In early 2020, it seemed that this year the banks would get their mojo back. Rising profits were expected with the 2018 Royal Commission passing into the rear vision mirror along with falling compliance and remediation costs. After Commonwealth Bank reported their first-half 2020 earnings in early February, the bank's share price surged over $90 after delivering 11% profit growth. The only cloud on the horizon was the question as to how the banks would maintain profit margins with interest rates so low.

How wrong we were! In late March, a mere five weeks after reporting solid profit results, Commonwealth Bank's share price had fallen 40% (like all banks) to $54. The financial press was wondering whether the mulit billion dollar provisions each bank had taken for bad debts stemming from Covid-19 shutdowns will be enough.

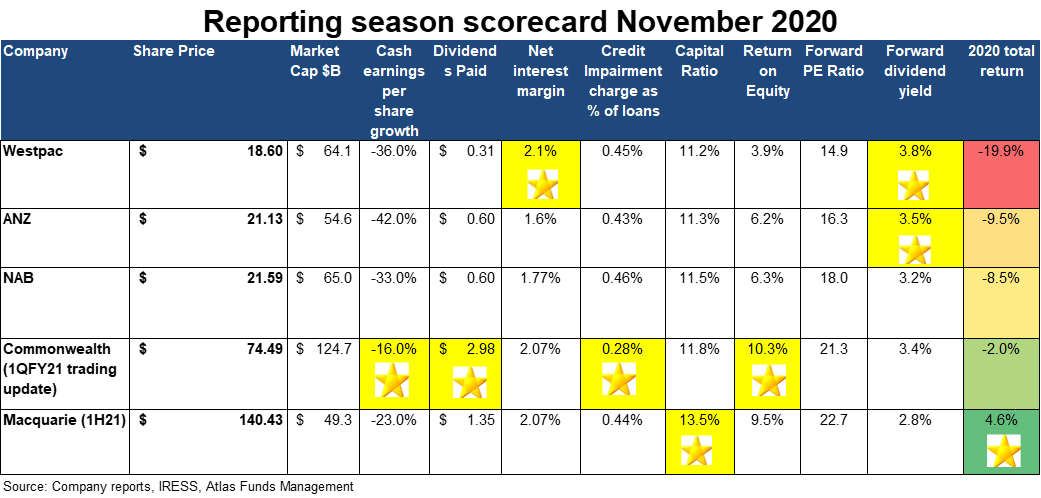

In this piece, we are going to look at the themes in the approximately 800 pages of financial results released over the past two weeks including Commonwealth Bank's 1st Quarter 2021 Update, awarding gold stars based on performance over the past six months.

Uncertainty falling

In May 2020, the base case for the banks was unemployment between 10-12% and house prices falling by between 15-20% throughout 2020, with further deterioration expected in 2021. This cautious stance saw Westpac taking $1.8 billion and ANZ $1 billion in provisions and most banks declining to pay a dividend. The lack of dividends surprised many investors as Westpac even paid a dividend during its near-death experience in 1992.

November revealed cautious optimism due to the high levels of fiscal stimulus, falling levels of Covid-19 transmission and historically low interest rates. The economy in late 2020 is in better shape than was expected six months ago. Indeed instead of seeing a steep fall in house prices which could have exposed the banks to losses on their mortgage books, in October CoreLogic revealed that house prices across the five main capital cities were up +4% over the past year, with Sydney leading the pack gaining +7%.

Furthermore, in November, the banks showed that the number of stressed customers had been falling steadily. In June, Commonwealth Bank had 210,000 loans on their book deferring payments, this fell to 129,000 in September and again to 52,000 in October as borrowers returned to making full payments.

Strong capital positions

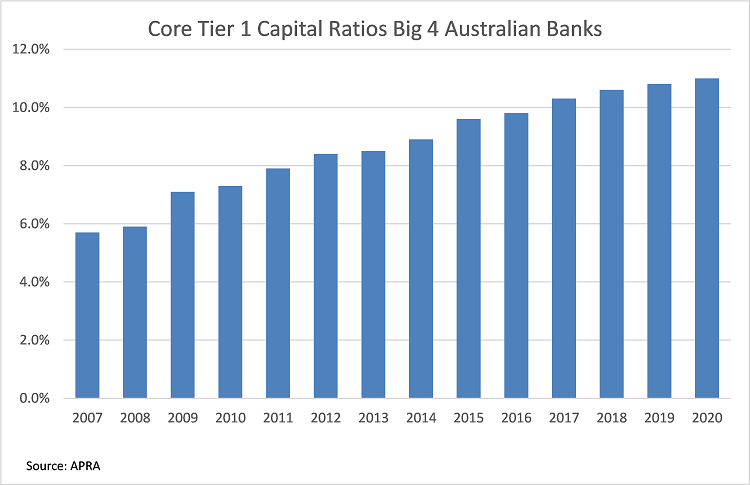

All banks have core Tier 1 capital ratios above the Australian Prudential Regulation Authority (APRA) 'unquestionably strong' benchmark of 10.5%, despite the billions of dollars of provisions taken and in the case of Westpac, a $1.3 billion-dollar AUSTRAC fine. This allowed Australia's banks to enter 2020 with a greater ability to withstand an external shock than was present in 2006 going into the GFC.

From the below table you can see that the banks have been building capital particularly since 2015 when APRA required that the banks be "unquestionably strong and have capital ratios in the top quartile of internationally active banks".

Furthermore, in the lead up to the Financial Services Royal Commission, the banks have divested their wealth management and insurance businesses to varying degrees. This resulted in the banking sector remaining well capitalised despite taking heavy provisions due to expected loan losses from Covid-19.

In the November management presentations, there was again a tone of self-congratulation from bank executives at their prudence for having such high levels of capital in 2020. In the GFC all banks raised several billion dollars each, whereas in 2020 only NAB raised capital and may not have had to do so if they had been able to divest MLC Wealth in a timelier fashion. Among the banks, Macquarie came out ahead in November with the strongest capital ratio, though in fairness to the trading banks, Macquarie's business model which has a high weighting to annuity funds management income will see lower loan loss provisions that erode capital.

Net interest margins holding

Before the pandemic, the biggest issue facing the banks was maintaining net interest margins as the cash rate moved towards zero. Banks earn a net interest margin [(Interest Received - Interest Paid) / Average Invested Assets] by lending out funds at a higher rate than which they can borrow at. When the prevailing cash rate is 6%, it is much easier for a bank to maintain a profit margin of 2% than when the cash rate is 0.1% and there is nowhere to go in lowering deposit rates further. Also, falling interest rates reduce the benefit that banks get from the billions of dollars held in zero or near-zero interest transaction accounts that can be lent out.

Westpac revealed in September 2020 that it held $196 billion in accounts earning less than 0.25%, an increase of $39 billion over the previous six months that indicates that a portion of the stimulus payments is being saved and not spent. Net interest margins remained stable at between 1.6% and 2.1%, with the banks more heavily exposed to mortgages (CBA and Westpac) traditionally having higher margins. The business banks (NAB and ANZ) generally have lower margins as they face competition from international banks when lending to large corporates. In aggregate net interest margins for the banks only reduced by 0.06% over the past year, a solid outcome given falling interest rates over the past year.

Dividends

While ANZ, Westpac and NAB cut their dividends during the depression, both World Wars, the 1991 recession and the GFC, investors need to look back to the banking crisis of the 1890s to see the last time the major banks declined to pay dividends to shareholders, as they did in May 2020.

The banking crisis of 1893 was arguably more severe than what the banks faced earlier this year. After the collapse of the Melbourne land boom in 1888, a large number of Australian banks were unable to pay depositors, who saw access to their funds locked up for several years. This stressed situation saw the English, Scottish & Australian Bank and London (Chartered) Bank of Australia (precursor banks of ANZ) and National Bank of Australia suspend dividends between four and nine years. In fairness, Westpac (née Bank of New South Wales) could claim to have paid dividends during this period.

In November most of the banks returned to paying dividends from profits, following APRA's guidance of limiting dividends to 50% of statutory profits. However, Westpac's final dividend payout was underwritten by an investment bank issuing new shares, which dilutes shareholders. CBA wins the gold star for the smallest decline in the dividend and by not resorting to financial gymnastics to make the payment.

The road back to pre-COVID-19 levels of profits

While the banks will eventually see profits from banking return to pre-COVID-19 levels, the road back to the same dividends per share that we saw in 2019 will be slow. NAB and Westpac have both conducted significant equity issues over the past 12 months, which have expanded the share count. Commonwealth and ANZ are in a more fortunate position, as they entered 2020 with excess capital, courtesy of the sale of their wealth management and insurance businesses over the past year. As a result, neither of these banks issued shares at depressed prices during 2020.

We expect dividends to increase across the banking sector in 2021, as APRA has indicated that it will relax its stance on limiting bank dividends if the economy continues to improve.

History provides some clues on when the banks will return to their 2019 levels of profitability. After the GFC, the banks took roughly three years until 2011 to regain their pre-GFC level of dividends per share. Less encouraging is the historical example of bank dividends in the 1990s and the 1890s. Westpac took until 2000 to reinstate the same dividend per share that it paid shareholders in 1990.

Atlas believes that the path to restoring dividends is likely to be closer to the post-GFC experience than the 1990s. Today the banks have higher credit quality in their loan books, and no Quintex, Bond Group, ABC Learning nor poorly supervised foreign adventures. Additionally, their customers face interest rates in the low single digits, not the 18-20% mortgage rates seen in the early 1990s and enjoy high levels of fiscal stimulus. Unlike the GFC, in 2020, the banking system is not the cause of the problems we face, and the banks themselves are carrying increased levels of capital to absorb losses.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor. The author would like to recognise Ashley Owen's assistance in looking at historical Australian banking crises.