Growth stocks have driven global equity markets higher over the past few years, but greater volatility in early 2021 may suggest that growth investors face a more challenging environment ahead. Successful growth investing will require greater selectivity to deliver attractive risk adjusted returns over the market cycle.

Competitive advantages and long-term growth trends

A deep understanding of what drives a company’s business and its markets is crucial to long-term success as a growth investor. We look for high-quality growth companies that have both the technological and operational prowess to build lasting competitive advantages. The businesses should benefit from long-term secular growth trends such as e-commerce adoption, vehicle electrification, cloud computing, and financial technology.

Businesses in such growing markets tend to be dynamic, always adapting to the needs of their customers and innovating to bring new technologies and services to market. We have found that investing in either best-in-class ‘pure-play’ companies, or those that operate in a small number of complementary businesses, is one way to stay ahead of changes in the business and the broader industry.

Unlike conglomerates, these focused companies offer growth investors the following three significant advantages:

- Deeper analysis of dynamic, fast-growing underlying markets

- Focused capital allocation

- A clear understanding of company-level economic exposures that can help with portfolio risk management.

Three examples of these insights

1. Deeper industry analysis: Intuitive Surgical vs Medtronic

The trend towards robotic-assisted minimally-invasive surgery is one place where a pure-play company can provide investors a deeper understanding of market dynamics than a more sprawling enterprise. We expect the penetration of robotic surgeries will increase over time, with worldwide procedures to grow from 2% to ~15% of surgeries over the next decade to ~US$18 billion (sourced from Goldman Sachs, Company Data).

Source: Intuitive Surgical

Intuitive Surgical Inc. is a US-based company that pioneered the robotic systems used in minimally invasive surgical procedures. Its da Vinci surgical system strives to make surgery more effective and less invasive, while also improving patients’ recovery times. The company currently has about 90% of an ever-expanding market as more types of surgeries are approved to be performed with the system.

Given its dominant position, Intuitive Surgical can provide investors with a better understanding of the trends in surgical systems than many of its competitors, such as Medtronic PLC.

Medtronic is a medical device conglomerate. Their robot-assisted surgical system remains under development and the division in which this product is being developed also includes several other surgical tools. Given the diversity of its product portfolio, analysing Medtronic may not give investors a clear picture of the trends at play in the specialised robot-assisted surgical market.

Additionally, within Medtronic, it can be difficult to assess which products and systems are being prioritised with research spending, and even then, this may change significantly over time. At Intuitive Surgical, by contrast, all its research and development efforts go into improving and expanding the capabilities of the da Vinci system which can further widen its lead over competitors.

In a growing, highly technical field such as robotic assisted surgery, changes in manufacturing, intellectual property, and the regulatory landscape can make large differences in relative market-share and future profitability potential.

To accurately analyze the competitive position of our portfolio with respect to this attractive market, we value Intuitive Surgical’ s direct exposure and market-leading position.

2. Focused capital allocation: Zebra Technologies vs Honeywell

Capital allocation is also often more efficient and better understood in pure-play companies than in conglomerates. For example, Zebra Technologies Corp. which makes barcode printers and scanners to help companies manage their inventories and assets, can more efficiently and effectively allocate capital than its largest competitor Honeywell International Inc.

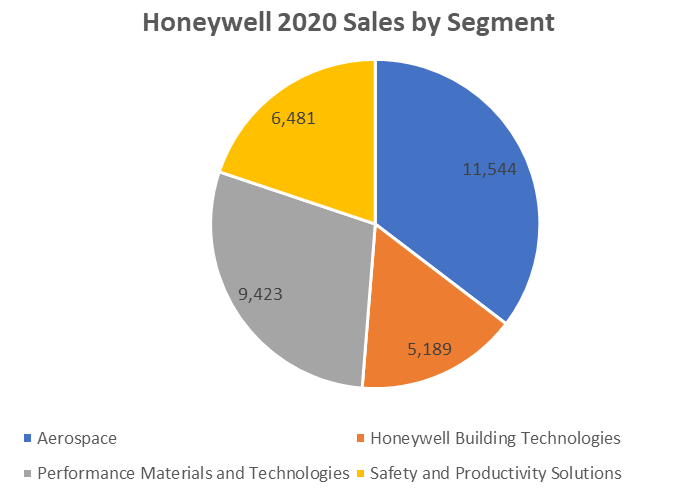

Honeywell is a conglomerate, with business lines that span aerospace, building technologies, performance materials, and safety and productivity solutions. While Honeywell competes in the barcode scanner space, the division makes up just 5% of total revenue. It is inevitable that a company with such diverse operations, politics and persuasion may lead management to stray from the most efficient capital allocation strategy and potentially underinvest in attractive growth opportunities.

Source: Franklin Templeton, Honeywell Company Filings, 2020

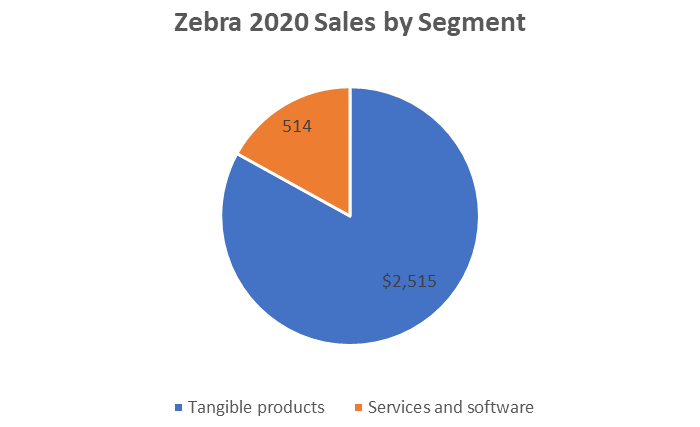

Zebra’s management, by contrast, is focused on its one business, allowing it to be more effective, strategic, and proactive in real-time, by our analysis. A real-world consequence of this advantage was Zebra’s introduction of a mobile device based on the Android operating system, which has now become the industry standard. Competitors like Honeywell have struggled to get customers to switch to their later entries.

Source: Company reports.

A management team concentrating on one business gives us greater confidence in Zebra’s ability to remain nimble to take advantage of new market opportunities that arise in its dynamic industry.

3. Improved risk management: Aptiv PLC vs Infineon

Best-in-class companies with focused business models allow us to better understand risk at the portfolio level, particularly given our focus on building a concentrated growth portfolio that is still highly diversified.

In a 40-stock portfolio, for instance, understanding where potential investments may share a source of revenue or have similar expenses is critical in ensuring the portfolio is diversified. Since growth businesses often change over time, being able to keep ahead of these changes can help avoid instances where companies that once had little overlap begin to see greater exposure to a common market.

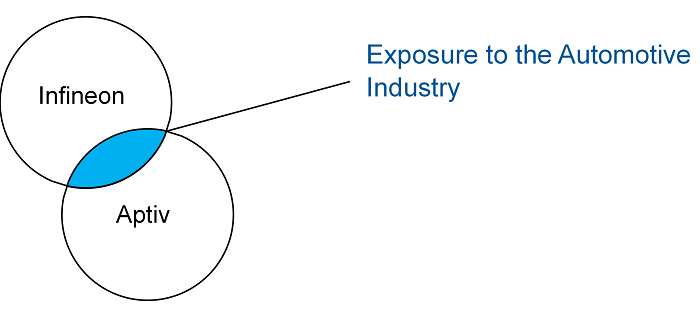

For instance, on the surface, Germany-based semiconductor manufacturer Infineon Technologies AG might not appear to have much in common with global auto parts manufacturer Aptiv PLC. But as cars and auto components have become more sophisticated and as the number of chips powering these systems have increased, Infineon’s business increasingly overlapped with Aptiv, given their exposure to auto production.

Two Sectors, One End-Market Exposure

Our experience has been that changes such as this can be more evident in companies that operate a single business or set of highly complementary businesses.

Concentrating on the long term

The universe of growth stocks is large and diverse and finding opportunities that can outperform across a market cycle is challenging. Our experience as growth managers has reinforced our view that a focus on pure-play companies can help to build a concentrated, yet still highly diversified portfolio of best-in-class growth stocks. Often this can lead us down the market cap spectrum toward lesser-known names, however we also believe that there are plenty of large cap names which operate highly focused businesses, capable of generating attractive returns over the long term.

Though the world has become more uncertain in the past year, high-quality companies tied to long-term secular growth trends should produce compelling shareholder value, regardless of the macroeconomic environment.

Francyne Mu is a Portfolio Manager of the Franklin Global Growth Fund. Franklin Templeton is a sponsor of Firstlinks. This article contains general information only and should not be considered a recommendation to purchase or sell any particular security. It does not consider the circumstances of any individual.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.