The last few months have been eventful to say the least, from tariffs to Middle East conflict to the passage of U.S. budget legislation, but ultimately impacts on fixed income have been fairly muted.

The Trump administration’s announcement of the tariff “Liberation Day” on April 2 inaugurated a period of extreme volatility in financial markets trying to assess the potential levels and impacts of proposed U.S. levies on imports. Postponement until July (and then August) of more severe tariffs helped risk assets reverse course, although the dollar continued its sharp decline amid foreign skepticism over U.S. deficit spending. In geopolitics, the sharp escalation—and swift apparent conclusion—of the Iranian conflict created a temporary spike in oil prices but otherwise had little effect on global markets. Meanwhile, the July 4th enactment of the U.S. President’s “Big, Beautiful” budget law was greeted with a mixture of relief and worry over fiscal strains, only to be overshadowed within days by new tariff threats, perceived by some as a negotiation tactic.

As is often the case, bond investors had their eye less on the commotion and more on the ultimate drivers of returns—growth and inflation. There, the overall backdrop was relatively benign, with “hard” U.S. growth data coming in better than “soft” sentiment-driven data, and inflation continuing to recede even amid worries about the impact of tariffs on prices. In Europe, inflation is also fading, but growth weakness is being tempered by new spending, particularly in Germany given its new commitment to infrastructure and defense. Japan is in solid condition and China may be on the mend, aided by policy initiatives.

Looking ahead, we see broad potential for rate cuts, particularly in the U.S., where softer near-term growth, encouraging disinflation and more labor market ambiguity could curtail the central bank’s wait-and-see stance on tariff impacts. (Current pressure on Fed leadership could conceivably prove a risk, which we are watching closely.) Easing could prove beneficial to short- to intermediate-term bonds, although longer-dated U.S. issues still face questions over deficit spending. While tariff noise may continue, the world appears likely to avoid recession, reinforcing the justification for tight corporate credit spreads. Among sectors, we think high yield bonds offer relative advantage, while emerging markets debt issued in local currencies could prove a bright spot given dollar weakness, moderate inflation and resilient growth.

Here are the key investment trends that we see:

U.S. growth and inflation are easing, but questions remain

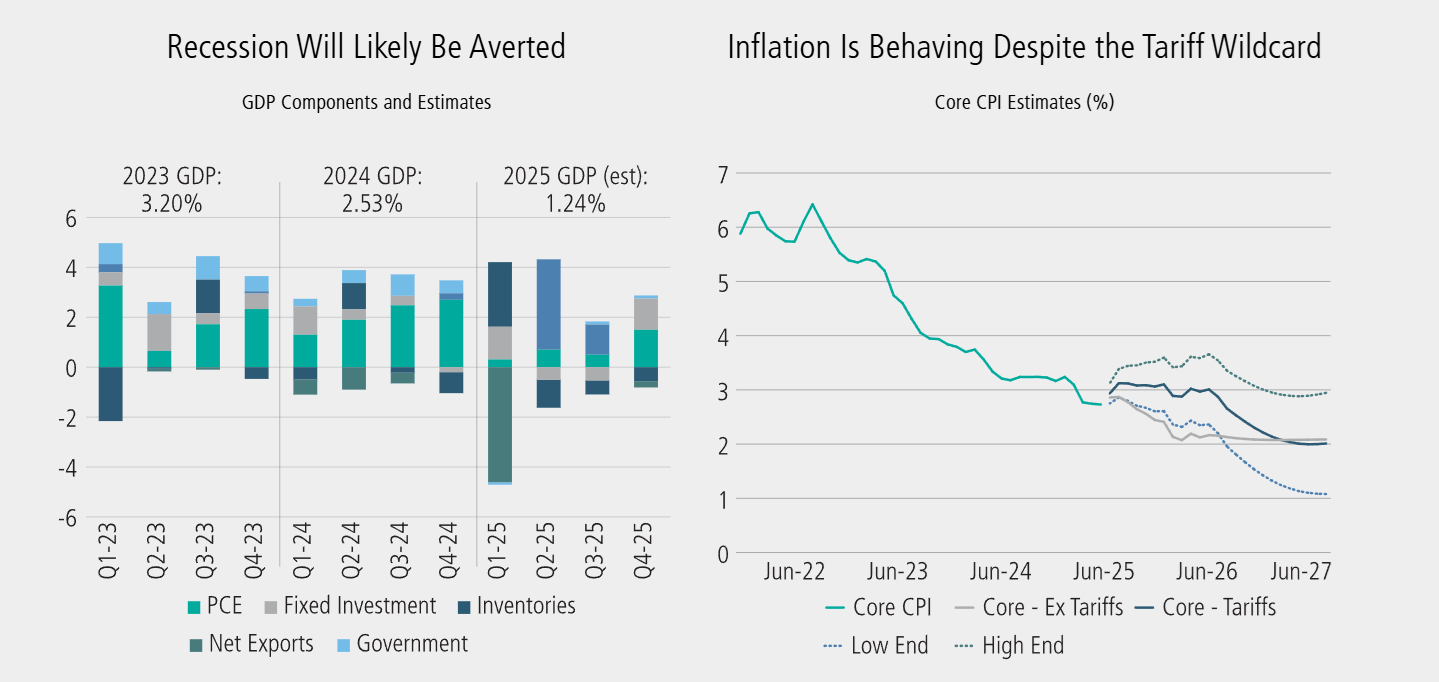

Tariffs have been a key stumbling block for corporate managements and investors this year, given the relatively extreme “opening bids” by the Trump administration and the wide range of potential outcomes for tariff levels and impacts, depending on results from negotiations across much of the globe. However, in the midst of this uncertainty, the U.S. economy has remained resilient, in part due to an acceleration of buying to front-run tariff impacts, even as sentiment has remained more negative. In our view, effects on growth are likely to show up more obviously over the next few months in inventories, consumption and investment.

That said, although friction around tariffs appears to ebb and flow (with August serving as the next hard deadline for dealmaking), we believe that uncertainty around trade could ebb toward the end of the year, providing more of a tailwind for growth in the second half of 2025 and into 2026. Supporting a reacceleration could be the ongoing deregulatory efforts of the Trump administration, combined with the passage of the tax and spending law, which took a major U.S. tax hike off the table and provided new incentives for corporate investment.

Inflation has been gradually easing, supported by declining shelter prices, with little impact from tariffs so far. One notable trend for pricing is the concentration of payroll growth in health and education, underscoring the muted condition of the broader labor market. Limits on immigration have helped keep the unemployment rate steady by dampening the overall supply of workers while muddying the broader labor picture. Tariffs could further drive consumer prices, but we believe that, even with worst-case levies, the inflation impact could be muted.

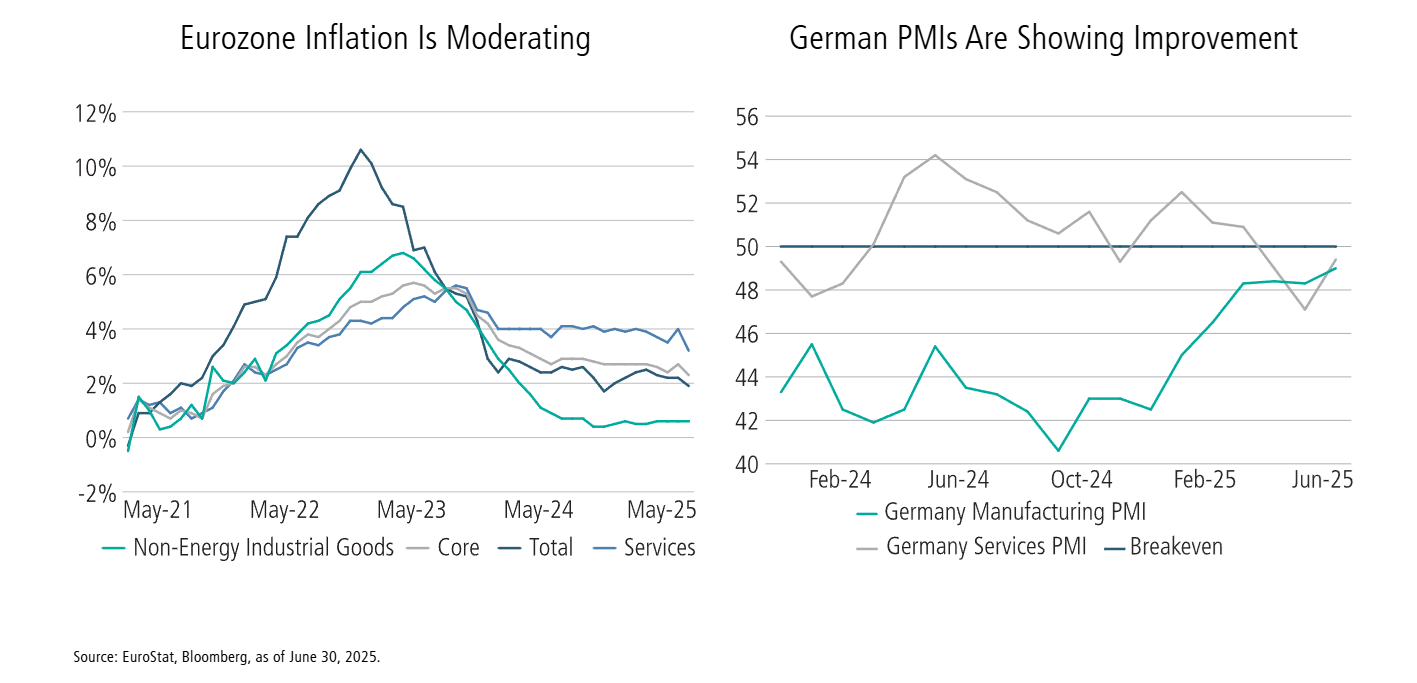

Even as Europe stabilizes, stagnation remains an issue

Despite still-sluggish growth, a key source of Europe’s recent economic optimism is the current fiscal plan by the German government, moving past previous spending limits to help jumpstart infrastructure and defense. That said, the impacts appear to be largely stabilizing rather than inflationary given broader issues with economic weakness. For the bond market, a major issue is the absorption of new Bund supply, estimated at around €15 billion of additional issuance in the third quarter and around €10 billion for the fourth.

Meanwhile, U.S. tariffs remain an ongoing concern. The Trump administration’s “90-day pause” followed by another month-long extension failed to remove uncertainty, which has weighed on capital expenditures and household spending, thereby contributing to persistently subpar growth. A strong tourist season should benefit the south of Europe, but the benefits will largely end by the fall.

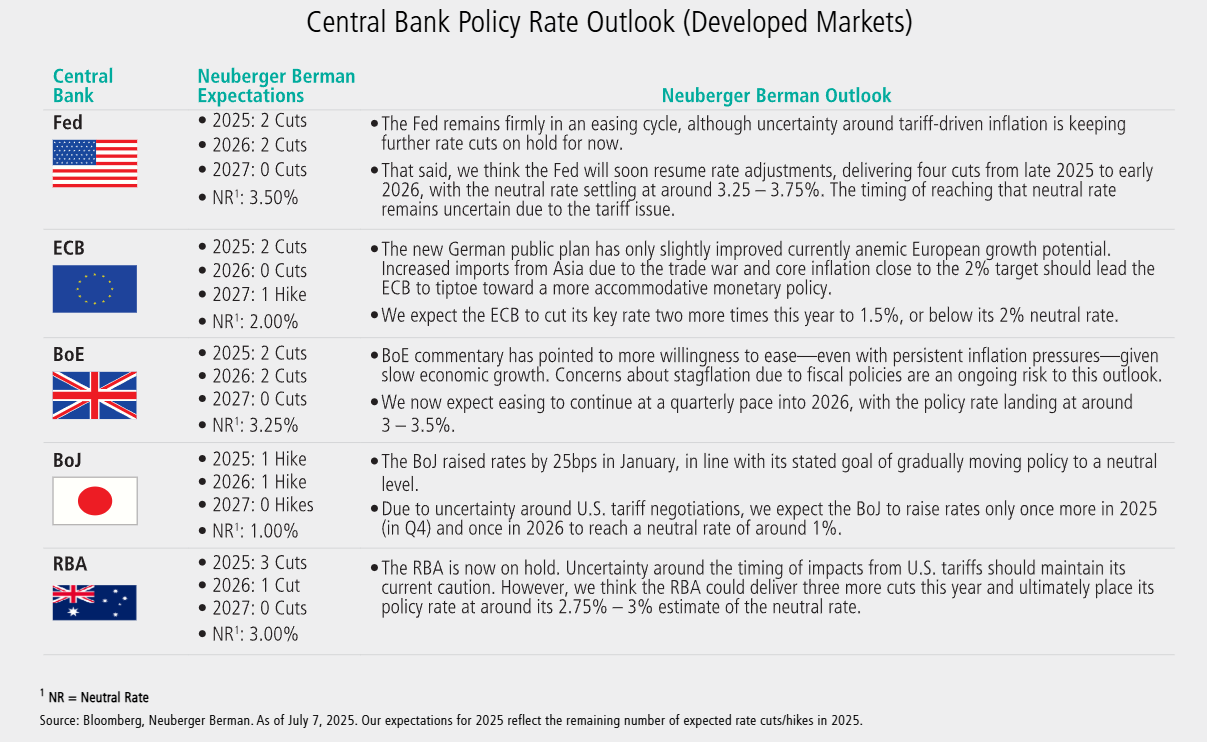

The U.S. is poised to join global easing trend

Despite favorable U.S. inflation trends, the “known unknown” of tariff impacts has kept the Fed on hold for the past few months. Given a benign labor picture (and pressure to introduce rate cuts) we believe that U.S. central bankers will become more comfortable with further easing, likely reducing rates by a full percentage point within the next 12 months—and potentially sooner than the market expects. In Europe, German spending plans are helping the overall economic picture, but not enough to discourage further ECB rate cuts, of which two more appear likely this year. Although Britain continues to face inflationary pressure, the Bank of England may maintain its current quarterly rate-cutting pace. Often the outlier, Japan is likely to introduce another two rate hikes through 2026.

Term premium and foreign sentiment remain key variables for U.S. fixed income

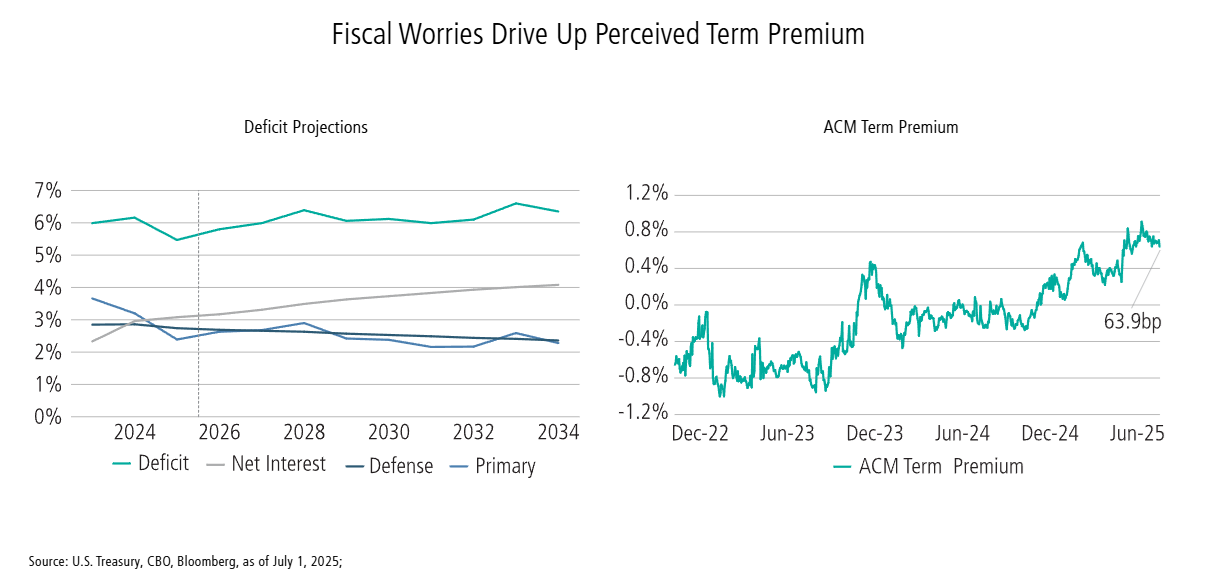

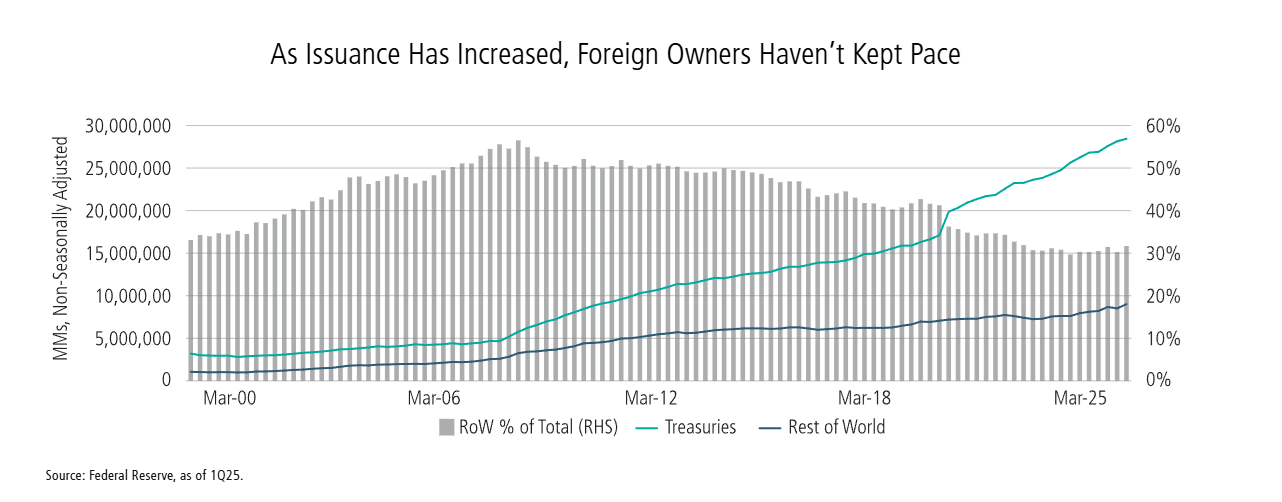

The passage of the U.S. tax and spending package reduced domestic economic uncertainty but reinforced the growing concern among global investors about the size of the U.S. budget deficit, which has helped drive up the term premium for U.S. bonds even as shorter bonds seem likely to benefit from the Fed’s rate reductions.

Complicating matters is the role of non-U.S. investors in absorbing the debt needed to fund the deficit. Increased skepticism about the U.S. fiscal environment, coupled with a weakened dollar, has softened the appetite for U.S. securities, while decreasing U.S. trade deficits suggest that the Treasury could be forced to become more reliant on domestic sources. Overall, we do not anticipate any abandonment of U.S. assets, but see a reduced proportion of foreign investors (still the largest buyers of U.S. Treasuries) absorbing the new supply, while some may potentially limit their dollar exposure through hedging.

From an investment perspective, we see opportunity in the shorter end of the Treasury yield curve given likely moves by the Fed over the coming year, but we remain cautious on the long end due to debt sustainability and demand issues. While scope for additional European rate cuts remains in place, the opportunity may be more limited given the progress that has already occurred.

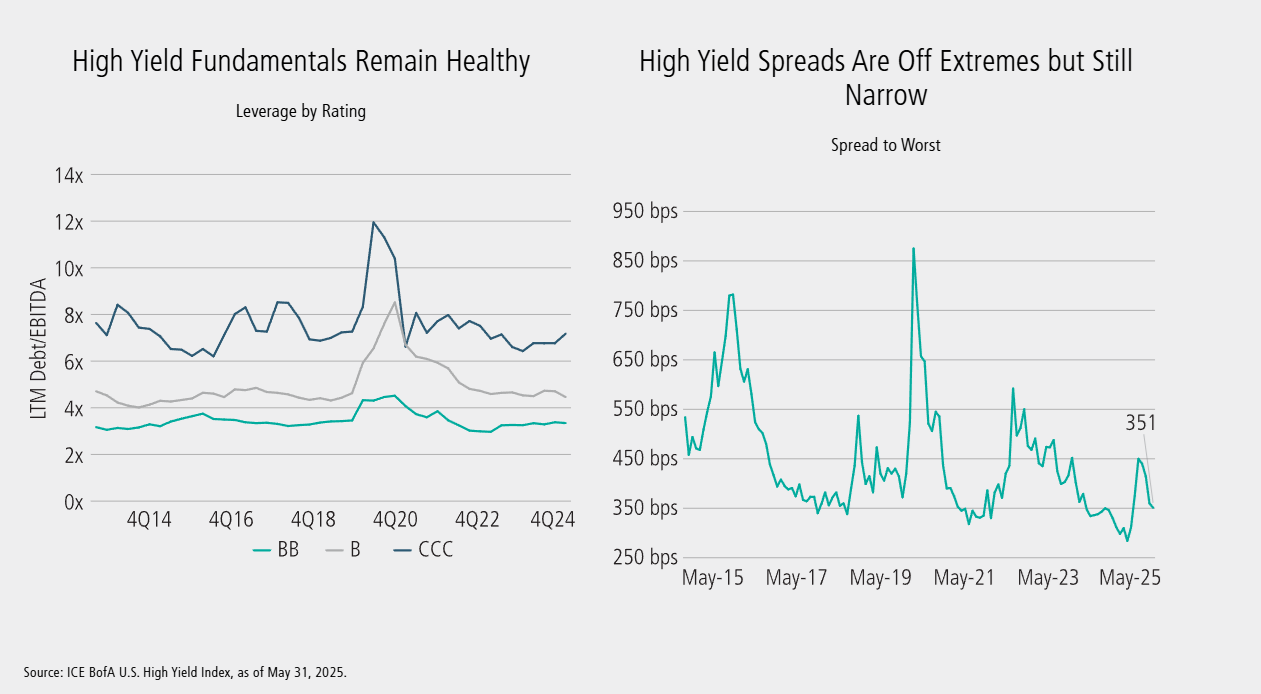

Credit selection remains key

Credit spreads remain historically tight, limiting obvious opportunities in the market and lending support to a focus on carry and individual sector and credit selection. In this environment, we believe that high yield provides relative potential given sustained fundamental strength as reflected in moderate debt and default levels. And although much of the spread advantage generated after April’s tariff-related volatility has dissipated, we view relative and absolute yield levels as attractive.

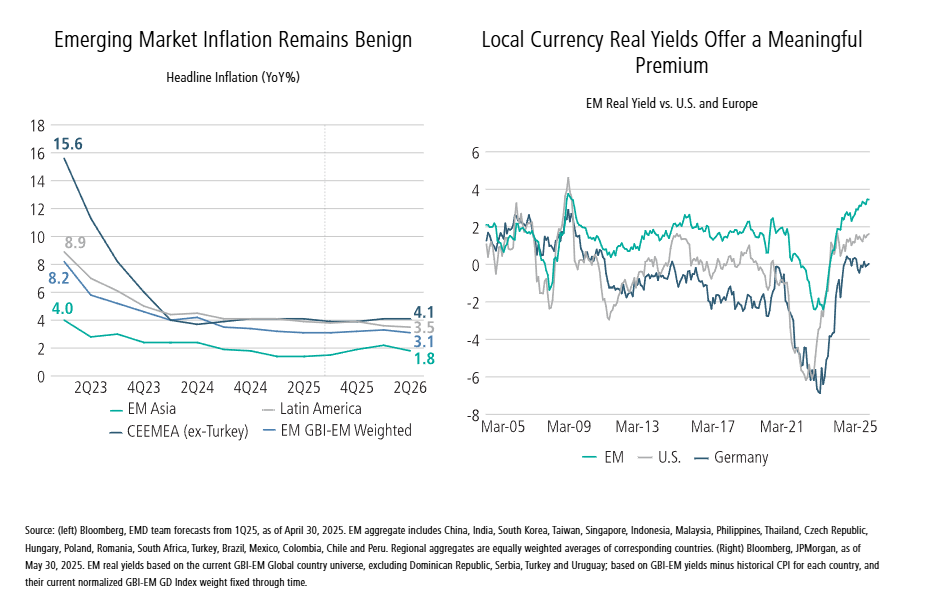

Local emerging market debt stands out

Despite the potential for market turbulence around the U.S. trade picture, we believe the risks for emerging market assets are mitigated by a continued healthy growth pick-up over developed markets. Subdued inflation, growth pressures from trade war escalation and expected rate cuts by the Fed should provide room for most emerging market central banks to maintain a bias toward easing monetary policy. Combined with emerging market real yields that are near decade highs, this should provide an attractive backdrop for local bonds.

Neuberger Berman is a sponsor of Firstlinks. This material is provided for general informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. You should consult your accountant, tax adviser and/or attorney for advice concerning your own circumstances.

For more articles and papers from Neuberger Berman, click here.