So far this year, the DAX index is up 7% while the S&P 500 is down 12%. This illustrates Europe’s biggest outperformance relative to the US in over two decades. Currently, the STOXX Europe 600 is trading at just 14.6x 2025 earnings, significantly lower than the S&P 500 trading at 19.4x.

Global investors are starting to diversify away from the US equity markets and the US dollar. The uncertainty surrounding Trump Tariffs has led to increased international diversification in asset allocation.

European equities offer a rare combination of quality and value. Robust European businesses (often founder-led with durable earnings streams) are trading at meaningful discounted valuations compared to those in the US. These companies are also exposed to unique opportunities only viable in the European market. The Euro is also appreciating, up 11%, against the USD this year.

Germany’s fiscal shift: An economy boost amid market volatility

Amid the noise of global macro volatility, Germany has quietly staged a policy pivot. Its new fiscal policy, declared on March 4, aims to boost borrowings to renew economic growth.

Germany’s major fiscal boost includes a new €500 billion infrastructure investment fund, an exemption from the 'debt brake' for defence spending above 1% of GDP, and a rise in the net borrowing cap for federal states from 0% to 0.35% of GDP.

This movement presents Germany’s most aggressive fiscal stimulus in decades, positioning Europe as the next investment hotspot in the global macro landscape.

Europe’s expansion of monetary and fiscal policy provides a drastic contrast against the US tariffs, which primarily attack US domestic consumers. The US is effectively tightening fiscal policy and heightening the risk of stagflation, which will make it hard for the Federal Reserve to loosen monetary policy. This divergence could be the catalyst for European equity outperformance from 2025 onward.

Our European investments

At Profeta Global Investment Funds, we invest in quality (and mostly founder-based) companies in the European market. We currently have over 30% of our portfolio invested in Europe in high-quality companies including Nomad Foods and Euronext. Our collection of European companies has delivered and is expected to deliver strong earnings results, despite market downturns and volatility, as we invest in their resilient cash flows and long-term growth potential. Our current positioning is governed predominantly by defensive businesses with stable and growing earnings streams.

Nomad Foods

Nomad Foods delivered a strong set of results with organic revenue growth of 3.1% in 4Q24, driven by 4.7% volume growth. EBITDA grew 17.6% and their earnings per share were up 31%. This is a very strong result for a consumer staples company.

Nomad Foods has seen an inflection in volume growth, driven by winning back market share from private labels as well as new product initiatives, particularly in the frozen chicken categories in Germany and Italy. The stock has been appreciating nicely in the past month, and we expect this to continue with positive earnings momentum.

Profeta met with Stefan Descheemaeker, Nomad Food’s Chief Executive Officer, in London. Stefan founded Nomad Foods with Martin Franklin and Noam Gottesman, building the company into a leading frozen foods business in Europe.

Over the past decade, Stefan has transformed Nomad Foods into a market leader in frozen fish, vegetables and poultry. The business has doubled earnings over the past decade and is expected to grow continuously earnings per share at a double-digit rate.

The United Kingdom is their biggest market with about 1 billion in sales, led by the Birds Eye brand. Nomad Foods also owns Ledo, the leading ice cream brand in Croatia, with a 70% market share. They have started selling Ledo ice cream in Austria, where the brand has strong recognition amongst consumers.

Since it was listed in 2014, we have been following Nomad Foods and have been impressed by Stefan and the team’s execution in the food industry over this time. We have also been impressed with the capital management steered by the other two founders, Martin Franklin and Noam Gottlesman.

We like to invest long-term in owner-managed businesses with management being aligned with shareholders. In this case, we have this benefit as the founders still own 17% of the company, but we also have highly experienced billionaire financiers in Noam and Martin making the capital decisions.

Euronext

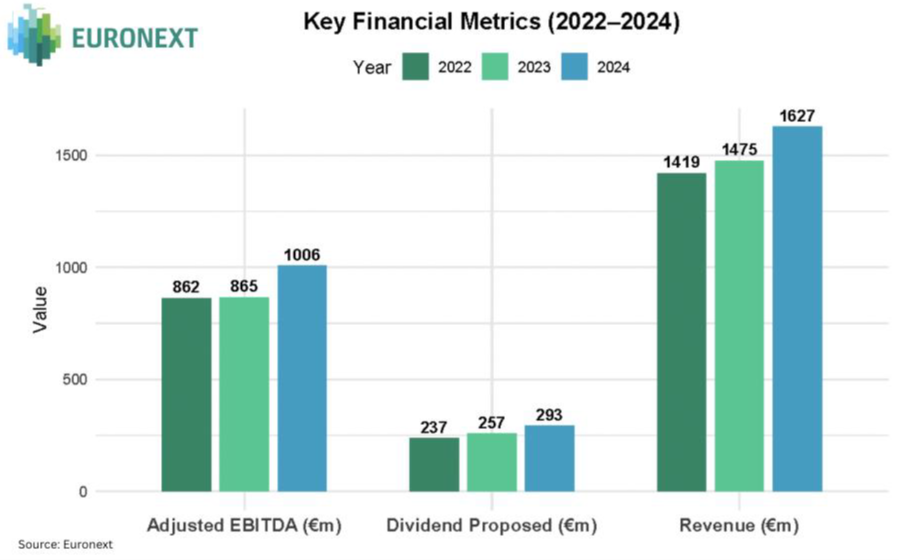

Euronext delivered a strong set of results for 4Q24 and the full year 2024. For FY24, revenue grew 10.3%, EBITDA was up 16.4% and adjusted earnings per share grew 19.6%.

All divisions drove strong earnings growth with trading revenue up 14% and clearing revenue up 19%. 58% of their revenue is from non-volume related businesses, making this equities-and-derivatives exchange a defensive business during weak economic cycles. Custody and settlement revenue grew 9% and advanced data services revenue grew 8%.

Profeta recently met with Georgio Modica, Euronext’s Chief Financial Officer (CFO), in Paris. Georgio has been the CFO at Euronext for the past eight years, over which time earnings per share have more than doubled.

Alongside Stéphane Boujnah (CEO), the management team and the board, Georgio has done a tremendous job consolidating the European exchanges industry and building up the business both organically and through acquisitions.

Euronext’s recent acquisition of Bolsa Italiana has been a success with most of the cost synergies delivered and all the clearing from London Clearing House migrated to their own platform. This has given them more flexibility to launch new derivatives products. Georgio is excited about the outlook for organic growth.

Their commodities derivatives are seeing strong growth with a large increase in the number of professional trading members. They are also set to launch power derivatives in the Nordics. In 2024, FX trading and power trading had a greater than 30% growth and Georgio expects continued strong growth out of fixed income and power trading.

Garry Laurence is the Chief Investment Officer at Profeta Investments. This article contains general information only and is not intended to provide you with financial advice or consider your objectives, financial situation or needs.