International Women’s Day 2020 coincides with the release of the latest online investor research from Investment Trends, based on a survey of more than 13,000 Australians. So there is no better time to look at key trends in the retail investing space from the perspective of women investors.

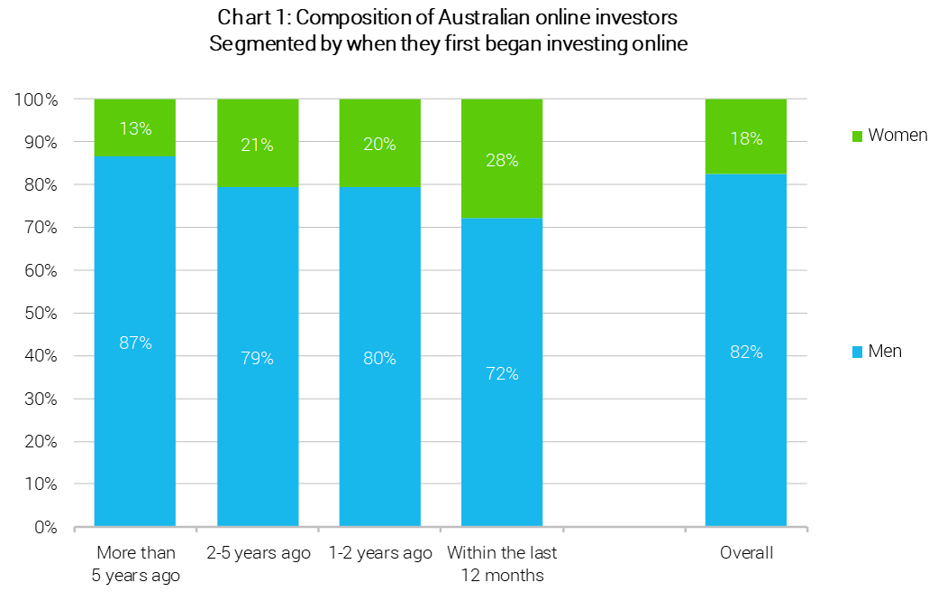

Our latest research shows that women still make up only 18% of the 750,000 active online investors across Australia. But the good news is this gap is closing.

In recent years – and particularly through 2019 – the proportion of Australian women who began investing for the very first time grew substantially to 28% of that cohort. This is more than double the rate observed five-plus years ago, as shown in chart 1 below.

While more work needs to be done to lift the ratio of women investors, Australia is substantially ahead of established markets such as the UK (11% women, 89% male) and is drawing closer to the US (21% women, 79% male).

Improving investment knowledge

For women, knowledge and education are central to their investment journey.

Our research shows that women who invest have a strong desire to expand their knowledge and further educate themselves on investments and investing.

Women most often rely on their own research and company-produced reports as a foundation for making investment decisions - which is similar to their male counterparts.

But they are substantially more likely to collaborate and discuss ideas with their friends and family members (37% cite this vs 28% for males).

Women are also more likely to:

- seek out the views of prominent investors and commentators (24% versus 22%)

- listen to investment-related podcasts (19% vs 17%)

- rely on investment-related online forums and blogs, with the Barefoot Investor a firm favourite (36% vs 19%).

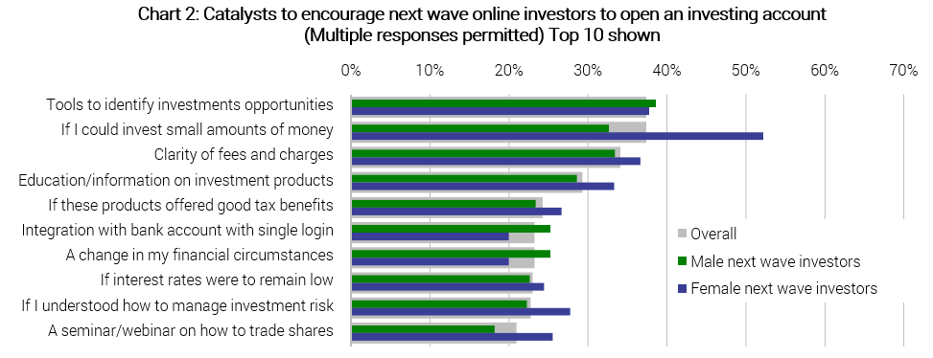

The same is true for women who want to begin their investing journey in the next 12 months. This group – to a vastly higher extent than men – want to start by investing small amounts of money (52% vs 33%). And they are significantly more likely than men to want education, a good understanding of how to manage risk and the ability to share and learn from the experience of others (see chart 2).

It is no coincidence, then, that both in Australia and globally, women investors have increasingly embraced low entry cost products that rely largely on exchange-traded funds, such as microsavings apps and robo-advice services.

Investing globally and sustainably

Right across the Australian investor population, our research has tracked a growing investment demand in two areas:

- international markets

- environment, social and governance.

Currently, over half of the online investors surveyed say they invest in international assets in some shape or form, a proportion that is roughly similar across gender lines (50% for women and 55% for men).

But the propensity to add overseas investments to their portfolios is strongly linked to investing experience. The longer a person has been investing, the more likely they are to seek exposure to investments outside Australia.

Where our research does show a gender differential for overseas investing is in the investment vehicles used for overseas exposure.

Women are more likely than men to access international exposure through ETFs (55% vs 49%) instead of direct equities (36% vs 46%). In fact, the core benefits of ETFs – low cost, easy access to a diversified portfolio – resonate strongly with women irrespective of the fund’s underlying exposure.

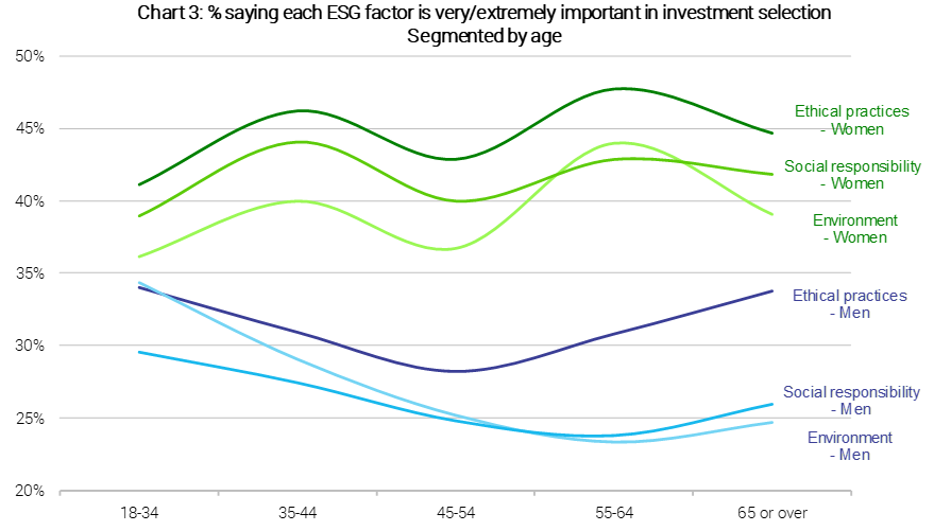

On the ESG front, more than a third of Australian investors (36%) now say they have or will use ESG factors when selecting their investments. While men and women report this in equal proportions, women across every age group place greater emphasis on ethical, socially responsible and environmentally responsible factors (see chart 3).

But once again, women investors are almost twice as likely to feel they don’t know enough about responsible investing to get started (22% vs 12%).

Industry’s role in empowering female investors

Service providers and product manufacturers can help women align their investments to their values, goals and aspirations. But to do this they must deliver the products and tools to help start the investment journey as well as deepen the investing journey.

The theme of this year’s International Women’s Day is #EachforEqual, and financial equality remains central to this goal. It is crucial that the wealth management industry continues to empower women from all walks of life to take control of their financial wellbeing – young or old, wealthy or financially-challenged, self-reliant or requiring financial advice.

To make a positive difference, the entire wealth management ecosystem needs to focus on providing meaningful, engaging and networked self-education materials that help women start or deepen their investment journey.

Suzie Toohey is Global Head Client Service and Sales at Investment Trends.