The appeal of owning traditional defensive assets of any type is currently less than in almost any other period in history. In fact, in this extremely low rate environment, we are seeing just how unattractive traditional defensive assets can become.

But despite the serious headwinds facing defensive assets, investors started moving billions into these safe havens well before COVID-19 struck, as many feared equity markets were toppy and it was late in the economic cycle. This may have proven a saviour for some investors in March 2020.

A redefinition of what is defensive

In the flight to safety, many investors took their medicine even though the cash rate was at an historic low, term deposits above 1% were rare and incomes from investment grade bonds had plummeted. The riskier high yield bonds broadly tracked the share market which calls into question their raison d'être as they do not have the desired defensive qualities in a downturn.

With income generation previously a major drawcard for a defensive allocation, many investors have realised they can no longer rely on an income of 5-7% a year and are having to rethink their future. Or at least change their investment strategy.

It is time for investors to broaden their approach to defensive investing and take a closer look at defensive sectors, rather than just the asset class.

To look only at defensive asset classes is a narrow view of the investment universe. This fails to take into consideration one critical factor that impacts the success or failure of the underlying companies, and that is the sector in which they operate.

For those more sophisticated investors who already take a sector approach to portfolio construction, it may also be time to look outside the usual suspects of consumer staples, healthcare and utilities, where demand for these goods and services are relatively inelastic and as a result they perform relatively well in a downturn.

Technology has joined the defensive club

During this pandemic and early days of the economic recession, we are seeing a surprising new entrant to the defensive sector grouping. Technology shares have been behaving a lot like defensive shares such as food and utilities.

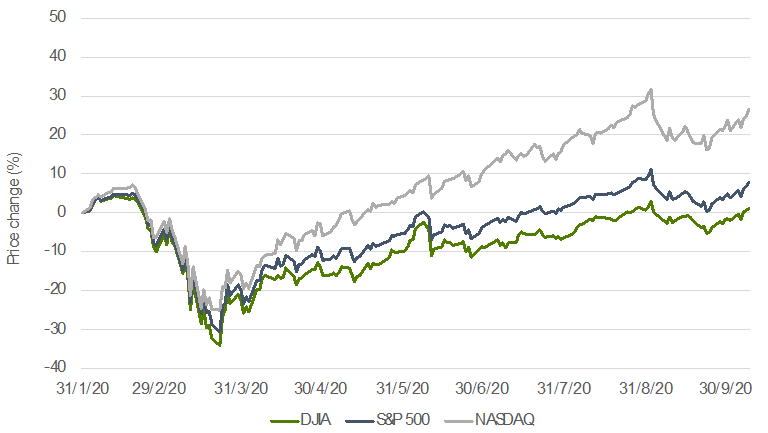

The S&P/ASX 200 is down 12.6% since February 2020, while the S&P ASX All Technology Index, a broad index of technology companies, is up 30%. Over the same period, the S&P500 is up nearly 8%, while the NASDAQ, the home of many technology companies, is up over 25%. This is not a fluke. See the chart below for a comparison between the NASDAQ, S&P 500, and DJIA.

DJIA v S&P 500 v NASDAQ

Source: S&P Global

Technology is holding its own and providing investors with a defensive position in this time of great uncertainty, with the NASDAQ fuelled by the strong revenues and forecast growth rates of many of its technology companies.

The reasons are plain to see, not least because technology has been the lifeline for individuals and businesses during lockdown. In the US, a recent Fortune 500 CEO poll found that 75% of companies plan to increase spending on technology.

So while the NASDAQ suffered a fall in September due to investors reducing their valuations for companies such as Apple and Tesla, and further exacerbated by the number of equity derivates involving both retail investors and SoftBank, the index has stabilised (and recovered) recently. Their traditionally higher valuations can be attributed to drivers such as high margins, growth rates and their ability to be agile in adapting to consumer and businesses changes caused by COVID-19.

History has proven that technology thrives on shocks. These are events that are, by and large, unexpected and bring out changes in real economic growth, inflation and unemployment.

There has been no greater shock in a generation than COVID-19. This is a shock that will have lasting effects and technology will exacerbate the impact on certain sectors and force changes that allow businesses to survive. COVID-19 has accelerated innovation in sectors including ecommerce, cloud computing, gaming, streaming and remote communication such as videoconferencing.

Technology is a deflationary force

Investments in technology by companies are made to reduce costs, increase profits and improve efficiencies. It is difficult to imagine that any business will reject technology that enables them to produce more product, more quickly and ultimately make larger profits.

Investors are already shifting away from the today’s sunset industries and hedging with investments in technology. As a resource economy, it has been difficult to avoid investing in large mining companies but the shape of our economy is changing. Some commentators have suggested that COVID-19 has hastened the slow passing of the oil age and is driving an increasing focus on sustainability generally. Technology drives this sustainability.

Investors taking stock of tech opportunities

Investors will undoubtedly be taking stock and assessing their investment portfolio as the world waits and watches to see what happens next in these strange times. With tech shares currently trading at high multiples, we can expect investors will look across the spectrum of tech investment opportunities. Venture capital funds are sought after as investors seek exposure to early stage tech businesses in what is ultimately a long-term game plan.

Technology has never been more important. This holds true in daily lives, in business and in the global economic recovery. When times are tough, corporates slash procurement costs, automate procedures and optimise back-office efficiencies. Technology delivers on all of these fronts. In better times, we can expect to see high growth tech businesses continuing to innovate and bring new products to consumers and business.

With a greater focus on defensive sectors rather than poor-performing defensive asset classes, investors may just be able to have their cake and eat it. A strategy that is both high growth yet defensive, supporting economic recovery and creating an economy of the future.

Benjamin Chong is a partner at venture capital firm Right Click Capital, investors in high-growth technology startups. This article is general information and does not consider the circumstances of any investor.