[Updated version with new research on super fund satisfaction ratings from Roy Morgan at the end of the article].

The Productivity Commission (PC) Report to assess the efficiency and competitiveness of the superannuation system has pushed the wealth industry into a spin since its release in January 2019. The full 700-page Report is an impressive piece of work, linked here. Its key conclusion is that structural flaws are harming millions of Australians, and fixing the problems could give new job entrants today an extra $533,000 by the time they retire in 2064.

Here are a selection of the headlines the PC Report has generated, showing both support for and opposition to the recommendations.

Source: Stephen Huppert

Source: Stephen Huppert

This article focusses on the proposal for a shortlist of 'Best in Show' funds for new superannuation members. An independent expert panel would select 10 top-performing funds, and the two-thirds of new workers who don’t know what to do with their super would be handed this list to choose from. The names would be updated every four years, and according to the PC: “Our approach is one of employee (rather than employer) choice.”

Superannuation industry reaction

It’s not often that the Financial Services Council (FSC) representing retail funds, and the Australian Institute of Superannuation Trustees (AIST) representing industry funds, agree. Change often benefits one over the other. In this case, both want to protect their clients, and choosing only 10 winners undermines most of their members. Chief Executive of the FSC, Sally Loane, said:

“Taking default superannuation out of the industrial relations system and putting choice into the hands of consumers should be the cornerstone of a modern superannuation system. The FSC is very concerned about the potential unintended consequences for the economy of a ‘10 best in show’ model because it could create a monolithic concentration of funds, stifle competition and create huge barriers for innovative new products.”

AIST’s Chief Executive, Eva Scheerlinck, dislikes the denial of default status for the over 90% of funds not in the top ten:

“It will remove many high-quality funds from the default system, which may also disadvantage members in these funds.”

Let’s look at some reasons why the PC’s recommendations are unlikely to work.

1. The focus should be more on the worst funds, not the best

In diverting most attention to how the Best in Show will be selected, the PC creates the wrong emphasis. Although it acknowledges that many funds are poor performers, with low scale, high fees and inadequate compliance, its primary solution is to pick the 10 best and hope members gravitate towards them. However, the list is overwhelmingly for new super members who do not make a choice, and their balances are tiny in the super pie. The vast majority of members will not change, so the proposal will do little for the estimated five million members in poor funds who are victims of the ‘unlucky lottery’.

For example, on scale, 93 of the 198 APRA-regulated funds have less than $1 billion in assets. The PC estimates cost savings of at least $1.8 billion a year if the 50 highest-cost funds merged with 10 of the best. Then it admits switching between funds is modest, and most people do not understand performance, fees and charges and therefore will see no incentive to change.

The PC is aware of the case for ‘lopping off the tail’ of poor funds but dismisses it in favour of Best in Show. On page 539 of the Report, Geoff Warren of ANU is quoted:

“The performance benchmarking analysis is notable for revealing what appears to be a tail of poorly performing funds. It is not clear that the remainder of the industry is delivering anything different from random variation around their benchmarks.”

The main way to help people in poor-performing funds is not to take the hazardous path of picking 10 winners from 198. It will not matter much over time if a member is in the 11th, 15th or 30th fund. They are all likely to be acceptable as the better funds among 198. The main point should be rationalising the sub-par funds.

2. Change will be extremely slow

In fact, change in super fund allocations will be much slower than most commentators are suggesting. The Best in Show list is only a ‘nudge’ (to use the PC’s word). Another recommendation to only have one default fund for life will increase the likelihood that people will not change. Members are not forced to select a new fund, the Best in Show is targetting new employees who do not make a choice, employees can continue to choose from the wide set of MySuper funds or select their own SMSF.

The PC’s own numbers for contributions each year are:

- New workforce entrants: $1 billion

- Job turnover or workforce re-entering: $16.5 billion

- Voluntary switching: $2.2 billion

- Staying with existing fund: $128 billion

All this fuss is for a few billion in a system with $2,700 billion in balances and $150 billion in new contributions a year. New workforce entrants are the lowest-paid employees, and most higher-paid employees are generally disengaged and will not even notice there is a Top 10 list. How will anyone make them care? Are we having this debate solely over the $1 billion from new workforce entrants each year?

3. This year’s winner is often next year’s loser

Fund performance comes from asset allocation, stock (or manager) selection and fees. Even where two funds make exactly the same proportional allocation to, say, Australian equities, there will be a significant difference in the stocks held, directly or indirectly. Super funds either insource stock selection to an in-house equity team, pick active managers or select index funds. Some funds have a value bias, some growth, some large cap, others small/mid cap.

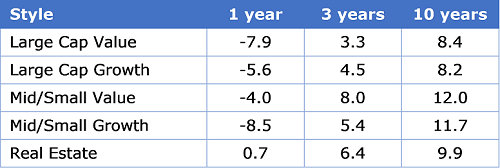

Consider the Morningstar data for sector performance to 30 November 2018 for Australian equities and property in percent per annum:

These are all Australian equities. In large caps recently, a growth style has outperformed a value style, but over longer terms, value normally does better. In small and mid cap companies, the distinction is even larger between growth and value. A mean reversion might occur at precisely the wrong time for a fund selected based on recent success.

Industry veteran and former CEO of Lazard Asset Management, Rob Prugue, wrote in LinkedIn on the PC’s recommendations:

“I guess the authors of the productivity report have never heard of mean reversion? Even indexes, when thrown into an investable universe, mean revert. When I was a manager, return-based ‘fund awards’ used to scare me as more often than not, these awarded funds would likely mean revert. Never met a portfolio manager whose stock selection criteria was based on the historically best-performing large cap names with low margins. Yet it seems ok for members to choose their super funds accordingly?”

4. Large inflows (if they occur) may lead to average performance

Let’s accept the Best in Show change might generate large flows, since many prominent people are arguing this. For example, former Labor Minister and Chair of IFM Investors, Greg Combet, said funds not selected will be “just left to die on the vine”.

A fund receiving massive inflows faces a continuous problem sourcing attractive investments. They will need to operate in the most liquid, highly-researched and transacted sectors to find assets in large volumes. Any of the CIOs of a large super fund will say there are certain asset types, such as hybrids and small caps, that they cannot access in large enough volumes to make investment worthwhile. Imagine a $100 billion fund buying a $10 million parcel. It is 0.01% of the fund, so even a doubling in value will have negligible impact on performance. It’s not worth making a phone call or undertaking the research.

(As an aside, one of my past roles was to select fund manager relationships, and often these were new businesses. Performance invariably fell with volume, as a manager with a small portfolio can concentrate on a few best ideas, but then must add less convincing ideas as the money pours in).

In 2016, when John Pearce of Unisuper wanted to buy CBA’s PERLS8, he dealt directly with CBA and underwrote the issue to the tune of $300 million. If he had waited for the secondary market, he would have moved the price buying as little as $1 million. In fact, one of the reasons Unisuper itself is not a public offer is they do not want the fund to become too large and force it to compete even more for scarce quality assets.

Across asset classes such as infrastructure, small to mid cap companies and corporate bonds, the larger super funds like AustralianSuper (holding over $100 billion in assets) and benefitting from the Royal Commission focus on retail funds, are already coping with massive inflows.

5. There are many definitional problems

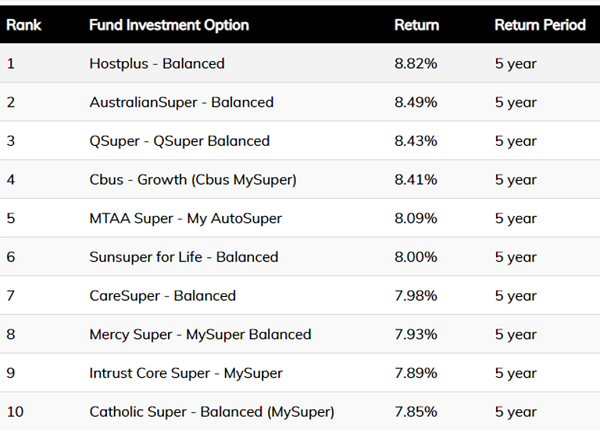

It is extremely difficult to compare super fund performance, if for no other reason than they all take different risks. The PC has made a good attempt at it. SuperRatings' current Top 10 funds ranked by returns in the Balanced Option (60% to 76% growth assets) category are shown below:

The problems start with the asset categorisation. Funds in this group hold between 60% and 76% ‘growth’ assets. That is a massive difference in a period when the equity markets rally strongly and bonds are flat.

The inclusion of certain assets in ‘growth’ is controversial and left for the super fund to determine, rather than following an industry standard. Is a BB-rated corporate bond ‘defensive’ because it is a bond, or ‘growth’ because it is non-investment grade with price volatility typical of an equity portfolio? Are infrastructure assets ‘defensive’ due to their long-term inflation-linked monopoly structure, or ‘growth’ because they are listed equities? What if they are not listed and are revalued infrequently?

There is a lot of subjectivity and apples/oranges comparisons in fund return numbers. Issues include listed versus unlisted, smoothing of returns, arbitrary and opaque discount rates on assets, convenient selection of revaluation cycles and techniques when conditions change, etc.

Where do Environmental, Social and Governance (ESG) issues sit against performance and fees? If a fund has a strong ethical tilt and excludes many companies from its portfolio, should this influence the selection process? And whose ethics are we considering in a default fund?

What weighting is given to the insurance offer? For example, many members of a super fund like Mine Super work in mining with dangerous occupations, and Mine has negotiated special group cover for them. If Mine is not in the Top 10, would new workers in mining be denied such cover?

Trustees with responsibility for their own members can make these decisions, but the selection committee cannot cover the complexity for all members.

What might happen at a quality fund like Unisuper? It is not a public offer, and could be overlooked by the selection panel although its performance would make it a contender for a Top 10 position. Would new university workers be pushed away from Unisuper despite its long-term track record and other features such as high-quality advice?

KPMG Superannuation Advisory Partner, Adam Gee, told the AFR:

“It is not so much the constitution of the panel that concerns us, it is more so the ability of the panel to undertake an appropriate assessment of the best-in-show list, as well as the criteria that will be used to select these funds.”

6. It should be about risk and retirement as much as performance and accumulation

The wide range of risk-taking in superannuation funds is rewarded or punished according to market conditions.

In mid-2018, as equity markets continued the bull run of many years, the Chief Investment Officer of an industry super fund told me that the trustees of his fund required him to hold risk at the bottom end of the 60-80% growth band in which his fund was judged. Consequently, his fund was in the bottom quartile on performance, and depending on definitions of growth, some of his competitors were arguably 90% growth and delivering great results. His relatively poor numbers did not reflect well on him as CIO.

This was not his fault, as he was following instructions, and indeed, it is inappropriate to criticise the trustees. They had decided their primary role was to protect the capital of their members, and naturally, this come at the cost of performance in a strong market. It’s a reasonable position with many members in retirement, who are likely to be more concerned about preserving their wealth than an extra 1% on the earnings.

In different circumstances unrelated to investment prowess, the CIO would look like a hero. He would be fated in the media, featured at conference for his foresight, and qualify as Best in Show.

The PC recommendations focus too heavily on the accumulation of super over a lifetime, rather than preserving wealth in retirement or drawdown. For retirees, the main destruction of living standards comes not from losing a small amount of performance due to not being in a Top 10 fund, but from high risks in a collapsing market. They face ‘sequencing risk’ issues where their balances are at their maximum, as they do not have the time to contribute more to recover losses. A National Seniors survey in July 2018 titled ‘Once Bitten, Twice Shy’ showed 23% of retirees claim they cannot tolerate any 12-month loss on their retirement savings.

The best example in Australia of a fund that took excessive risk is MTAA Super, which delivered exceptional results in the five years prior to the GFC. Their exposure to commercial property in particular was then severely punished in the crisis and subsequently they delivered years of poor performance, yet they may have been on a Top 10 list selected in 2007.

7. Unwelcome consequences of a fund dropping out off the list

Checking the SuperRatings list in section 5 above for a five-year term against the names in the same category based on 1-year returns, only four super funds make both lists. The majority of funds do not retain their status in subsequent time periods. The PC is recommending a review every four years, and turnover of names is inevitable.

Then a new list is listed, potentially creating switching out of the lesser-performing fund, which will need to liquidate assets to meet redemptions. This comes with costs such as brokerage and spreads. I was once involved in the closure of a fund and as money transitioned from one manager to another, hitting the bid to sell shares at rapidly-falling prices was far more expensive than we expected. The market knew we were selling and a significant cost hit fund members.

Generally, industry funds invest more than retail funds in illiquid assets (such as roads and airports) as they expect to remain in inflow, but a loss of status could impede their cash flows. Will they be forced to sell illiquid assets? Will the market anticipate these changes and mark down the assets?

Imagine the frustration of doing well against the vast majority of your peers, delivering excellent results for your members from 198 APRA funds, but coming 11th in the beauty contest.

And what happens if a Top 10 fund does really badly in subsequent time periods? It will reflect poorly on the entire selection process, and further undermine public confidence in the superannuation system.

Darren Stevens, Mercer's Head of Corporate Superannuation, warned a Best in Show list would result in funds copying the investment strategies of leading funds, over-exposing millions of members to particular investments or cycles.

8. Top quality staff are essential for ongoing performance

Outperformance of the market in investment management is limited to a few talented individuals with special skills. Overall, most active managers do not match the index. Every institutional fund has a Chief Investment Officer and a few key staff, and although trustees and boards play a role, they are often guided by the views of the CIO. These individuals are keenly sought by competitors and their abilities would be a major consideration for the panel selecting the Top 10 funds. What happens to a nominated fund if the CIO leaves?

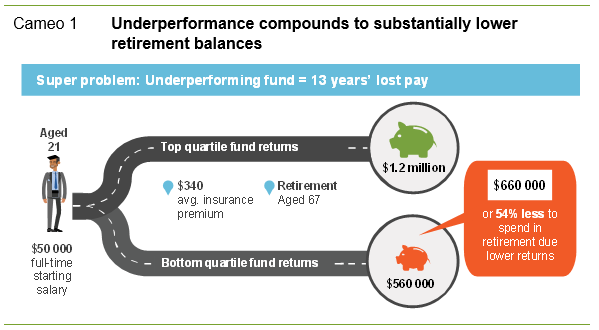

9. The gains in final superannuation balances are too optimistic

It is obvious that if an investor always holds money in the top-performing fund throughout their life until retirement, then their balances would be significantly higher than if they had stayed in an underperforming fund. But funds cannot be selected in hindsight. The much-publicised $500,000+ extra that has featured in the headlines is the difference in final retirement amount between the bottom and top quartiles of 53 funds surveyed by the PC.

Source: Productivity Commission Report on Superannuation, Overview, page 11.

Source: Productivity Commission Report on Superannuation, Overview, page 11.

This is wishful thinking. A top fund in the initial period is highly unlikely to stay in the top quartile over a lifetime, and investors continually switching into the Best in Show from the previous period are unlikely to keep backing winners. In fact, with a default fund only chosen once over a lifetime, with the employee taking that fund everywhere they work, most people will stick with one fund. It might go well, or it might not.

10. Selecting the experts will be fraught with risk

In 2016, the Financial Conduct Authority in the UK recommended reforms in the role of major investment consultants that advise the largest pension funds, saying they work under potential conflicts of interest and are “not effective” at selecting quality fund managers. These consultants are supposed to be the world’s experts at identifying good managers.

According to the PC Report, selection of the panel would be decided by a group of non-super experts:

"The process could be overseen by the Governor of the Reserve Bank of Australia (as committee chairman), with the Chairman of the Australian Competition and Consumer Commission and the Parliamentary Budget Officer. The consumer representative could be decided by the selection committee chairman ... with heads of government agencies that are noted for their independence, judgment and intellect".

The panel members themselves should be “free of direct conflicts of interest, and seen to be so by the public". The obvious problem is this removes many people most qualified in superannuation and fund selection, since all come from a perceived vested interest. But then there is this statement which blows the field wide open to a range of experts from outside finance:

"To strike the right balance between expertise and independence, not all members would need to have a high degree of expertise in super. Some could be accomplished individuals with experience in collecting and evaluating evidence and advice, but who are also able to see beyond it (such as academics)."

Check the funds listed in the tables above and there is an obvious omission: none are for-profit retail funds. Will it be politically acceptable for an independent body to favour industry funds to the exclusion of all retail funds? The substantial businesses of Colonial First State, Macquarie, BT, AMP and MLC would be compromised over the long term. These funds handle the superannuation of millions of Australians, and while many of their legacy products should be mothballed, they have recently-developed offers which are competitive with industry funds.

In fact, it’s likely that the inclusion of some of these retail funds would be required for competitive and political neutrality. The PC itself acknowledges this:

"the panel should always seek to ensure a competitive dynamic exists between funds, without compromising the integrity of the 'best-in-show' list".

Given the massive commercial implication involved in any selection of funds, with considerable powers in the hands of a few people, they will no doubt be subject to intense lobbying, political pressure and media scrutiny. Claims of conflict are inevitable, and the public is already tired of the superannuation industry arguing with itself.

Besides, superannuation is not the main game for wealth accumulation

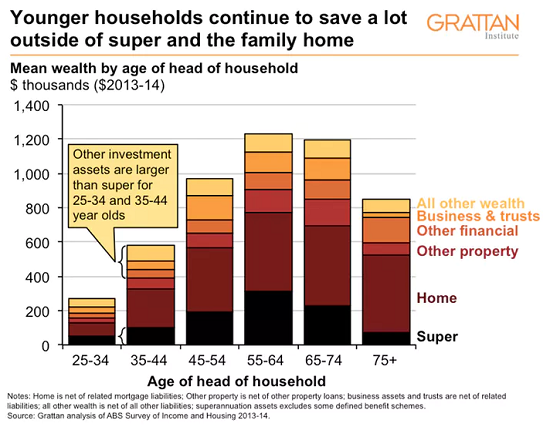

While superannuation is a significant political and social issue in Australia, especially because compulsory contributions are an alternative to wages, far more wealth is held outside superannuation, as shown in the chart below.

We do not interfere with individual selection of homes and other financial assets, we do not offer decent financial literacy courses in schools and we do not require trustees of their own superannuation to meet eligibility tests. There are 1.1 million Australians managing their own superannuation, free to invest in anything they wish.

A footnote based on new research on likely beneficiaries of Best in Show

Updated Roy Morgan research issued on 21 January 2019 showed superior customer satisfaction for industry fund over retail funds. The conclusion was:

"The Productivity Commission’s proposal to use the ten best performing retail and industry funds as the default options for new workers is more likely to benefit industry funds over retail funds. Apart from the already highly publicised performance tables that generally show industry funds to be the best performers, new data also shows that fund members rate satisfaction with the financial performance of industry funds higher than for retail funds. The experience of fund members need to be taken into account by those selecting the ten best funds to be listed, as they are the ones to be impacted by the final decision on choice of fund."

"Over the six months to November, eight of the top ten performing funds, based on satisfaction with financial performance, were industry funds. The highest rating was for Catholic Super with 70.5%, followed by Unisuper on 69.7%. The only retail funds to make it into the top 10 were ASGARD with 65.1% and Macquarie with 63.7% satisfaction but both were below the average of 65.5% for the top ten.

The top ten are by no means a uniform group, ranging from 70.5% for Catholic Super down to only 62.5% for HOSTPLUS, making it unlikely for all funds in the top ten to have an equal chance of selection."

"The five major retail superannuation funds have an average satisfaction rating of 54.7%, compared to the total retail fund average of 57.2% and well below the industry fund average of 61.8%.

The best performer among the majors was Colonial First State with 60.7%, well ahead of second placed BT (55.6%). The lowest satisfaction among these majors was for AMP with 50.4% and it was in fact the lowest of all the funds reported on in the ‘Superannuation Satisfaction Report’."

Graham Hand is Managing Editor of Cuffelinks. This article is based on his reading of the PC Report on Superannuation, and readers are welcome to correct any misinterpretation. It is 700 pages long and it’s impossible to do all the key issues justice in one article.