Two primary goals of Australia’s retirement savings system are to encourage financial independence and to reduce reliance on the age pension. However, for some retirees, the system works against these goals. For retirees caught in this trap, saving and investing more can actually result in a lower income in retirement.

The ‘Retirement Trap’ anomaly results from the progressive reduction of age pension entitlements as assets and income in retirement increase above certain thresholds. This trap affects retirees with superannuation balances between ~$350,000 and ~$600,000. It creates a bias towards short-term spending or directing resources into exempt assets such as the home, ahead of using assets to generate long-term additional income.

The current retirement system

Australia’s retirement system relies on retirees drawing income from the ‘three pillars’, a combination of superannuation, the age pension and external assets. The pension is means tested, with the level of entitlement calculated using an income test and an assets test. As assets and income levels increase, pension entitlements are phased out. Above certain levels, all pension (and other entitlements) cease.

For an individual, there is an income range between $174 and $2,026 per fortnight where for every additional dollar earned, the pension is reduced by 50 cents. This effectively halves the value of additional earnings for retirees in this range.

On the assets side, for individual homeowners whose assessable assets are above $263,250, the pension is reduced by three dollars a fortnight (or $78 per year) for every additional $1,000 in assets. To offset this reduction, each $1,000, if invested, must generate an annual return above 7.8%.

Our work focuses on ‘retirement age’ using age 67, which will be the age at which Australians are eligible for the age pension in 2023, with savings of between ~$350,000 and ~$600,000. Increasing their savings may result in their income decreasing, and the effect also termed the ‘Pensioner Taper Trap’, has been illustrated and modelled by other researchers, such as National Seniors here and here.

Reductions in income can occur because such savings increases are unlikely to generate enough additional income to offset the pension entitlements that are lost.

The Retirement Trap

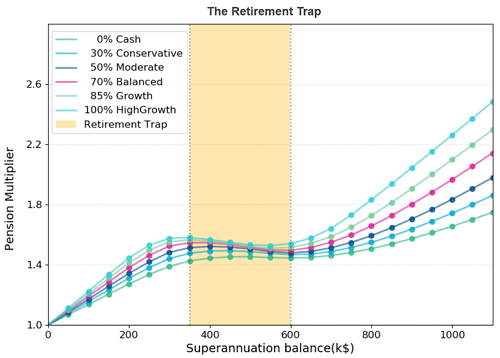

To illustrate the Retirement Trap, BetaShares introduced the concept of a pension multiplier. This is a number (greater than or equal to 1) which represents the current or future income stream a retiree can expect relative to the age pension. For example, a pension multiplier of 1.5 means that income of one and a half times the government pension can be expected in retirement. The Simulation of Uncertainty for Pension Analysis (SUPA) model, developed at CSIRO Data61’s RiskLab, is used to calculate the resulting pension multiplier expected from various investment strategies.

The SUPA model is a statistical tool which uses the behaviour of economic factors such as inflation, interest rates and asset returns to generate long-term forecasts. Around 100,000 forecasts for each investment strategy were used to generate the results shown below.

Five different investment strategies, ranging from 30% to 100% allocations to growth assets – Conservative, Moderate, Balanced, Growth and High Growth – were tested. Under all these strategies, the Retirement Trap can be observed in the graph below.

Source: CSIRO

The chart shows that retirees with a superannuation balance of between ~$350,000 and ~$600,00 see their pension multiplier decrease as their superannuation balance increases.

The system therefore implicitly encourages these retirees to spend additional savings or redirect them towards exempt assets like their homes, instead of choosing to invest them to generate income.

If a retiree in this scenario does invest their additional savings, they must generate returns that are well in excess of 7.8% per annum to exceed the pension entitlements that are lost. This is likely to entail a level of risk which is well beyond what is normally recommended for retirees.

The analysis illustrates that Australian retirees currently can escape the Retirement Trap only if they can accumulate well over half a million dollars. Above this point increased savings will lead to increased income.

Retirement Income Review

In September 2019, the Federal Treasurer announced a review into the retirement income system with the following intentions:

“The review will cover the current state of the system and how it will perform in the future as Australians live longer and the population ages.

The review will consider the incentives for people to self-fund their retirement, the fiscal sustainability of the system, the role of the three pillars of the retirement income system, and the level of support provided to different cohorts across time.”

The consultation period for the Government’s Retirement Income Review has just finished.

BetaShares made a submission to the Review Panel outlining the Retirement Trap anomaly, and proposing a new model for the retirement system where the age pension would become universal, with the means and assets tests discarded.

Compulsory superannuation contributions would be streamed into defined benefit schemes (to fund the universal pension) and defined contribution schemes (much the same as those which currently exist). This streaming would be based on age, income, asset balances and other factors. Where a retiree has not fully funded their pension through their defined benefit contributions, the shortfall would be funded by the Government. Within defined contribution schemes, individuals would still have flexibility and choice as to where their contributions are directed and how they are invested.

It would mean Australian retirees can choose to spend or save additional income or assets based on their personal circumstances, without that choice being distorted by the structure of the system.

BetaShares acknowledged that such significant changes to the superannuation system would be controversial, but argued that the proposed model would not only remove the distortions that discourage a certain group of retirees from increasing their financial independence, it would also reduce the financial burden on the Government.

The current structure of Australia’s retirement income system can produce unintended and undesirable outcomes for certain retirees, due to the interaction between the eligibility for pension entitlements and the assets and income tests.

Dr Roger Cohen is the Senior Investment Specialist at leading ETF provider, BetaShares, a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any investor.

The full BetaShares study provided to the retirement Income Review can be found here. For more articles and papers from BetaShares, please click here.