In this Weekend Edition, we include two new articles on women and investing to celebrate International Women's Day 2021 on 8 March 2021. The White Paper section is updated with an article on diversity and inclusion in business.

Weekend market update: It shows the perils of short-term predicting when the AFR carried the headline on Friday, 'Bonds blow up equity markets - again' and that night, the S&P500 rallied 2%, NASDAQ recovered 1.6%, and Australia is likely to open strongly on Monday. The US recovery was driven by strong payroll data leaving the market up 0.8% for the week, which hardly looks like a 'blow up'. Australia gained 0.6% last week despite losing 0.7% on Friday.

We have added another article this weekend on what is happening with bonds and how it might affect stockmarkets.

***

In 2020, the clichés reigned as we tired of hearing circumstances were 'unprecedented', we lived in 'uncertain times' but not to worry, 'we're all in this together'. Of course, we learned about 'social distancing', 'zoom-bombing' and 'lockdowns'. 'Working from home' was so common it became 'WFH'.

There's a new version in Canberra for 2021. The 'polispeak' has featured in the speeches of Treasurer Josh Frydenberg and Superannuation Minister, Senator Jane Hume. Listen closely. Two words have become platitudes, that is, words with a moral content that are used so often that they lose their meaning. This week, we explain what 'flexibility' and 'efficiency' now mean in superannuation policy. These two innocent-sounding words are softening us up for major changes in the way we think about superannuation.

In fact, if you go to the Treasury website and search for 'flexibility', you'll find the Government is offering flexibility on a wide range of super policies. There's even this little gem dated 3 May 2016 to improve super's flexibility:

"The Government will enshrine in law that the objective for superannuation is to provide income in retirement to substitute or supplement the Age Pension."

We're coming up for its fifth anniversary and nothing has happened. Well, perhaps the Government is not THAT flexible. The Treasurer at the time should have enough clout now to make it happen. It was Scott Morrison.

Superannuation, including whether to proceed with the legislated SG increases from 9.5% to 12%, is at an historical milestone as there will soon be more money in the decumulation (or retirement) phase than in the accumulation phase. Spending is a different ball game to saving, coming with a new set of complexities.

But as a sign of growing maturity, APRA announced this week that assets in the system now exceed $3 trillion for the first time. Jane Hume issued an underwhelming media release including:

"High fees, persistently underperforming funds and too many duplicate accounts are a drag on the system. Australians can be reassured that the Morrison Government is determined to continue our arc of reform ensuring the superannuation system is working harder for all Australians.”

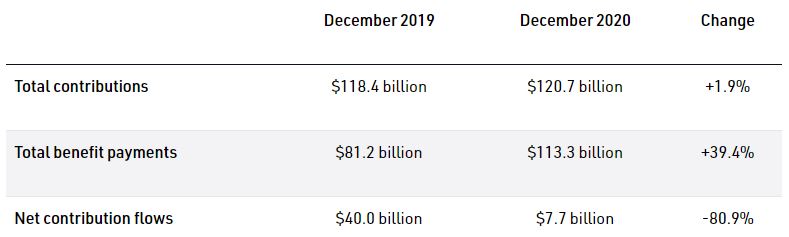

Total contributions to super were flat year-on-year, as shown below, and with personal contributions down 6.4%, the total was held up by employers. This demonstrates the importance of compulsion. Benefits paid grew strongly due to $36 billion under the Early Release Scheme.

For the Weekend Edition and International Women's Day, two additional articles.

Christine Benz checks whether the popular claim is correct that women do not invest as aggressively as men, and we have added Australian data to confirm her findings.

Then Karen Wallace examines five lessons from the life of Hetty Green, who became a highly successful investor, but was dubbed the Witch of Wall Street. The title comes mainly from her reputation for extreme frugality but the lessons are relevant for all investors.

Also in this packed edition ...

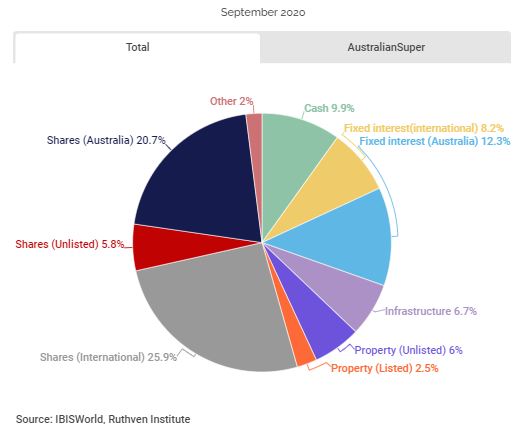

How is Australia's largest super fund allocating its investments? The chart below from new research by The Ruthven Institute reveals the AustralianSuper Balanced Fund (the top balanced fund performer over 10 years at 7.6%) adopted the following asset allocation in September 2020. How does this differ from your own allocation?

The next 10 years are unlikely to be as good as 7.6% for a balanced fund. Cash is a 10% allocation earning less than 1%, while bonds at 20% have benefitted from a major rally that is now over. That's 30% probably delivering negative real returns unless the bond investment moves up the risk spectrum.

It's always difficult to pick turning points in bull markets for equities, but we do know that high valuations lead to lower future returns. While the last decade delivered better than the superannuation industry expected back in 2010, don't expect to say the same thing when we look back in 2030. Roger Montgomery gives his reading on which parts of the market are overvalued, drawing on the warnings from many of the biggest names in global investing.

Also see last week's White Paper from First Sentier. It asks important asset allocation questions for 2021, such as whether it is worth owning bonds, can the good times continue for equities and is inflation a worry.

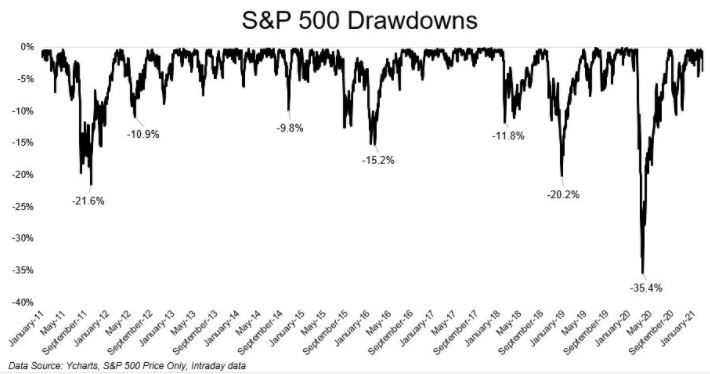

It's useful to remind ourselves that in the last decade, although the US S&P500 Total Return index is up almost 300% since 2011, there were still periods of significant drawdowns (that is, market falls) as shown below. Taking the up days and 10-year price rise chart out of the picture and seeing only the negatives makes it look like a poor decade. Investors need to accept that these drawdowns are an inevitable part of equity investing, and anyone who can't live with it will struggle for returns in the current environment.

It's rare that there is so much focus on bond yields and inflation, and it's mainly due to their potential impact on the sharemarket. The Reserve Bank of Australia (RBA) is so aggressive trying to keep the 3-year bond rate at its target 0.1% that it now owns 39% of the $34 billion April 2023 bonds and 60% of the $33 billion April 2024 bonds, according to Mason Stevens. It makes genuine price discovery limited as there are far fewer bonds trading in the open market.

The buying should go further along the curve, as it's distorting the yield curve. While 3-year is around 0.1%, it jumps to about 1.7% (and last week 1.96% before a rally) in the 10-year and above 2.5% in the 30-year. But the RBA resolve remains firm, and the market seems to be placing too much emphasis on the near-term threat of a rate increase. The RBA said this week:

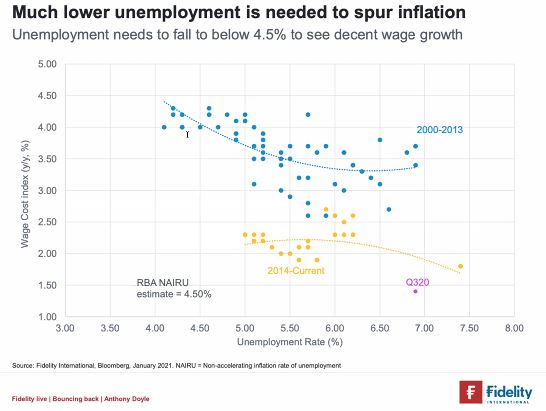

"The Board remains committed to maintaining highly supportive monetary conditions until its goals are achieved. The Board will not increase the cash rate until actual inflation is within the 2 to 3% target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest."

As this chart from Fidelity shows, wage growth in the blue dots from 2000 to 2013 was far stronger than in the yellow dots from 2014 to now, and in late 2020, wage growth was tiny and unemployment nearly 7%. We are a long way from meeting the RBA employment goals.

Two articles this week explore rates, inflation and economic conditions.

Simson Sanaphay expects a strong Australian recovery and describes five factors which will drive the outcome. Either way, expect bonds and inflation to be a much bigger influence on all assets in 2021 than we have seen for years. The important point for both Australian and US central banks is they are looking for (to quote US Fed boss, Jerome Powell) “actual progress rather than forecast progress” on inflation and growth before raising rates.

Then Miles Staude describes the market as a 'coiled spring' ready to jump ahead, with strong recovery signs and few clouds on the horizon (Australian GDP rose 3.1% in the December 2020 quarter, beating market expectations of 2.5%). He's one of many fund managers becoming more optimistic about 2021.

Remember also that rising bond rates are a sign of economic recovery, so it's not all bad for portfolios. An upwards move of bond rates is normal after our recent emergency period.

Dr Stephen Nash says the steepening of the yield curve with long bonds around 2% presents an opportunity to repeat the March 2020 trade where bonds provided some protection against the falling equity market. This trade clearly comes with downside price risk should rates rise further.

We haven't given much coverage to Bitcoin as its price movement looks like pure speculation not suitable for the portfolios of most of our readers. Jordan Eliseo explains why Bitcoin is unlikely to usurp gold as a preferred investment option for risk-conscious investors.

Take a look at the chart of the Japanese stockmarket below and its looks strong. But Hasan Tevfik reminds us that this is at the end of a lost generation of investment returns with the market still below its level of 1989. His worry is that some Australian companies might head down the same path, and there are stocks to avoid.

Back to IWD, this weekend's White Paper from MFS International features their President, Carol Geremia, discussing how the culture of every business must support diversity and inclusion. A few people in Federal Parliament would benefit from reading this after events over the last couple of weeks.

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter or extended Weekend Edition marking International Women's Day 2021.

Australian ETF Review from Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Latest LIC (LMI) Monthly Review from Independent Investment Research

Plus updates and announcements on the Sponsor Noticeboard on our website