The most commonly followed global bond benchmark, the Barclays Global Aggregate Index, is poised to reach seven years – not in age (it has been around a lot longer than that) but in duration, being in simple terms the index’s average weighted term to maturity. Why should we care about such a milestone? The answer lies in how the index’s duration has tracked over time and how that affects investment returns, particularly in the current context of historically low (in some cases negative) interest rates.

Know your duration

Duration is important to investors as it indicates the sensitivity of bond exposure to changes in interest rates. All else being equal, bonds with higher durations have greater price volatility than bonds with lower durations. The longer the duration, the greater the price will fall for a given rise in interest rates, and vice versa.

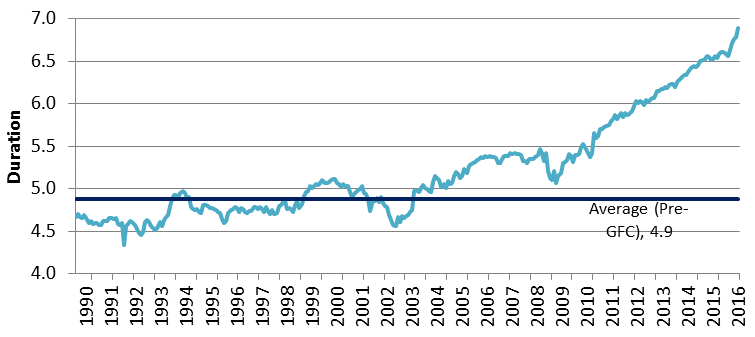

The chart below shows the duration history of the Barclays Global Aggregate Index.

The duration of the Barclays index has progressively lengthened, like many conventional fixed interest benchmarks, particularly over the past decade. Currently sitting at 6.9 years, this compares to 5.5 years in 2010 and an average of 4.9 years prior to the Global Financial Crisis (1990-2008). One of the drivers is the increase in longer-dated issuance by both governments and companies – who themselves have diminished in credit quality on average – to lock-in the alluring borrowing rates on offer.

The consequence for investors is that, by being in a fund which closely or broadly tracks the Index, the interest rate risk exposure has increased markedly over time. And it has happened without an investor necessarily making any active decision.

A related issue is that the yield on the Barclays Index is now just under 1.2% compared to, say, 4.3% a decade ago. Investors are receiving lower compensation per unit of interest rate risk for their investment. At the same time, the positive return ‘carry’ from hedging to local currency has fallen in recent times, alongside the Reserve Bank’s opposite monetary policy path to that of the US Federal Reserve. Hence the buffer to help insulate a fund’s overall return from any downward movement in the capital price of bonds has diminished.

So is this a comfortable state of affairs for investors? That depends on your outlook for global interest rates. If you believe yields will rise in the short-medium term (particularly at a relatively brisk pace), then that could have an adverse effect on portfolio returns. Even if you hold no view you should be aware that, by default, indexes have been changing the risk characteristics of your portfolio.

We need not jump to the conclusion that additional duration is a bad thing. Global economic weakness and low inflation over recent years have pulled yields downward, thereby generating solid returns for bond holders, and high quality credit exposure is typically a useful safe haven for investors during times of market stress. However, when it comes to duration, the relevant question is ‘how much is too much?’. There is no sign of an end to higher duration trend in conventional benchmarks. One might wonder where it will end, and moreover, what the rationale may be for an investor to passively follow.

Forewarned is forearmed

Most portfolios would do well to retain material exposure to the diversification and liquidity benefits of fixed interest. At the same time, however, some regard for ‘duration creep’ in bond indexes is warranted. This may be addressed via asset allocation decisions, or in some cases we have worked with clients to consider alternative benchmarks or partially using more absolute return-oriented solutions.

The lower-for-longer interest rate theme continues to dominate markets, but this theme is notably embedded in current equities pricing and other risk assets as well as fixed interest. Strong exposure to duration has been a tailwind to portfolio returns for an extended period, but under some economic scenarios it could be a less-than-welcome attribute.

David Scobie is a Principal in Mercer’s Investments business, based in Auckland. He advises institutional clients on their investment policies and structures. He is also involved in evaluating fund managers, linking in with Mercer's research capability in Australia and globally.

This article does not contain investment advice relating to your particular circumstances. No investment decision should be made based on this information without first obtaining appropriate professional advice and considering your circumstances.