pandemic turned lives upside down and millions suffered. But it also proved again that for financial markets and capitalism, far from being a free enterprise system where government interference is despised, when the going gets tough, bankers and companies run to the authorities for support. Central bankers become the heroes who save the system with a bottomless bucket of cash.

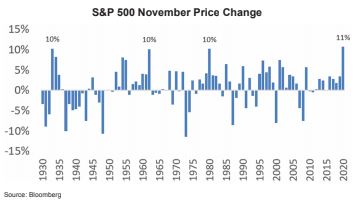

And so 2020 became the punch bowl full to the brim with liquidity spiked with 'whatever it takes' to have a recovery party. Iron ore prices are at a seven-year high, NASDAQ hits records daily and there is a flood of IPOs making people wealthier. Far from the predicted collapse in residential property prices, new mortgage commitments rose 23% in the year to October 2020 driven by owner occupied loans and rising prices. A friend told me this week he has borrowed at 1.79% fixed for four years ... champagne pricing. The S&P500 has hit frequent highs, and just experienced its best November on record, up 11% as shown below.

CBA reports that annual growth in wages and salaries paid into its bank accounts has accelerated rapidly in recent months as employment recovers. Gerry Harvey of Harvey Norman calls it the best trading conditions he has ever seen (and he's 81-years-old) and Metcash shares jumped when CEO, Jeff Adams said:

“It has been a standout first half for Metcash, with unprecedented sales growth underpinning a significant lift in earnings and cash generation. I am pleased to report that the Group has had a good start to the second half, with strong sales momentum continuing in all pillars in the first five weeks of trading. We are also expecting strong trading over the Christmas and New Year period."

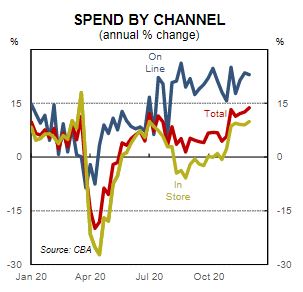

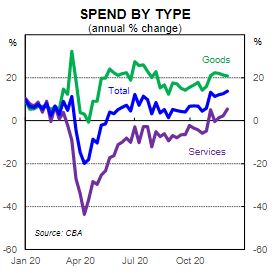

CBA credit card statistics are published quickly as a leading indicator, and this week they showed in-store and online doing well for both goods and services.

The ANZ-Roy Morgan Consumer Confidence index increased 1.8 points to 109.3 on 5 December 2020 and is now 13.8 points above the 2020 weekly average of 95.5. Consumer confidence is at its highest since November 2019 with more Australians saying now is a ‘good time to buy major household items’.

The Westpac-Melbourne Institute Index of Consumer Sentiment rose by 4.1% to 112 in December, and is now 48% above the low in April. It has reached its highest level since October 2010.

When the drinks are spiked, the headaches come later. While it looks like the party will continue well into 2021, at some time, the drinks must be paid for and someone will have to clean up the mess.

If this is what a recession looks like, funded by governments, who needs capitalism?

With markets so strong, where is value left in global equities? Most Australian investors do not have much exposure to emerging markets, and in this interview with John Malloy, he explains the case for the next cyclical upswing in these developing nations and shows how they are changing. Although the index is dominated by Asian countries, active portfolios find opportunities across the world.

Two of this week's articles take a look at what to expect in 2021.

Neuberger Berman's Joseph Amato and team have distilled their views into 10 key themes for next year in this summary to help position equity, fixed income and alternatives for the year ahead.

Economists at Vanguard, Qian Wang and Beatrice Yeo, have run their models on expectations for 2021, including what a balanced portfolio might look like under three scenarios. A diversified portfolio might not shoot the lights out but it will deliver over time.

Then three hard-hitting opinion pieces from experts in their fields.

Superannuation policy expert David Bell describes the shortcomings of the Government's proposed performance test for super funds. This is a major issue for the industry when the proposal imposes severe punishments on a fund underperforming by only 0.5%. Implementation is due by 1 July 2021 but it cannot continue in this format.

Actuary and demographer Bruce Gregor has pored over the Retirement Income Review and thinks a courageous government has an opportunity to make a couple of changes without drawing the ire of increasing the 9.5%.

On the subject of how capitalism does and does not work, activist investor Miles Staude says problems arise for investors when management controls the messages reaching the board. On behalf of his Global Value Fund (ASX:GVF), which is the largest shareholder, Miles is currently engaged with Contrarian Value Fund (ASX:CVF) on solutions for the LIC's weak performance and poor share price rating.

And Ashley Owen calls on Australian companies to diversify their revenue sources to counter the increasing trade tensions with China, the recipient of 40% of our current exports.

This week's White Paper from Neuberger Berman expands on their article above to explore the evolution of the investment environment over the past 12 months and the themes they anticipate for 2021.

Look out next week for a special ebook which brings together all our interviews for 2020 for some holiday reading.

Graham Hand, Managing Editor

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website