Australia’s age pension rose in March reflecting rising inflation and the growing cost of living pressures. This represents a pay rise of just over 2% and is the biggest increase in the payment in almost a decade.

Single pensioners will be $20.10 better off per fortnight, and couples up to $30.20 per fortnight (where both members of the couple are eligible).

Indexation also means that some people who were previously ineligible for a pension may become eligible as the cut-off amounts of assets and income are also increased.

But older Australians receiving aged care need to know that an increase in the pension also means an increase in their Basic Daily Fee. This means they’ll only see $4 of the $20 pension increase.

In this article, we’ll walk through the changes step by step and what they mean for you.

Payments

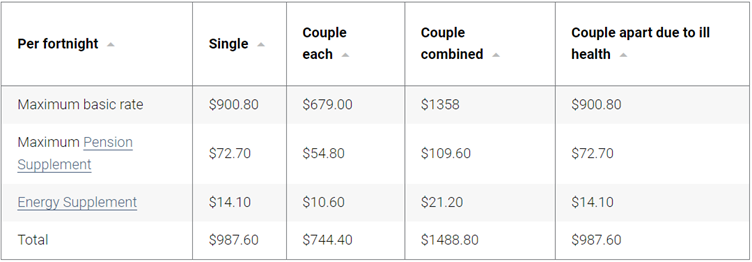

The maximum rate of age pension payment for singles increased by $20.10 per fortnight from $967.50 to $987.60. The maximum rate for couples increased by $15.10 each from $729.30 per fortnight for each eligible member to $744.40.

A couple where both members are eligible to receive the maximum payment can receive $1,488.80 per fortnight or $38,708.80 per year combined.

Source: Services Australia

The assets and income level before pensions are disqualified under the means tests have also increased.

Assets

For homeowners who are single, the asset test cut-off increased from $593,000 to $599,750. For couples it increased from $891,500 to $901,500.

For couples who are separated by illness, as is the case when one or both move into aged care, the cut-off increased from $1,050,000 to $1,063,500.

*It’s important to remember that the value of your home is not included in these assets.

Income

For singles, the amount of income you can earn before the age pension ceases has increased from $2,115 per fortnight to $2,155.20. For couples, the cut-off has increased from $3,237.20 per fortnight to $3,297.60.

*It’s important to remember that income earned under the work bonus (up to $7,800 per year) is not included. Income from investments is based on deemed income, rather than the actual income earned.

In announcing the changes Minister Anne Ruston said, “This is putting money in the pockets of all Australians who rely on our social security system and, in particular, older Australians.”

But older Australians receiving aged care, whether that’s a Home Care Package or residential aged care, need to know that an increase in the pension also means an increase in their Basic Daily Fee.

The Basic Daily Fee you pay towards your cost of aged care is set based on a percentage of the Age Pension. In a Home Care Package, the maximum Basic Daily Fee is set at 17.5% of the basic Age Pension (and applies to people on a Level 4 Package) it was $11.02 per day and has increased to $11.26 per day from 20 March.

In a Home Care Package, the Basic Daily Fee is based on the level of your package:

- Level 1 was $9.88 per day increasing to $10.08

- Level 2 was $10.44 per day increasing to $10.66

- Level 3 was $10.74 per day increasing to $10.97

- Level 4 was $11.02 per day increasing to $11.26

So, if the fortnightly pension increases by $20.10, up to $3.36 will be needed to meet the increased cost of a home care package.

In residential aged care, the Basic Daily Fee is set at 85% of the basic Age Pension, it was $53.56 per day, increasing to $54.69.

This means that the Basic Daily Fee increase is $15.82 a fortnight, so of the extra $20.10 in Age pension, people living in aged care will only have $4.28 per fortnight to cover increases in their cost of living.

While the Basic Daily Fee does cover some of the cost of living in aged care such as meals, utilities and insurances, many aged care residents need to pay extra or additional service fees to cover alcohol, food, entertainment, and personal services. Personal expenses such as clothing, medications, health care, other insurances, transport, and communication costs remain the responsibility of the resident.

A $4 per fortnight increase in the Age Pension for people living in aged care is definitely a pay cut, not a pay rise.

Rachel Lane is the Principal of Aged Care Gurus where she oversees a national network of adviser dedicated to providing quality advice on retirement living and aged care. She is also the co-author of a number of books with Noel Whittaker including the best-seller 'Aged Care, Who Cares?' and their most recent book 'Downsizing Made Simple'. To find an adviser or buy a book visit www.agedcaregurus.com.au.