The retail real estate asset class is benefitting from a cyclical upswing, evidenced by increased investor demand, transactional activity and sector-leading returns. Transaction activity across the retail sector reached $10.7 billion over the past year, surpassing the long-term average by +32%.1 Since mid-2024, the retail property sector has delivered the strongest returns across all core Australian real estate sectors. This article examines the drivers behind this momentum, the outlook for performance, and the strategic considerations for positioning and exposure.

Economic tailwinds - exposure to the cyclical upswing

The macroeconomic backdrop has become increasingly supportive of retail demand. Australian Gross Domestic Product (GDP) growth is forecast to accelerate in 2025, supported by stable inflation, rising real wages, and a resilient labour market. If interest rates are stable or lower, that will be supportive of retailer margins and household balance sheets, leaving tenants in a stronger position and consumers with more disposable income.

Real wage growth (wage growth less cost of goods growth) entered positive territory in 2025. As of June 2025, annual real wage growth reached 1.3%, the highest since mid-2020 and significantly above the long-term average of 0.3% per annum.2 This trend should continue as inflation normalises and wages rise.

Retail sales and household spending have accelerated, recording the largest annual increase since the inflation crisis. Employment growth and the unemployment rate remain stronger than historical averages, reinforcing consumer confidence and spending power.

Government policy is expected to add further stimulus over the coming years through infrastructure investment, further potential tax cuts, cost of living support and student debt relief. Additionally, population growth continues to exceed long-term averages, driven by labour shortages – further supporting retail demand fundamentals.

The growing supply gap

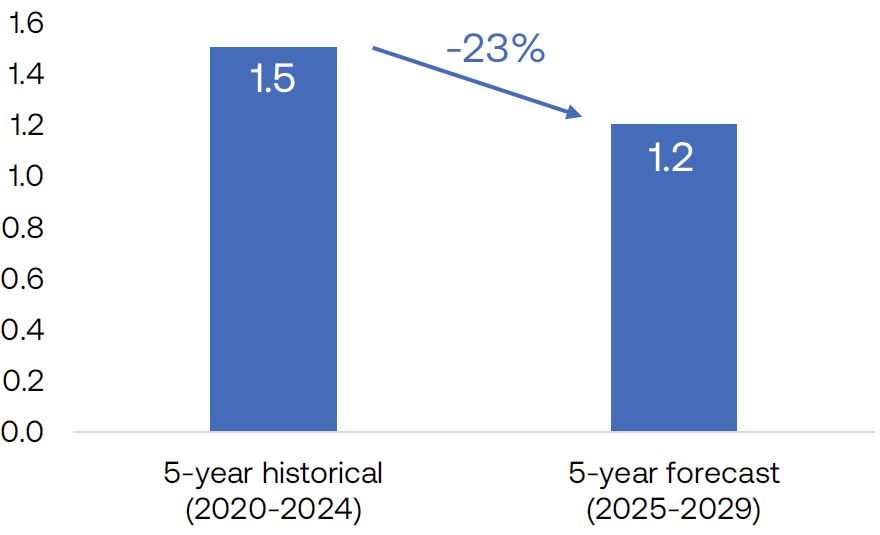

The rise in construction costs continues to have a profound impact on new developments. Construction activity across the retail market remains at historical lows, with restrictive supply contributing to an acceleration in rents. In our view, the scale of this supply gap remains underestimated, particularly over the medium-to-long-term. Forecasts suggest 2025 will see the lowest retail supply in over 30 years. See figure 1.

By 2030, only 30% of required new supermarkets are forecast to be constructed.3 Whilst population growth remains strong it is unevenly distributed, with high- quality catchments capturing a disproportionate share of this population expansion. These areas, however, continue to face restrictive supply conditions. As a result, retail assets in these areas are positioned to benefit from solid demand and limited competitive supply.

Figure 1: Forecast retail supply (millions sqm)3

Source: JLL, Charter Hall Research

Navigating divergence - not all retail is equal

The retail asset class is diverse, and performance across its sub-categories has differed significantly in recent years.

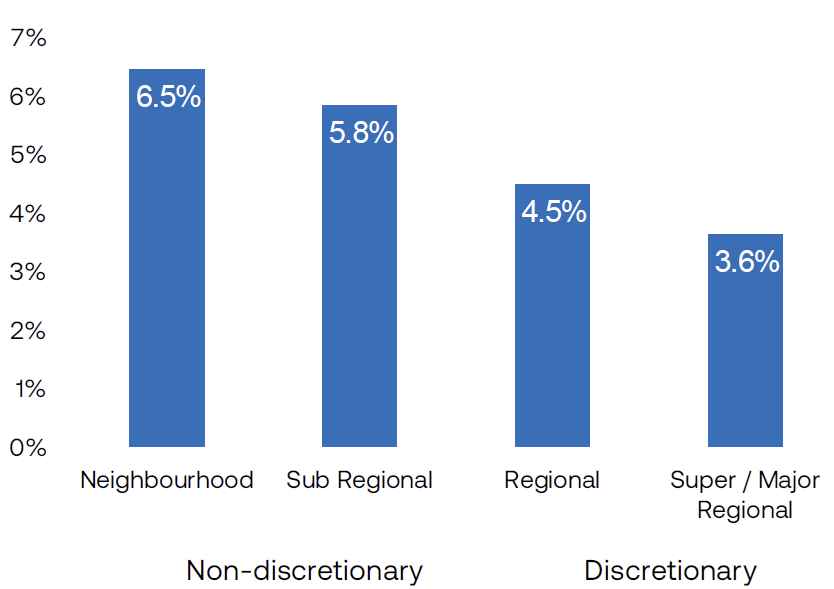

Convenience-based retail assets, which are characterised by a greater exposure to non-discretionary retailing (daily essentials such as groceries, medical, hardware and household goods) have outperformed larger, discretionary-focused shopping centres, particularly over the last decade. See figure 2.

Figure 2: 10-year annual returns (CAGR)

Source: MSCI Direct Property Digest, Charter Hall Research

Larger shopping centres focused on discretionary retail have faced headwinds as consumer behaviour shifts toward online shopping. Technological advancements and evolving consumer behaviour have made e-commerce a formidable alternative to physical discretionary retail formats. As such, investor returns have been challenged by weaker rental growth, higher capital intensity, devaluations, and fund redemptions.

By contrast, non-discretionary online retail relies on physical store networks, which remain critical for fulfilment. For example, 80% of online grocery sales are fulfilled instore via click and collect, direct to boot and home delivery. Convenience retail assets, typically anchored by one or more supermarkets, benefit from longer leases, steadier demand and lower income leakage due to reduced re-leasing costs.

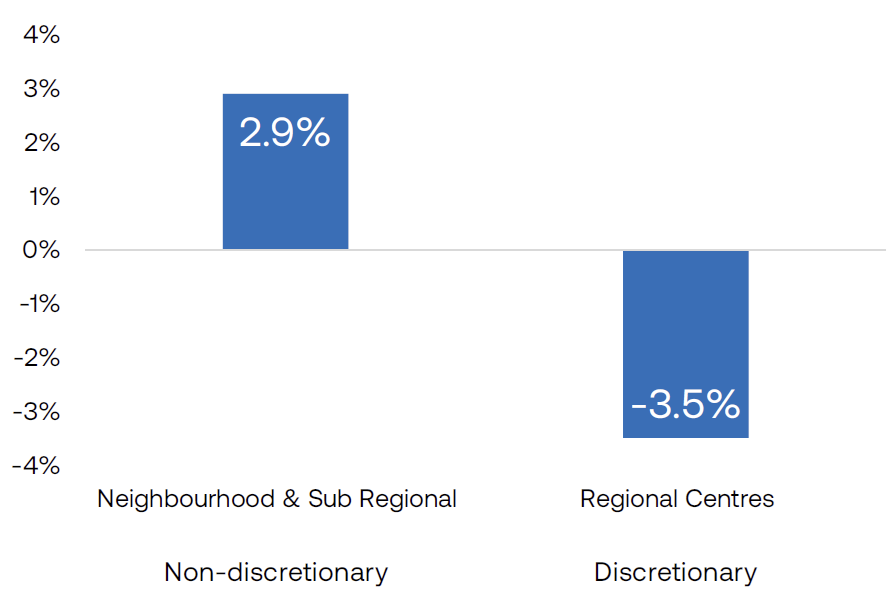

Sub regional and neighbourhood centres have recorded positive re-leasing spreads over the last six years; whereby new leases signed at lease expiry achieved a higher rent than the previous lease. See figure 3.

This divergence is reflected in the MSCI/Mercer Australia Core Wholesale Monthly Property Fund Index (MSCI Index). Retail Specialist Funds (which are predominantly exposed to discretionary shopping) have been challenged by lower property valuations, weaker rental growth and lower returns, leading to higher redemptions and lower capital allocations as investors shift to more accretive sectors.

Figure 3: Average re-leasing spreads between 2018 and 2024

Source: Urbis, Charter Hall Research.

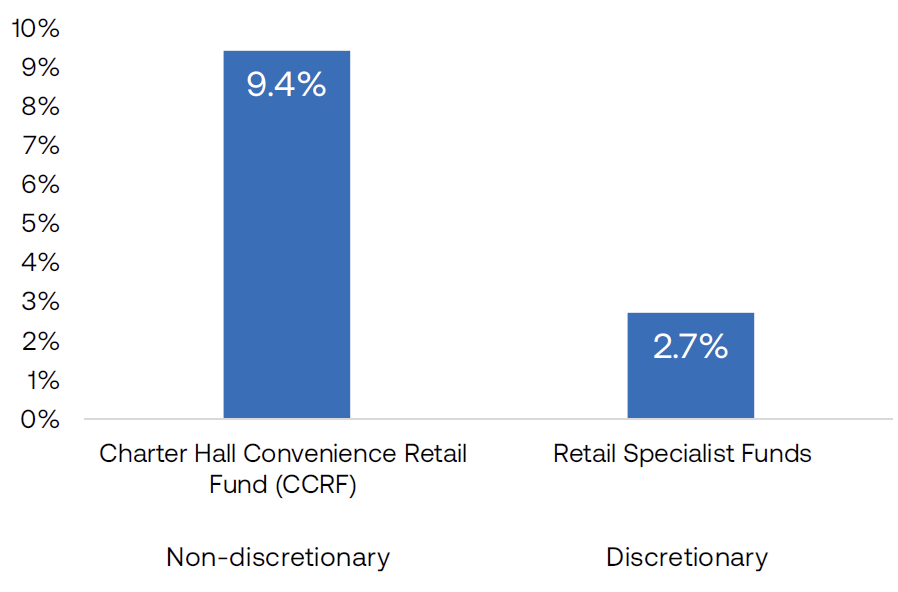

Longer-term returns highlight this divergence. Charter Hall Convenience Retail Fund (CCRF) has generated annual returns at 9.4%, compared to the broader Retail Specialist Fund sub sector returns at 2.7%, as per the MSCI Index data.4 See figure 4.

This reinforces the strategic importance of holding well-located, convenience-based retail assets with resilient demand fundamentals. Strong population growth and constrained supply are expected to drive rental and capital value growth, strengthening market confidence in the sector’s outlook.

Figure 4: CCRF vs. Retail Specialist Fund performance, 10-year annual returns (CAGR)

Source: MSCI/Mercer Australia Core Wholesale Monthly Property Fund Index, Charter Hall Research. At Sep-25.

1 JLL Research. At 3Q25.

2 ABS. At 2Q25.

3 Source: JLL Neighbourhood Centre Supply (October 2025)

4 CCRF established in August 2025. Pre-formation fund performance is based on predecessor fund metrics and is not included in MSCI historical index results.

Steven Bennett is Chief Executive of Direct Property and Sasanka Liyanage is Head of Research at Charter Hall Group, a sponsor of Firstlinks. This article is for general information purposes only and does not consider the circumstances of any person, and investors should take professional investment advice before acting.

For more articles and papers from Charter Hall, please click here.