It's rare that there is so much focus on bond yields and inflation, and it's mainly due to their potential impact on the stockmarket. When stock analysts value a company, they estimate the future cash flows from the business and discount the amounts to a present value. This gives an estimate of the intrinsic value of the shares. The lower the assumed discount interest rate, the higher the value of the company in the modelling. This is one reason why equity markets like lower interest rates, as it tends to push up share prices.

Low rates make growth companies look more attractive because the distant expected profits are worth more in present value terms. Lower rates also mean cheaper funding costs for companies, both in the debt and equity markets.

Of course, the opposite occurs when interest rates rise. It is somewhat paradoxical and another reason why share investing is not easy, because rising rates are often a sign of a stronger economy, which should be good for shares. It’s a reason why the market often reacts to economic news counter-intuitively. The economy is strong but stocks are sold. Go figure. If stronger economic growth means higher interest rates, should that be good or bad for share prices?

At the moment, the fear of rising rates is spooking equity markets.

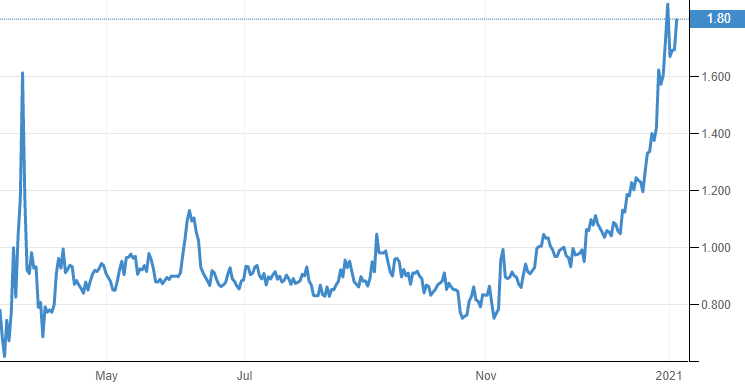

The bond market is reading the signs of vaccine optimism and stronger economic growth (Australian GDP rose 3.1% in the December 2020 quarter, beating market expectations of 2.5%) and pushing up the 10-year bond rate. The chart below shows the 10-year Australian Government bond rate for the last 12 months. For much or 2020, faced with the pandemic and slower economic growth, the bond market was not worried about inflation or rising rates, and the 10-year bond stayed below 1%. Recently, it almost touched 2%, reminding investors that even government bonds can be risky investments.

Remember, prices and yields have an inverse relationship. If yields rise from 1% to 2%, prices must fall. In this case, assuming a duration of 10 years and an immediate rate move, the price of the bond would fall 10%. Or rise 10% if the bond quickly falls from 2% to 1%.

10-year Australian Government bond rate over the 12 months to 4 March 2021

Source: Trading Economics

Reserve Bank wants low rates

What does the Reserve Bank of Australia (RBA) think of all this? Australia’s central bank has stated that it does not expect to increase the cash rate above 0.1% until 2024 at the earliest. It is deliberately holding rates down to stimulate the economy in response to the pandemic, and it has extended its interest rate target to 3-year bonds, also keeping it below 0.1%.

In fact, the RBA is so aggressive buying bonds to keep the 3-year rate at 0.1% that it now owns 39% of the $34 billion April 2023 bonds and 60% of the $33 billion April 2024 bonds. The market is happy to sell to the central bank and switch to longer bonds offering some yield gain, with the 10-year bond around 1.8% and 30-year above 2.5%.

Despite longer bond rates rising, the RBA’s resolve remains firm. It said in its latest report:

"The Board remains committed to maintaining highly supportive monetary conditions until its goals are achieved. The Board will not increase the cash rate until actual inflation is within the 2 to 3% target range. For this to occur, wages growth will have to be materially higher than it is currently. This will require significant gains in employment and a return to a tight labour market. The Board does not expect these conditions to be met until 2024 at the earliest."

There is little sign of significant wages growth and with unemployment at 6.6%, Australia is a long way from meeting the RBA employment goals. There has also been a major change in their rhetoric, as they now look for actual signs that inflation has risen, rather than anticipating a rise and trying to stop it. It means short-term cash and bond rates should remain low until at least the stated date of 2024.

What is the impact of rates on share markets?

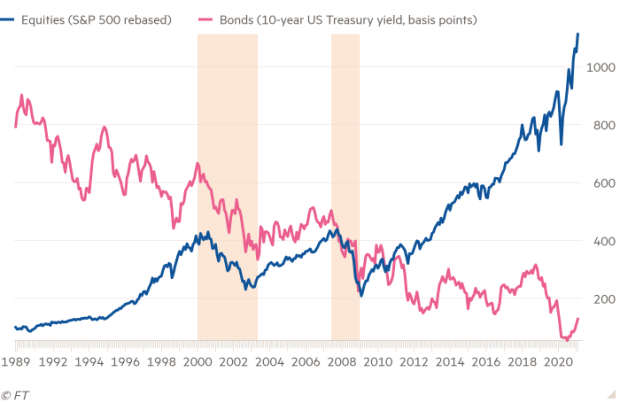

The following chart from The Financial Times shows the complexity of the bond rate/equity market relationship. At first glance, it looks like the blue line, the strongly-rising stockmarket (based on the US S&P500 index) since 1989 is accompanied by falling interest rates, the pink line showing the US 10-year Treasury yield. It is evidence of the valuation tailwind low rates give share prices.

Falling bond yields have often been associated with weaker equities

But look closer at the two shaded areas, the sharemarket declines around the ‘tech wreck’ of 2000, and the GFC and subprime crisis of 2007 to 2008. Sharemarkets fell and interest rates fell.

Australia tends to follow leads from the US, so it is equally important to know what the US Federal Reserve and its Chairman, Jerome Powell, are thinking. Powell said recently that the Fed will also maintain ultra-low interest rates and massive asset purchase programmes until substantial progress has been made on their US employment and inflation goals.

The central banks are singing from the same hymn sheet. Given current official unemployment in the US is at best 6.3% (and unofficial more like 10%) compared to the 3.5% level prior to the pandemic, there is still a long way to go.

Does it mean as economies recover from the pandemic and rates rise, sharemarkets will fall? Shane Oliver from AMP Capital recently said the key points are:

- Higher bond yields are normal in economic recovery and should not be a major problem for shares if they are matched by rising company earnings.

- But too rapid a rise in bond yields risks driving a deeper correction in shares.

- Central banks want higher inflation but will look through any short-term spikes.

- The 40-year downtrend in inflation and bond yields is likely over.

- But the fundamental backdrop of improving growth, rising profits and still low rates supports the case for solid 6-12 month returns from shares.

To date, the rise in bond rates has been orderly as inflation fears ebb and flow. The higher bond rates are close to pre-COVID levels. There is evidence of inflation creeping into the economic system, especially due to raw material price rises and some consumer goods shortages. The funding of massive multi-trillion dollars stimulus packages in the US also comes into focus for inflation and rate risks.

It’s not that 2% is historically a high rate, but the market is so comforted by artificially low rates held down by central banks that it is difficult to pull away from the feeding trough. Government bond rates also impact company and personal borrowing, and millions of Australians rely on low rates to service their mortgages. Higher rates would therefore feed into consumption and spending patterns.

Where does that leave us?

As ever in economics and stockmarkets, there is no one correct answer. There are many factors at play in the current recovery, especially when a mutant virus could scupper every other scenario.

In any case, investing should be about building a portfolio for the long term based on goals, risk appetite and financial capacity. Worrying about how a market might react to a high inflation number week-to-week is more short-term trading or speculation.

On balance, it is likely that the stockmarket would not react well to further rises in interest rates, especially if central banks seem to be struggling to meet their goals. However, if the rate rise is accompanied by economic growth and strong corporate earnings, then some companies would outperform the overall market and favour stock pickers.

For the moment, central bank resolve is high, they have plenty of firepower and the overall market is optimistic about a rebound from the virus. There is talk of ‘revenge spending’ as consumers open their wallets after global lockdowns, giving retail stocks a major boost. Service sector, travel and entertainment could recover well as borders open.

The question for central banks and governments is when they should start worrying about repaying the trillions of dollars of debt they have accumulated, when they can raise rates to take the froth out of the economy, and how much inflation to allow into the system. That said, the rise in official rates and short-term bonds seems some years away yet.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor.