The excellent television series currently being shown on ABC television, Making Australia Great: Inside Our Longest Boom, by George Megalogenis (available on iview here), is a journey down memory lane for those involved in financial markets for many decades. It must be hard for younger folk to believe that the exchange rate was once set by regulators having a chat each day. They were the more relaxed days before deregulation.

This article recalls those days and explains why zero coupon bonds are sometimes called dingo bonds in Australia, 30 years after these securities were first created. Even the current Social Security Laws, released just last week, refer to dingos.

Where does the expression come from, what does it mean, and what happened to the other animals, especially the koalas?

A dingo bond represents a zero coupon bond stripped from a negotiable government bond obligation. A 10-year government bond paying half-yearly coupons is actually 20 interest payments and a repayment of principal on maturity. It is possible to ‘strip’ each of these obligations and sell the pieces individually. For example, an investor might buy the right to just one payment in seven years’ time. The 21 future payments can be sold to hundreds of investors as separate zero coupon bonds.

And that’s the deal I tried to do in 1984.

Treasury still told the Commonwealth Bank what to do

What is not mentioned in the ABC series is another form of market regulation: the Commonwealth Treasury used to tell the Commonwealth Bank what to do, at least until the Bank was privatised.

This is the story of a minor footnote in the history of government control over the market. I was too junior in the Bank at the time to know how widespread the government influence remained before privatisation, but I’m guessing it was considerable.

Prior to 1959, the Commonwealth Bank had dual functions as both the central bank and a commercial bank. The government then split the roles, giving central bank functions to the Reserve Bank, and the Commonwealth Bank remained under government ownership until privatisation started in 1991. I joined the Bank in 1979 when the Bank carried a government guarantee but otherwise operated as a normal commercial bank ... although not quite, in my limited experience.

Name the day you become a millionaire

The attractions of stripping individual zero coupon payments in 1984 were considerable:

- At that time, taxation law allowed the tax on the income to be paid on maturity. An investor could buy a zero coupon bond today and not pay any tax on the accrued income until it was actually received, maybe 10 or more years later. For investors who expected to be in a lower tax bracket, say after retirement, it was wonderful to defer income.

- Interest rates were high, and the increase in value was spectacular. Because the securities did not receive regular payments of interest, they would be priced at deep discounts to their face value. For example, a 10-year zero coupon at the prevailing rate of 14% would increase in value almost four times, so $26,000 would become $100,000.

- The future payment was an obligation of the Commonwealth Government, the most secure form of investment possible.

This form of coupon stripping had started in the US around 1982, but it had never been attempted in Australia. At Commonwealth Bank, we partnered with Merrill Lynch to develop the market here. These engineered products always carried animal names. Merrill’s was called TIGRs, or ‘Treasury Investment Growth Receipts’; Salomon Brothers invented CATS, or ‘Certificates of Accrual on Treasury Securities’; and Lehman had LIONs, or ‘Lehman Investment Opportunity Notes’. We sat around tables covered in empty pizza boxes and cans of beer late into the night, throwing around different names. It had to be a friendly Australian animal to improve global sales, and we had to have the name ‘Treasury’ or ‘Commonwealth’ or 'Australia' in there, to inform investors it was a government obligation, not the Bank’s or Merrill’s. And so we settled on COALA (pronounced ‘koala’), which were ‘Certificates of Accrual on Liabilities of Australia’. I was uncomfortable with the ‘C’ but the Americans loved the idea of selling little furry animals.

Over the course of several months, the excitement grew. We drafted offer documents, we developed the advertising campaign, we chose a suitable government bond, we decided how much to issue. The numbers seem unreal in the current low rate environment. If we bought $100 million face value of bonds at par with a 14% coupon, we had $14 million of annual interest payments to strip for 10 years plus the final maturity, giving a $240 million transaction. This was a big deal for a new product 30 years ago.

The advertising agency devised a detailed print campaign. ‘Name the day you become a millionaire’ screamed the headline. Then we showed someone investing $250,000 today and receiving $1 million back from the government in 10 years, with no tax until maturity. It was brilliant. We booked the advertising, installed extra phone lines in the office to cope with the calls, trained a few staff to answer simple questions and we were ready to push the button.

And this was all in the days when a young banker could try these things with a nod from his boss. There was no compliance team, no risk section, no committees, no marketing department. It’s incredible to think back on the delegated trust and authority. It would be impossible to do it now without a hundred people checking every step.

The birth of DINGOs, the still birth of COALAs

Shortly before the launch, the Treasurer of the Bank, Fred Hulme, who had been aware of the months of work undertaken with Merrills, made a fateful decision. He decided to tell the Managing Director, Vern Christie. And Christie thought he had better advise the Commonwealth Treasury, and the Secretary of the Treasury was John Stone.

John Stone is featured in the ABC Series. He was Secretary from 1979 to 1984, and when Paul Keating became Treasurer in 1983, he initially retained Stone as Secretary. As the Megalogenis story shows, Stone had very strong opinions on most Treasury matters. When he found out about the COALA project, he hit the roof. He immediately saw the potential for loss of government revenue. He told Christie to cancel the launch immediately, and he would move to introduce tax legislation to ensure the accrued income on a zero coupon bond of longer than one year would be treated for tax purposes as income in the year it was earned but not received.

The cancellation was due to the Commonwealth ownership of the Bank. When we told the Americans from Merrill Lynch, especially the one who had left his life behind in New York and camped in Sydney for a couple of months, they were dismayed. They said they would never have partnered with a government-owned bank if they had known the government could interfere in a commercial transaction.

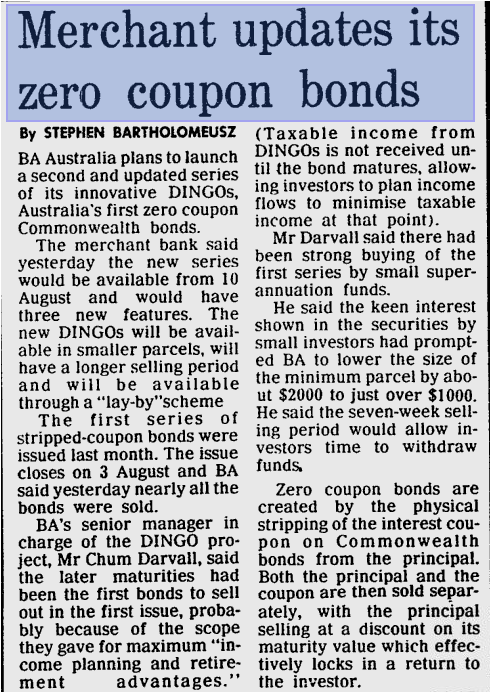

Within a few weeks, another investment bank, BA Australia, launched a competing product, called ‘Discounted Investments in Negotiable Government Obligations’, or DINGOs.

This is an extract from The Age, 1 August 1984. BA Australia managed some successful transactions before John Stone slammed the tax door shut. The COALAs never left their cage, the Americans trudged back to New York wishing they’d worked with someone else, and I wondered what might have been if we’d just done it without asking permission from our owner.

So today we have DINGO bonds

Everyone called the new rules the ‘dingo legislation’, zero coupon bonds generally became known as ‘dingo bonds’, and the expression has lived on through the decades. The COALAs, you might say, were stonewalled.

Graham Hand has worked in wealth management and banking for 38 years and is the Editor of Cuffelinks. He will be presenting on SMSF risk management to the Australian Investors Association on 8 April 2015.