BT Investment Management’s Crispin Murray, Vimal Gor, Peter Davidson and Ashley Pittard provide a summary of the key drivers of investment markets in 2017 and share their thoughts on the prospects for each asset class in 2018.

Look beyond the headlines

It is customary to sit back and take stock at this time of year to contemplate what has been, could have been and what is likely to be. Participants in investment markets are accustomed to navigating developments on many fronts and 2017 has offered its fair share of these. Fear factors ranged from North Korea’s nuclear aspirations, Trump’s ambitions to thwart those of Kim Jong Un, Amazon’s desire to scare domestic retailers, Holden marking the end of car manufacturing in Australia and Tesla revealing it fell short of its production targets due to a shortage of batteries to power electric cars. Add to these the constant reminders of escalating household debt, housing affordability, persistently low wages growth and pundits even warning of the next global financial crisis, the average investor has had enough reasons to be fearful.

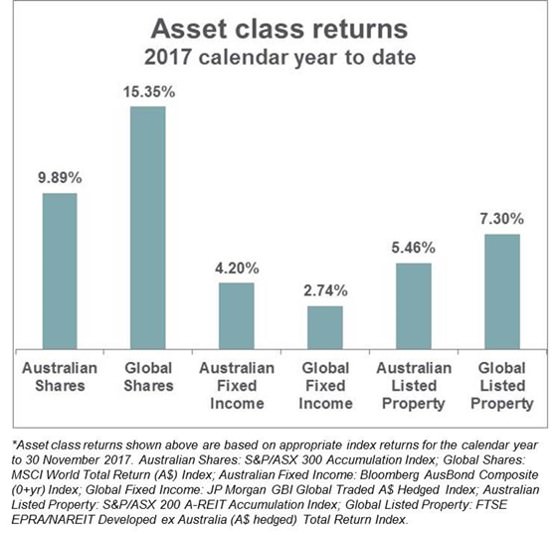

However, capital markets didn’t quite see it that way. Australian and offshore share markets have delivered healthy gains to investors and other asset classes have achieved positive returns. It shows that market noise can be disparate to reality. Investors who looked beyond the headlines with a degree of perspective and remained invested have done well this year.

Australian shares

Investors in Australian shares oscillated between fear and favour for Resources and bond-sensitive stocks, although Resources may have won the battle this year, with a sector return of 17.5%, compared to 8.4% for Industrials. But look a little deeper within the sectors and there are a plethora of winners and strugglers. Consider the retailing segment, Breville Group (+56.9%) has continued to be a solid performer, although sellers of Breville products like Myer Holdings (-40.0%) and Harvey Norman (-16.9%) languished. Within the travel and leisure segment, Qantas (+78.5%) materially outpaced Virgin Australia (+21.7%). In Media, Ten Network (-82.7%) ran into financial trouble while Nine Entertainment (+61.5%) saw a strong recovery in ratings and earnings.

These varied results provide another timely reminder of the importance of deep and rigorous company research to identify risks and opportunities within the market. Most importantly, the quality of a company’s management team and its strategy in navigating a challenging environment to ultimately drive stock performance should not be underestimated.

“The uncertainty created by disruption is unlikely to abate. This leads to mispricing and therefore great opportunities for active fund managers like us to add value, which is what we saw this year.”

Crispin Murray, Head of Equities

The Australian market does not have the same proportion of high growth stocks as the US so we won’t face the same issue with market valuations in that market. At recent levels the market is considered fair value. In the year ahead, valuations will largely be driven by earnings which are expected to be around mid-single digits. Add a sustainable dividend yield of 3-4% and we should see another healthy total return from Australian shares in 2018.

Australian listed property

The listed property sector produced healthy double digit returns over the 12 months to November on the back of solid earnings growth and rising asset values, although some of the gains were surrendered in January. Retail property was an expected focal point for investors, given the economic influences of dwindling retail sales and wages growth together with household indebtedness and the anticipation of Amazon’s arrival in Australia. Hence, retail property was not the place to be for investors, with weak returns from Westfield, Scentre Group, Vicinity Centres and Stockland – which together represent over 40% of the A-REIT index. The Office and Diversified REITs sectors delivered double-digit returns, while Industrial REITs – which are limited in offerings – was the best performing sector.

“US bond yields are an unavoidable headwind for the listed property sector, but the market can really be differentiated by qualitative factors”

Peter Davidson, Head of Listed Property

Filtering the sector for quality provides a fundamentally attractive picture. Despite the interest rate headwinds, key support factors such as the net withdrawal of Sydney office supply, low debt profiles, long term leases with inflation provisions and low vacancy rates make listed property an attractive asset class in 2018. The sector offers fair value and is priced at a discount to the direct property market, based on prices paid in major property transactions this year. We are expecting total returns of 6-8% in 2018.

Global shares

Global equities did a reasonably good job of delivering the growth our super funds aspire to achieve, with more than half of the companies within the MSCI World Index rising by at least 10% (in Australian dollar terms). Most regions registered double-digit gains, led by the US (+19.9%) with two thirds of US stocks achieving a positive return. Investing in the mega-techs – Facebook (+46.9%), Netflix (+44.5%) and Alphabet (ie. Google, +24.7%) – delivered exceptional returns. The S&P500 Index closed at record highs 59 times this year. In contrast, the UK (+6.4%) was a distant laggard while the euro zone (+12.0%) was backed for early signs of economic recovery.

We continue to believe that the tailwinds over the last five years which have rewarded indiscriminate broad market exposure are becoming headwinds. This approach is unlikely to yield as market valuations become less compelling and monetary support is ratcheted back. Moving into 2018, the market environment will be best suited to selective ownership of quality companies that are well positioned to withstand a higher interest rate environment and an uncertain geopolitical landscape.

“Share prices are unlikely to continue moving ahead in unison. The changing market environment means investors need to be conscious of valuation, conscious of franchise strength and cautious on cash flow”

Ashley Pittard, Head of Global Equities

Fixed interest

Australian fixed income posted reasonable returns in 2017, with little differentiation between the Government and credit sectors. Markets began pricing in expectations of rate hikes early in the year before pushing out the theoretical tightening timeline. Returns across the major overseas bond markets ranged from -0.9% to +2.0%, with the global fixed income asset class as a whole returning -2.7%. The Australian dollar appreciated 4.8% against the US dollar but weakened against the euro and British pound over the year. Although returns were muted across the government sector, credit investments performed well as they benefitted from strong share market performance. Strong appetite for risk also transferred to the high yield market, where the yield premium over investment grade credit tightened to levels not seen since 2014 when the market began to correct.

“Looking to the year ahead, we are wary that the goldilocks environment that kept yields range-bound and risk assets supported in 2017 will not be sustainable. We believe a defensive fixed interest allocation remains a critical component of an investor’s portfolio.”

Vimal Gor, Head of Income & Fixed Interest

Factors like an unprecedented unwind of accommodative central bank policy and a leadership-directed shift in the composition of Chinese growth highlight the risks facing credit and government bond markets. This in turn threatens to spark the return of volatility, as well as imbalances like the strong run from high yield credit to correct in 2018.

Investment implications

Investors need to be resilient to market gyrations and ensure risks are appropriate within their overall investment portfolio which is less likely to replicate the path set in 2017. Asset allocations need to be balanced to reflect the inherent shifts in market leadership on many levels. Interest rates are more likely to increase than decrease, albeit in a trajectory that follows evidence of sustainable economy recovery. Investors should also maintain an allocation within a multi-asset portfolio to the Alternatives sector through a selection of strategies that have a low correlation to equity and bond markets and therefore offer additional diversification with the potential for enhancing returns.

This article was prepared by BT Investment Management for general information and does not consider the circumstances of any individual investor.