Much has been written about capital gains tax (CGT) relief, and it’s worth understanding how it works. Transitional CGT relief is available for SMSFs affected by the new $1.6m transfer balance cap, or for SMSFs paying a transition to retirement income stream (TRIS).

With relief available, important decisions need to be made as we head towards 30 June 2017. These choices will have a direct effect on the amount of SMSF income tax paid in future years.

What is CGT relief in a nutshell?

The new CGT relief rule, which applies in particular circumstances, enables the cost base of fund assets to be reset to market value.

The intent of the new rule is to provide CGT relief on gains made before 1 July 2017, so as not to disadvantage fund members who are required to commute a pension due to the new transfer balance cap, or the TRIS tax changes. Whilst the focus has been on relief for retirement phase pension funds, relief also applies for funds paying transition to retirement (TTR) pensions.

Even though there’ll be no requirement to commute from a TTR pension to comply with the transfer balance cap (TTR pensions don’t count towards the cap), the introduction of the new TTR pension integrity measures will result in:

- assets being transferred from the segregated current pension asset pool to the segregated non-current asset pool, for a fund using the segregated method to claim Exempt Current Pension Income (ECPI), or

- a change in the proportion of total fund assets used to discharge pension liabilities, for funds using the unsegregated method.

What’s the process and which SMSFs should be looked at?

In essence, the process is the same as a fund with members who are required to comply with the transfer balance cap (see our CGT Relief explained article), except there’ll be no pension commutation. As there is no reference to the $1.6 million transfer balance cap, when reviewing which SMSFs will be eligible for CGT relief, this is not restricted to SMSFs who have members with pension accounts in excess of $1.6 million.

Fund with TTR members under $1.6 million eligible for CGT relief

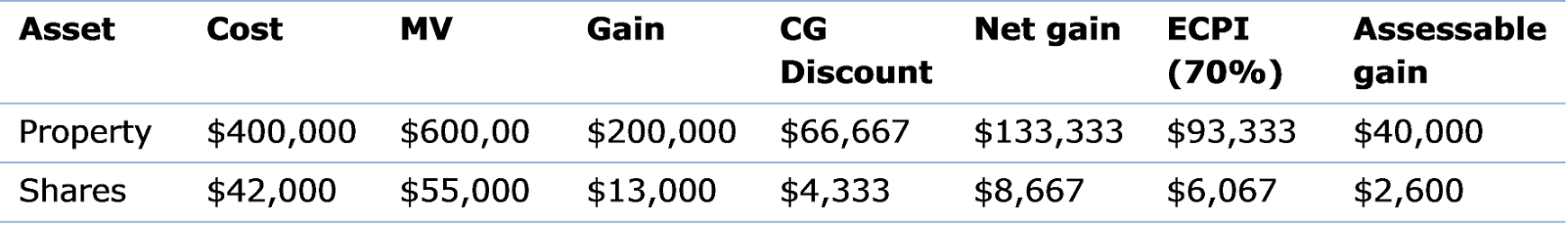

Let’s consider an SMSF with two members and total assets of $700,000. At first glance, this SMSF would not be eligible for CGT relief, however, one member has a TTR pension with a balance of $500,000. Assuming the SMSF is using the unsegregated method to claim ECPI in 2016/17, you would expect an ECPI% of around 70%. From 1 July 2017, the new TTR pension integrity measures will mean that the level of ECPI claimed will be nil. This will have an effect on the amount of tax the fund pays when an asset is sold as any gain accrued since acquisition date to 30 June 2017 will be fully assessable (subject to CGT discount rules) when sold after 1 July 2017.

Consequently, this SMSF is eligible to apply the CGT relief rules. As the SMSF is using the unsegregated method to claim ECPI in 2016/17, all of the assets are eligible for CGT relief.

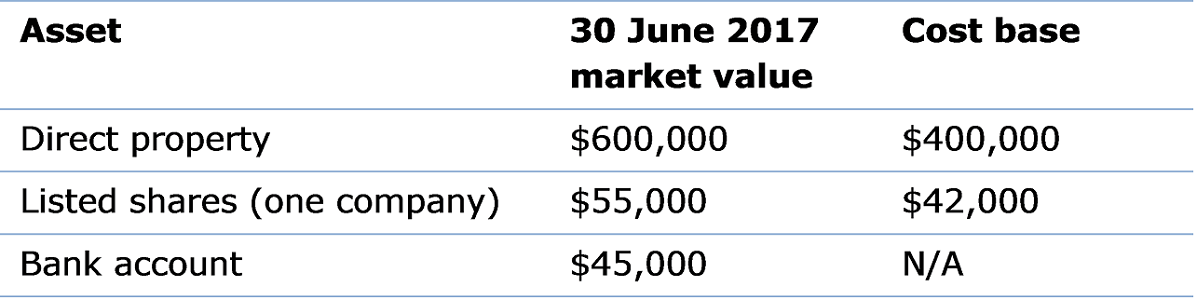

Let’s assume the SMSF has the following assets (all held for at least 12 months):

The SMSF then has the choice to either include the assessable gain for each of the assets, or defer until the asset is sold. The election to defer is made on an asset-by-asset basis and is also an irrevocable election to be made on the approved ATO form.

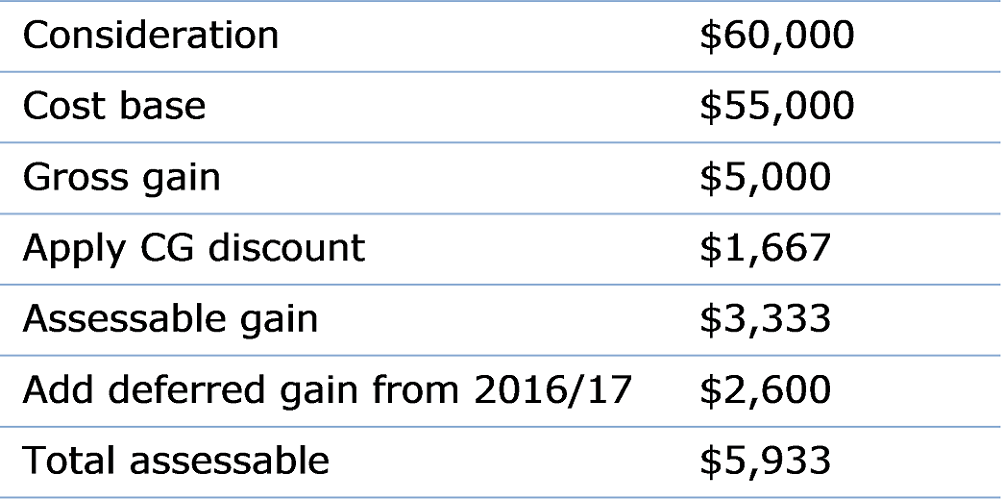

When the asset is sold after 30 June 2017, the assessable capital gain will be calculated based on a cost base of the respective 30 June market value and using a purchase date, for CG discount purposes, on 30 June 2017. The deferred assessable gain will also need to be included in the income year the asset is sold. For example, let’s say the listed shares were sold in 2019/20 for $60,000 and the notional gain in 2016/17 was deferred, the total assessable amount from this disposal will be calculated as follows:

In this example, by applying the CGT relief and deferring the notional assessable gain in 2016/17, the SMSF saved $919 in fund income tax for this asset.

Is the SMSF a 100% TTR pension fund? Watch out for the trap!

For SMSFs wholly consisting of TTR pensions, there is a trap that can prevent the fund from applying the CGT relief rules.

Such funds are by default segregated funds. For the CGT relief rules to apply the fund must either transfer assets from the segregated current pension asset pool to the segregated non-current asset pool or change to the unsegregated method, on or before 30 June 2017. In practical terms, this would require the SMSF to have at least one member accumulation account on or before 30 June 2017. This could be achieved by either a member or their employer, making a contribution or a member effecting a partial or full commutation of a pension, with the commuted amount being retained in their accumulation account.

However, be mindful of the ATO’s comments in relation to application of Part IVA to schemes or arrangements designed to trigger access to the CGT relief rules. For example, a member making a $1 contribution would warrant ATO scrutiny as opposed to a fund that received an SG contribution from a member’s employer or where the member partially or fully commuted a pension.

Mark Ellem is Executive Manager, SMSF Technical Services at SuperConcepts, a leading provider of innovative SMSF services, training and administration. This article is for general information only and does not consider the circumstances of any individual.