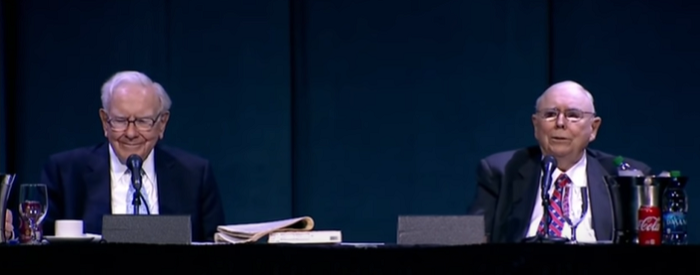

Charlie Munger has been investing with Warren Buffett at Berkshire Hathaway since 1978. While Warren hosts the company’s Annual Shareholder Meetings, answering questions for hours, it is Charlie who delivers the acerbic wit. Given his wealth and age, nobody and nothing is off limits, sometimes to Warren’s chagrin. It makes for fine entertainment when he is prepared to speak the truth that others avoid.

Charlie was born on 1 January 1924, and to mark his 98th birthday, some of his one-liners are collected on this video. As the introduction says:

“Charlie Munger isn't just one of the greatest investors who has ever lived, he is also one of the few brilliant minds who basically has no filter. When he sees something which he thinks is wrongdoing or stupid, he just can't help but being opinionated and speak up about it.”

Let ‘er rip, Charlie

“Those of you who are about to enter business school or are there, I recommend you learn to do it our way but at least until you're out of school, you have to pretend to do it their way.”

“Warren, if people weren't so often wrong, we wouldn't be so rich.”

“I think you would understand any presentation using the word EBITDA, if every time you saw that word, you just substituted the phrase ‘bullshit earnings’.”

“I'm optimistic about life. I can be optimistic when I’m nearly dead. Surely the rest of you can handle a little inflation.”

“The best way to get what you want in life is to deserve what you want. How could it be otherwise? It's not crazy enough so that the world is looking for a lot of undeserving people to reward.”

“Everybody wants fiscal virtue but not quite yet. They're like that guy who felt that way about sex. He’s willing to give it up but not quite yet.”

“Well, you don't want to be like the motion picture executive in California. They said the funeral was so large because everybody wanted to make sure he was dead.”

“It was investment banker-aided fraud. Not exactly novel.”

“Sure, there are a lot of things in life way more important than wealth. All that said, some people do get confused. I play golf with a man he says, ‘What good is health, you can't buy money with it.’"

“Well, there are a lot of things I don't think about and one of them is companies that are losing $2-3 billion a year and going public.”

“In accounting, you can do things like they do in Italy when they have trouble with the mail. It piles up and irritates the postal employees. They just throw away a few cartloads and everything flows smoothly.”

“The general system for money management requires people to pretend that they can do something that they can't do, and to pretend to like it when they really don't. I think that's a terrible way to spend your life, but it's very well paid.”

“I can't give you a formulaic approach because I don't use one. If you want a formula, you should go back to graduate school. They'll give you lots of formulas that won't work.”

“As Samuel Johnson said famously, ‘I can give you an argument, but I can't give you an understanding.’"

“It's perfectly obvious, at least to me, that to say that derivative accounting in America is a sewer is an insult to sewage.”

“Competency is a relative concept. And what a lot of us need, including the one speaking when I needed to get ahead, was to compete against idiots. And luckily, there's a large supply."

“I don't like multi-tasking. I see these people doing three things at once and I think, what a terrible way that is to think.”

“I like cryptocurrency currencies a lot less than you do. And I think that professional traders who go into trading cryptocurrencies, it's just disgusting. It's like somebody else is trading turds and you decide ‘I can't be left out.'"

“Once I asked a man who just left a large investment bank and I said, ‘How's your firm make its money?’ He said, 'Off the top, off the bottom, off both sides and in the middle.'"

“Well, I would rather throw a viper down my shirt front than hire a compensation consultant.”

“I think I'm offended enough.”

Graham Hand is Managing Editor of Firstlinks.