Overall, Australia’s businesses are way below world best practice (WBP) when it comes to profitability and have been for decades. Average returns on shareholder funds after tax (ROSF or Return on Investment, ROI) across the nation’s 2.3 million businesses have averaged just 3.7% over the past three decades (compared with the 10-year government bond rate averaging 5.5% over that period), although with a better 4.2% in 2018. Our largest 2,000 corporations averaged 6.9% ROI, and our Best 100 did a little better at 8%. The WBP level is 22%.

What do we mean by world best practice?

In this article, I have treated WBP as a company profitability level above 22% ROI, not a single 'best' as we might do with best practice in other comparisons (such as OH&S, triple bottom line, stakeholder action). Even with best practice processes and products there are often subtle if not significant differences.

It's instructive to see how WBP has evolved through the ages of economic progress.

- The Agrarian Age, up to the late 18th century. WBP profitability was probably around the 10-year bond rate of about 5.5%.

- The Industrial Age, up to the mid 1960s. WBP profitability was around double the bond rate, at about 11%.

- The current Infotronics Age, to the middle of the 21st century. WBP profitability has doubled again to 22%. The added returns come from intellectual property, brand strength, culture, etc, which often remain off balance sheet although shareholders accept them as real in valuing a company. The massive change has been in the value of intellectual property ahead of the audited net assets.

Global performance comparisons

All of the ROI averages of Australian companies stated in the first paragraph are just over half the averages in the USA.

However, Australia had more than one in 10 of our largest 2,000 - that account for 46% of the nation’s $5.3 trillion revenue in 2018 - achieving WBP of 22% in ROI terms over the 3-year period to 2018. Sadly, three in 10 lost money over the same period.

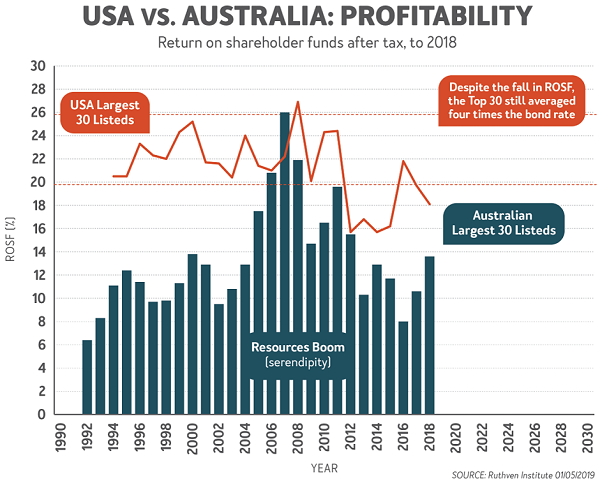

We see the same performance gap in our 30 largest listed stocks (by market capitalisation) compared with the 30 largest NYSE-listed stocks (the Dow Jones Index list) below.

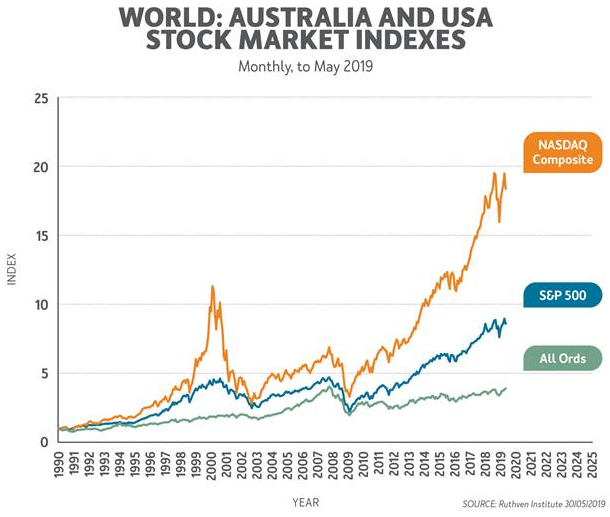

So, a lot of share portfolios and SMSFs have become more heavily weighted into US equities in recent times (directly or via managed funds and ETFs). That has been a no-brainer when one sees the diversity of performance between the All Ordinaries, S&P500 and NASDAQ in the next chart.

Tell us some good news about Australia

But, as always, there is good news as well as sobering news as shown below.

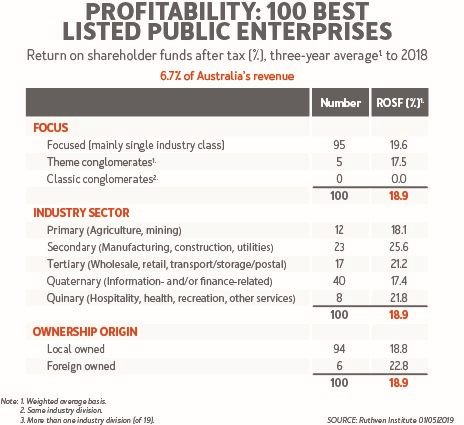

Some 42 companies in the Best 100 Listed Stocks achieved or bettered the WBP of 22% ROI in the three years to 2018, and the weighted average of the 100 was a commendable 18.9%.

The good performance took place across all five industry sectors with the toughest sector - the secondary sector of manufacturing, utilities and construction - performing best. Most of the 100 Best were focused companies with only five being diversified, and even they were theme conglomerates rather than dangerous classic conglomerates which all fail eventually.

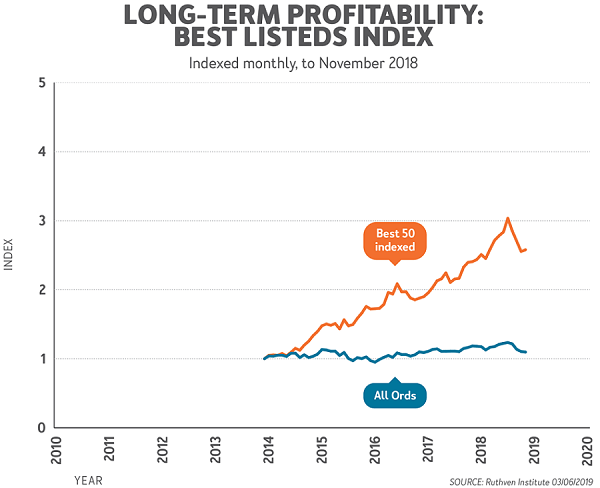

The best news of all is when we look at the Best 50 Listed companies over a 5-year period to 2018, and compare their weighted performance with the All Ordinaries Index, as below.

A million dollars invested in the Best 50 five years ago would have yielded a capital value of $2.5 million by 2018, a 30% pa return, plus dividends. The All Ords would have been worth just $1.15 million plus dividends.

Our Best 50 not only outpaced the S&P500, but also the NASDAQ. It would seem fundamentals do matter.

Phil Ruthven is Founder of the Ruthven Institute, Founder of IBISWorld and widely-recognised as Australia’s leading futurist.

A full 40-page online Summary of the latest Business Performance results is available from www.ruthven.institute along with a staggering amount of other strategic information.