I have previously suggested that reform of the age pension is likely at some point in the future and investigated one area of reform (the approach to pension indexation, see Cuffelinks 21 March 2014). I now look at another reform candidate, the income test taper rate. Once again we can identify how complex and sensitive an area of reform this would be – the Government needs to tread carefully!

Background on age pension income testing

Currently the full age pension fortnightly base payment for a single is $751.70, which can increase to $827.10 once supplement payments are included. Combined couple base payments are $1,133.20 ($1,246.80 with supplements).

To be eligible for the age pension you must meet age and residency requirements. The amount you receive is dependent on two tests, one based on the income and the other on the level of assessable assets. In this article we focus on the income test.

The income test consists of a threshold level; beneath this level the age pension entitlement is unchanged. For singles this level is a fortnightly income of $156 and for couples $276 combined. For each dollar earned beyond this level of fortnightly income the age pension fortnightly rate is reduced by 50 cents. So a single age pensioner would receive no age pension payments once fortnightly income reaches $1,841.60 (or a combined income of $2,817.20 in the case of couples).

In 2009 the Rudd government introduced the Work Bonus programme. Under this programme, a level of employment income is excluded from the income means tests ($250 per fortnight per individual regardless of whether one is single or part of a couple).

What did the Harmer Review say on income testing?

The ‘Harmer’ Pension Review, released in 2009, looked at income means testing in detail. It was a balanced exploration of the issues. Some key issues were:

- to ensure that those with a moderate reliance on the age pension were not receiving inadequate government support

- a focus on sustainability, meaning that there should exist sufficient incentives for those past retirement age to work

- treating different segments of the population equitably (by income and age).

With regard to the first dot point, the Harmer Review found that that “there is no evidence that the means test as a whole is operating to provide an inadequate level of support to pensioners with low to moderate reliance on the pension.”

The second dot point questioned whether high taper rates were sustainable given the backdrop of an aging population. The taper rate could be thought of as an effective tax rate. Once a single person (or a couple) earns more than the relevant minimum level of income, then for every additional dollar, even though it is (usually) not taxed, they receive a lower age payment. This has the same net effect on disposable income as a tax on earnings. To this extent, a taper rate of 40% (as it was at the time of the Harmer Review) represents an effective marginal tax rate of 40% - very high for low income earners. This could be viewed as a major deterrent to working beyond pension eligibility age. This taper rate is now 50% making working pensioners effectively the highest taxed (from a marginal perspective) of all working Australians.

From an equity consideration (the third dot point) the Harmer Review considered that those on low income were given appropriate assistance and that the poor required more additional support. The Harmer Review also identified large inequalities between the outcomes of workers below working age versus those who are eligible for the age pension. For instance, at the time of the Harmer Review, an age pensioner who is in employment and is paid the equivalent of the Federal Minimum Wage would have had a disposable income of $627.84 a week. Compared to the outcome of a non-pensioner ($494.44 a week), it is easy to identify the inequality that exists based on age.

Following this review, the Rudd Government announced major reforms to age pensions in 2009. The pension rate was increased and the income test taper rate was also increased, from 40c in the dollar to 50c in the dollar. The previously mentioned Work Bonus scheme was also introduced. This all appears to be reasonable policy: for those not looking to work the changes represented a redistribution of government age pension capital to the poor and away from those with other income sources (supported by the Harmer Review), while those looking to work are less penalised by high effective tax rates.

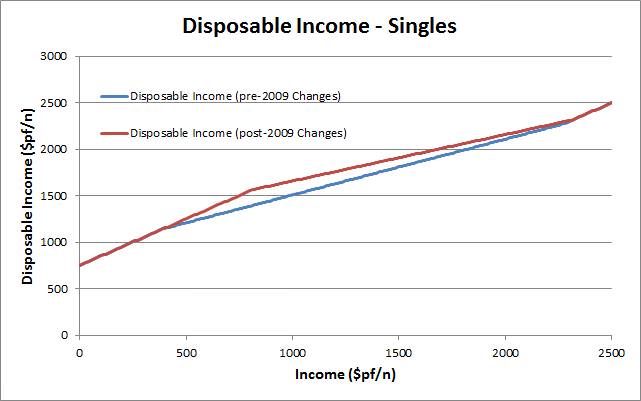

The effect on an individual of these changes is illustrated in Chart 1 below. The effect of the changes on couples is similar.

Chart 1: Impact of 2009 Rudd government changes to age pension

The changes make a small amount of work a more financially attractive proposition for those past retirement age. This fits nicely with Harmer Review focus groups where people were most people said they were not looking for full time or stressful work. The benefits of the Rudd Government changes gradually disappear as employment income increases and for those earning $2,000 per fortnight the changes have little or no impact.

Where is the potential for age pension reform with respect to income test taper rates?

I see little potential for a direct change to income test taper rates. Decreasing taper rates would be expensive for the government. And if taper rates increase then this will increase the financial disincentives to work and more people will cease to participate in the workforce and collect a higher age pension. It is worth noting that amongst the many (137 to be exact) reform recommendations of the Henry Review, it was recommended that no change be made to the way that employment income is treated versus investment income: the Work Bonus appears supported by those who have undertaken the major reviews.

I suspect that income test taper rates are not prominent on the Coalition budget radar. Issues such as pension rate indexation, asset testing (specifically the assessment of your home), and the age pensioner concession card appear more obvious candidates for reform.

David Bell’s independent advisory business is St Davids Rd Advisory. In July 2014, David will cease consulting and become the Chief Investment Officer at AUSCOAL Super. He is also working towards a PhD at University of NSW.