The current bushfire crisis is a tragic event that has affected many Australians. In addition to the personal tragedies, the impact on consumers, businesses and infrastructure assets will have implications for the economy and listed companies.

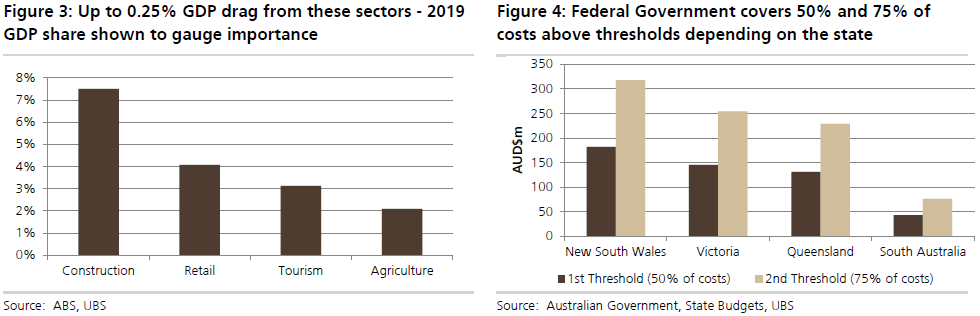

This article draws on research by UBS Securities into the impact on the economy and specific companies. They estimate the bushfires could reduce GDP by 0.25% per quarter in the final quarter of 2019 and first quarter of 2020. Agriculture, Retail, Tourism and Construction will be hit the hardest despite the Federal Government announcement of a $2 billion relief package over three years with an indicative $500 million spent this financial year. The budget surplus is not expected to be at risk.

What are some major stock implications?

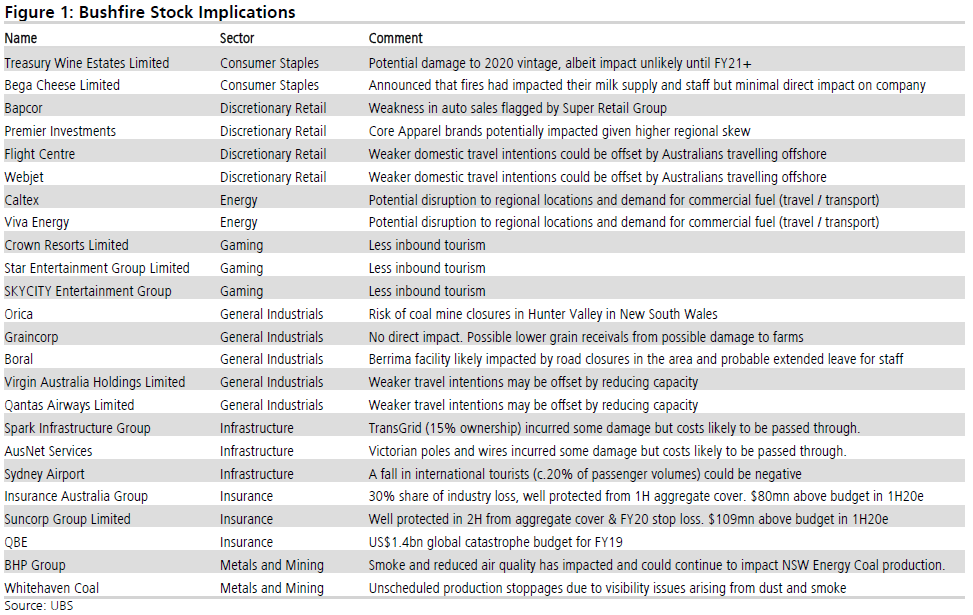

Figure 1 examines some stock-specific impacts from the bushfires.

What's the economic impact?

While the direct impact of the bushfires have largely been felt in rural and regional areas, the indirect impacts of the smoke haze and weaker overall consumer confidence have also been felt in the large cities of Sydney, Melbourne and Canberra.

According to Pieter Stoltz, Analyst at UBS:

“Global inbound tourism could be significantly impacted, with the Australian Tourism Export Council (ATEC) estimating a 10-20% (~$4.5 billion) reduction in international tourism revenue in 2020. Further, the indirect impact of the smoke haze will drag retail and construction with lost work days and lower retail spending, putting further pressure on already weak retail sales.

In terms of insurance cost, the impact is expected to be significant; with some industry estimates suggesting the cost could be similar to the 2009 Black Saturday fires (c.$2 billion in today's dollars). The current estimate of losses from the Insurance Council of Australia (ICA) stands at c.$1.34 billion, and will likely continue to rise.”

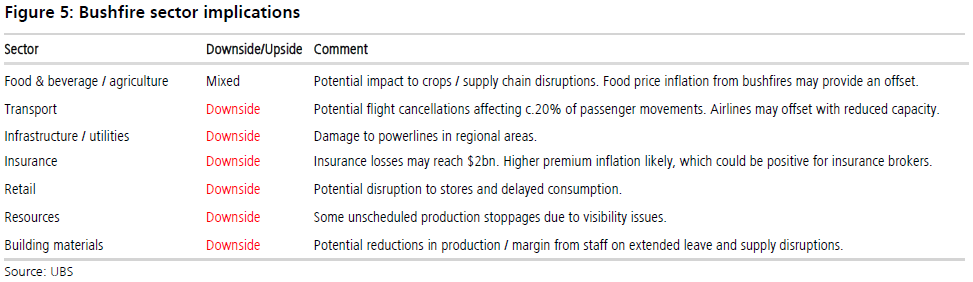

What are the sector implications?

On 14 January 2020, fashion retailer, Mosaic (formerly Noni B Group), said it would experience an 8% decline in comparable sales for the December half as bushfires had directly impacted a significant number of its stores. On 20 January, Super Retail Group announced declining comparable sales for its BCF and Macpac brands explaining that the bushfires had caused store disruptions and both bushfires and sustained drought conditions had hurt the performance of the outdoor category.

Stoltz believes further reports of store disruptions and softer trading conditions are likely from other retailers leading into and during reporting season. Companies identified include:

- Premier Investments' core apparel brands also have higher regional skew and could therefore be at risk.

- Insurance Australia Group and Suncorp each have about 30% share of the industry losses while QBE has about 10% of the potential $2 billion industry loss (but reinsurance and stop-loss cover means these bushfire losses are manageable).

- Treasury Wine Estates could experience some damage to vineyards, affecting yields. While reduced farm productivity may not directly affect listed companies, there have been supply chain disruptions.

- Bega Cheese announced that fires had impacted their milk supply but that there had been minimal direct impact on the company.

- Sydney Airport has noted that trading conditions "have been at their toughest in more than a decade".

- Whitehaven Coal has noted some unscheduled disruptions to production due to a combination of drought conditions, dust and smoke.

- BHP said that smoke and reduced air quality impacted and could continue to impact NSW Energy Coal production.

- Boral's cement facility in Berrima (near Bowral) is likely to have been impacted by extended leave for staff and road closures, which may lead to lower production or margins.

While stocks with bushfire exposure are likely to sell off on the announcement of negative news, we believe any financial impact will be non-recurring. Therefore, any share price overreactions could present a buying opportunity.

Figure 5 covers some of these sector implications.

Unprecedented fire damage

Over 10 million hectares have burned during the ongoing Australian bushfire crisis with nearly 5 million in New South Wales alone. The fires have destroyed more than 2,000 houses. For comparison, the 2009 Black Saturday bushfires burned 450,000 hectares.

The impact on consumers, businesses and infrastructure assets will have broad implications for the economy and listed companies, and at the time of writing, dozens of fires continue to burn across the Eastern states.

Graham Hand is Managing Editor of Firstlinks. Much of the material for this article was provided by UBS Securities. The article is general information and does not consider the circumstances of any investor. Equity market returns are influenced by corporate earnings, interest rates, and investor demand risk premiums. The outlook for any of these variables are subject to change.