So far this year we have seen good returns from all asset classes (except cash), in Australia and globally. Shares are fully priced or over-priced but they are still doing better than their long term averages. Likewise with listed and unlisted real estate. Bonds are horribly over-priced but they too have generated above average real returns.

In a world where everything is doing well for investors something is bound to go wrong. It is impossible to over-weight (or under-weight) everything in portfolios so it calls for tough decisions. How long can the great 2012-15 QE rally last?

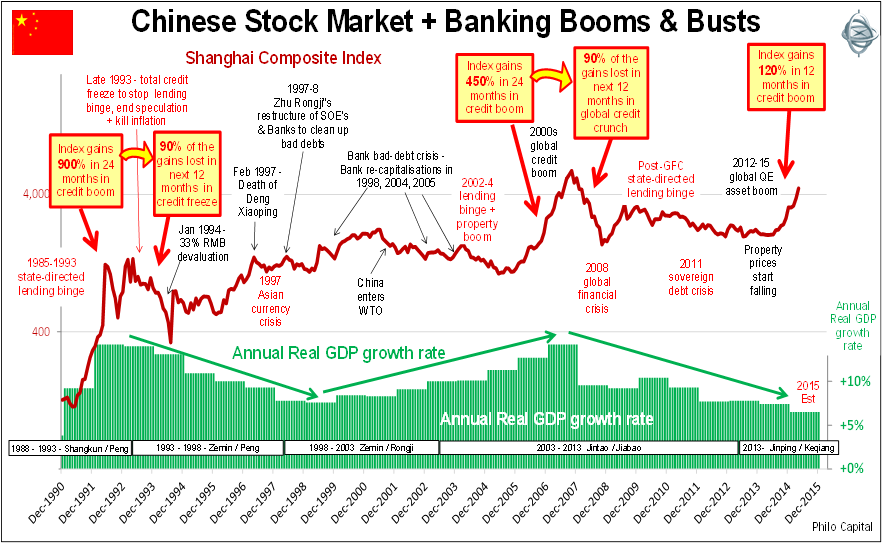

Here is a close look at the incredible spike in the prices of Chinese stocks in the last year, linked back to the perennial culprits – banks and the credit cycle.

The Shanghai index has shot up 120% in the past 12 months after five years of falls. Less well known is that this is a rather mild spike compared to past episodes.

There have been two great stock market spikes in post-1949 China. Both were fuelled by credit binges and both promptly crashed when credit dried up. In 1991-1993 the index gained 900% in 24 months but then lost 90% of the gains in the next 12 months. In 2006-2007 the index gained 450% in 24 months, but also promptly lost 90% of the gains in the next 12 months.

There was an orgy of bad lending in the 1985-1993 credit binge by the big Chinese state-owned banks. To end the party the government had to impose a total freeze on lending in late 1993. That crunched asset prices, employment, the economy and the banking system, and it took the next 12 years to clean up the mountain of bad debts in the banks.

As soon as it did, the next great credit/property/stock market bubble took off in 2006-2007, fuelled by cheap credit and geared-up local and global investors chasing the ‘China growth’ story. The boom ended in a crash in 2008 when credit froze as the global banking system seized up.

In the ensuing global financial crisis, the Chinese government embarked on a massive spending and credit spree to support the economy. The bubble re-appeared firstly in housing and then moved on to shares last year when housing prices started to fall. Driving the current boom are cashed-up first-time local punters, many using margin debt, and the spike is now being chased by foreigners eager to get in on the action.

The current stock market rally is quite modest by comparison to past bubbles and pricing levels are still not stretched – for example price/earnings ratios and dividend yields are not outlandish. The market may run up a lot further from here but banks are hiding another mountain of bad debts built up in the post-GFC lending binge, and so this boom will probably end the same way as previous episodes.

Ashley Owen is Joint CEO of Philo Capital Advisers and a director and adviser to the Third Link Growth Fund. This article is educational only. It is not personal financial advice and does not consider the circumstances of any individual.