Like many older people, my mother’s attitude to money and investing is simple. Save up cash, buy a house, upgrade to a better house in her case, put spare money into the bank, and use that savings plus the age pension to see out your remaining days.

My mother has always been suspicious of the share market. For her, it’s a quasi-form of gambling. Far too volatile for her to part with her bank savings.

The risks in not taking risk

While I’ve inherited some of her conservative ways, I’ve learned through my investing career that people like my mother overestimate the risk of owning stocks and underestimate the risk of not owning them in the long-term.

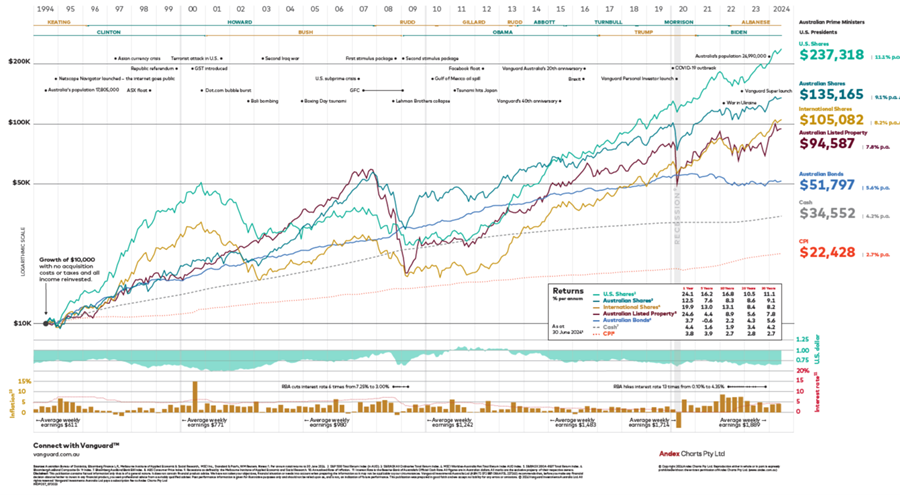

This chart illustrates it well.

Vanguard chart

Click for larger image

The chart shows the how a starting balance of $10,000 would have changed in value after being invested into six asset classes over the past 30 years. The top performer has been US stocks, where $10,000 investment in the leading 500 US companies in 1994 would have grown to $237,318 now. At an average total annual return of 11.1%, an investor would have made about 23x their money, assuming no additional investments and the reinvestment of all income distributions.

Australian shares have been the second-best performer, with a 9.1% per annum average annual return for the All Ordinaries Index over the 30-year period. Notice how much a 2% difference in annual returns between Australian and US stocks makes to total cumulative returns. An Australian share investor made more than $100,000 less!

International shares returned a little less, with an 8.2% annual return.

Fourth place goes to Australian listed property, measured by the S&P/ASX 200 A-REIT Total Return Index, where a $10,000 initial investment would have grown to $94,587, an average annual return of 7.8%.

Australian bonds are next, returning 5.6% per annum, and cash trails the pack with an average annual return of 4.2%.

Notice how much a small difference in average annual returns makes to the total cumulative returns of the different asset classes. For instance, 2% difference in annual returns between Australian and US stocks results in a $100,000 difference in total return. A 3.5% difference in annual returns means Australian stocks made $83,000 more than Australian bonds over the 30 year period.

Peter Thornhill’s tweak

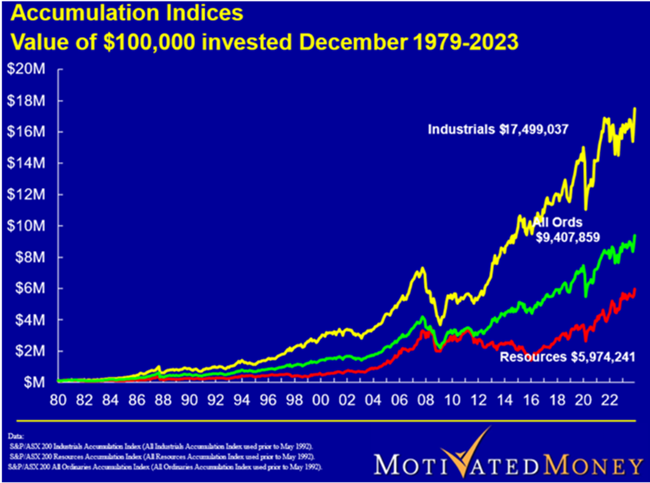

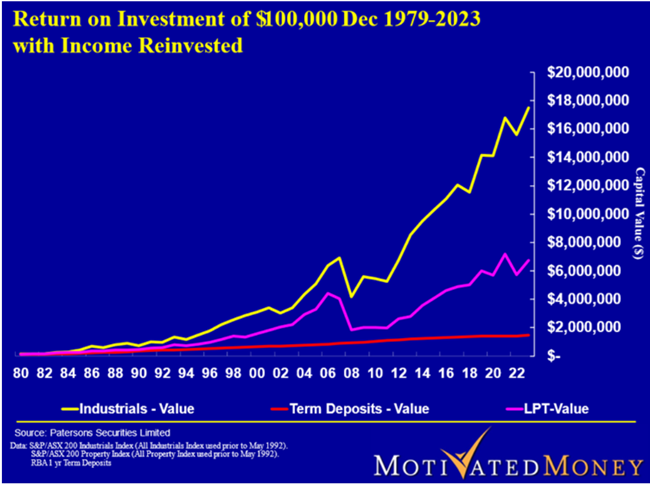

Well-known financial author and friend of Firstlinks, Peter Thornhill, makes a similar case for the power of owning shares in the long run, but with a twist. He advocates holding a particular part of the Australian share market, namely industrials.

In his eyes, buying and holding industrial shares is superior to owning the All Ordinaries. It’s also better than holding resources and property stocks, which have underperformed in the long term, primarily due to their capital intensive operations.

Thornhill says the opportunity cost of not owning stocks is too large to ignore.

Another perspective on returns

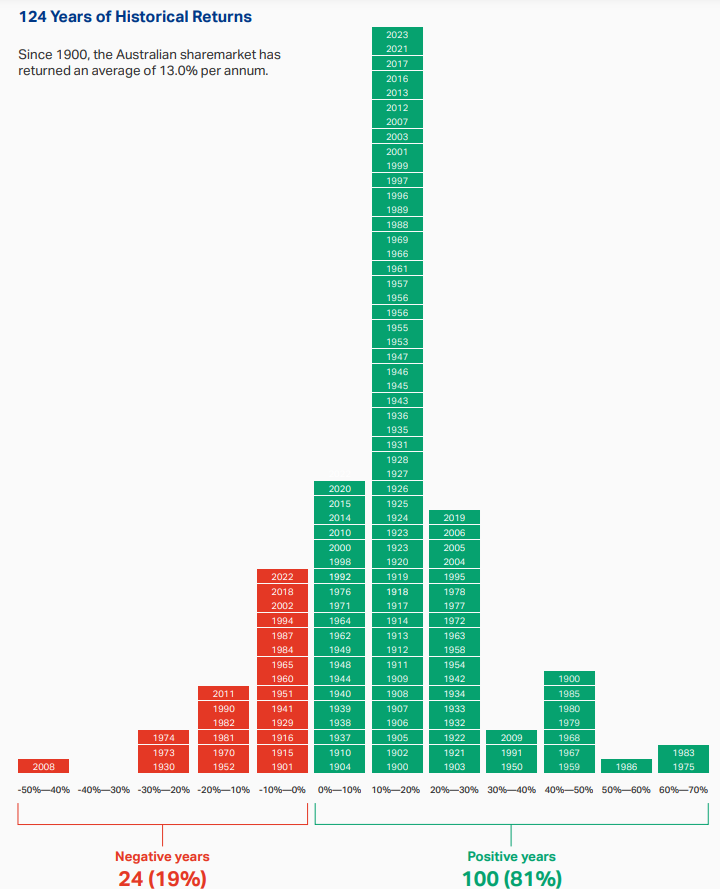

People like my mother will look at the above and think that’s all well and good, but what about the potential to lose a lot of money on stocks in the short term, or even medium-term.

Here’s a breakdown of ASX All Ordinaries Index returns over the past 124 years.

Source: ASX

The ASX All Ords has returned 13% per annum since 1900. 100 of the 124 years have resulted in positive returns – that’s 81%, or four out of every five years.

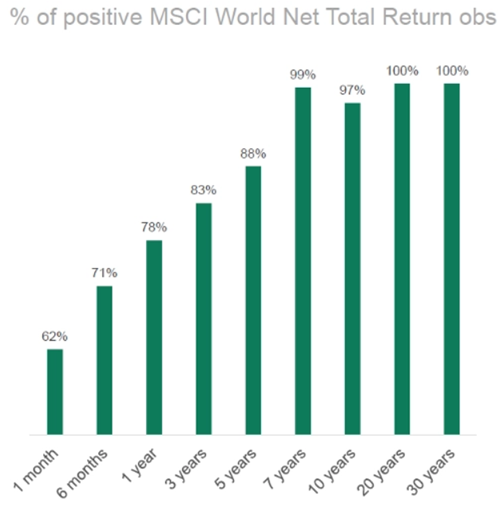

Also, if you hold shares for a period of seven years or longer, the chances of getting positive returns in Australia and internationally is almost 100%.

Source: Firetrail

Stock returns aren’t magic

The returns from stocks don’t come out of nowhere; they’re driven by earnings. Though these earnings can go up and down, they’ve consistently gone up in the long term.

Legendary stock picker, Peter Lynch, highlighted this in a speech in 1994:

“Some event will come out of left field, and the market will go down, or the market will go up. Volatility will occur. Markets will continue to have these ups and downs. … Basic corporate profits have grown about 8% a year historically. So, corporate profits double about every nine years. The stock market ought to double about every nine years. So I think — the market is about 3,800 today, or 3,700 — I'm pretty convinced the next 3,800 points will be up; it won't be down. The next 500 points, the next 600 points — I don’t know which way they’ll go. So, the market ought to double in the next eight or nine years. They’ll double again in eight or nine years after that. Because profits go up 8% a year, and stocks will follow. That's all there is to it.”

Essentially, Lynch is saying; buy stocks, hold them, and ignore everything else.

Funnily enough, the Dow Jones Industrial Average has compounded at 8% per annum in the 28 years since Lynch made that speech, while earnings compounded at a marginally lower rate.

Buying shares is easy, holding onto them is harder

Through the years, I’ve learned that investing is probably 20% maths and 80% psychology. It’s one thing to understand the power of owning stocks and compounding, it’s quite another to be able to stick with shares during tough times.

Respected investment author, William Bernstein, suggests many investors can’t handle volatility and their portfolios need to reflect that.

“… yes, compounding is magic, but you have to observe Charlie Munger’s prime directive of compounding, which is never to interrupt it. So, you have to design your portfolio not with the normal 98% of the world and 90% of the time in mind. You have to design your portfolio with the worst 2% of the time in mind so that you don’t interrupt compounding, which basically translated into plain English means that you probably should have more safe assets than you think you should have. In other words, a suboptimal portfolio that you can execute is better than a stock-heavy optimal one that you cannot execute.”

Bernstein has a point though I have a different take. Yes, switching portfolios at the wrong time can lead to terrible results. However, implementing a suboptimal portfolio also comes with a huge opportunity cost. It can mean leaving tens of thousands, or maybe a lot more, on the table. It can mean the difference between an ok outcome and building real wealth.

Which stocks?

You might be like my mother reading this (at least I hope she is) and thinking, “Alright, I’ll buy some stocks, or buy more stocks as the case may be, but which stocks should I buy?”

I’ve looked at how to build a lazy portfolio in a previous article.

The easy and low cost way to buy stocks is via ETFs which cover the entire market. For example, Vanguard’s Australian Shares Index ETF (ASX: VAS) tracks the ASX 300, which comprises most of the listed stocks. For international exposure, Vanguard’s MSCI Index International Shares ETF (ASX: VGS) covers the world ex-Australia stocks.

If you want to own stocks directly, I’ve written of 16 ASX stocks to buy and hold forever, and 20 US stocks to own indefinitely.

If you’re after income from companies, I’ve also written of 11 dividend stocks worth holding for the long term.

Finally, if Peter Thornhill’s ideas piqued your interest, there’s a well-run listed investment company (LIC) that invests solely in ASX industrial shares – Whitefield Ltd (ASX: WHF).

Final word

My argument that there's only one place invest to build wealth for the long term depends on investors having the right risk capacity and investment horizon. Please seek advice if you need it.

James Gruber is the Editor of Firstlinks.