Co-authored with Susan Dziubinski, Director of Content for Morningstar.com.

An antidote to all the talk about hot stocks and speculative bubbles emerged last weekend at Berkshire Hathaway's Annual General Meeting. Warren Buffett displayed his fundamentals-based approach to investing, touting the virtues of buying the market and holding it, forever.

His ideas may seem out of touch in a market where Tesla trades at a 99% premium to Morningstar's fair value estimate, Elon Musk is sending Dogecoin to the moon and social media is considered a valid source of stock tips. Buffett has also been accused of being out of touch with the modern economy and for 'betting against' America during the pandemic.

The first shareholder question asked at the meeting demonstrated this:

“Mr. Buffett, you’re well known for saying to be fearful when others are greedy and be greedy when others are fearful. But by all appearances, Berkshire was fearful when others were most fearful in the early months of COVID, dumping airline stocks at or near the low, not taking advantage of the fear of gripping the market to buy shares of public companies at exceptional discounts and being hesitant to buy back significant amounts of Berkshire stock at very attractive prices. I’d appreciate hearing your thoughts surrounding this time …"

Buffett has been criticised many times in the past in questions posed with the benefit of hindsight. He replied:

"Until both monetary and fiscal policy kicked in, well, we knew we had an incredible problem and I am, just as Charlie is the Chief Culture Officer, I’m the Chief Risk Officer of Berkshire. That’s my job. We hope we do well, but we want to be sure we don’t do terribly. But we didn’t sell a substantial amount."

Here are some lessons the Oracle of Omaha offered to first-time investors. The short of it: the average person can't pick stocks and most investors would benefit from purchasing an S&P 500 index fund over the long term.

Extraordinary things can happen

"I would like particularly new entrants to the stock market to ponder just a bit before they try and do 30 or 40 trades a day in order to profit from what looks like a very easy game."

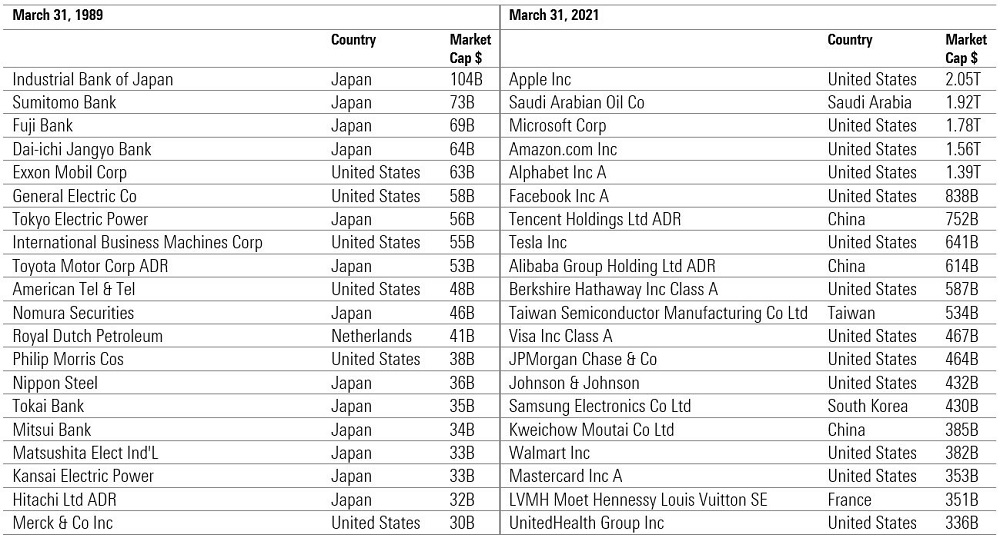

Buffett took time to remind people, particularly newer investors, of the extraordinary things can happen in stock markets. He included a list of the 20 largest companies in the world by stock market value on 31 March 2021. Apple was number one worth just over US$2 trillion with United Health at number 20, worth around US$330 billion.

Looking back at the top 20 from 1989, Buffett noted that none of the top 20 today appeared on the list 30 years ago. He said:

"None. Zero. There were then six US companies on the list and their names are familiar to you. We have General Electric, we have of Exxon, we have IBM Corp. None made it to the list 30 years later, it was zero."

20 Largest Companies by Market Value

Source: Berkshire Hathaway AGM, Bloomberg, EQS Function

Buffett then invited the audience to think about how many of the companies in the 2021 list will still be on the list in 30 years. He said:

"It’s not going to be all 20. It may not even be all 20 today or tomorrow. You’d think it could be repeated ... Yeah, it seems impossible and maybe it is impossible, but we were just as sure of ourselves as investors and Wall Street was in 1989 as we are today, but the world can change in very, very dramatic ways."

The lesson for investors is that the world will change in dramatic ways. Don't get too sure of yourself.

Investing themes are attractive but don't fall for them

Buffett said the best thing first-time investors can do is to be in the market.

"The main thing to do is to be aboard the ship. A ship. You couldn’t help but do well if you just had a diversified group of equities (US equities would be my preference) but to hold over a 30-year period."

To illustrate this point, Buffett said investors are attracted to popular industries, whether that be railways in the mid-1950s or tech companies today. But picking the winners and losers in an industry is incredibly difficult.

For example, Buffett said in 1903 the place to be was the auto industry. The thesis was that someday 290 million cars would be buzzing around the US. However, there were at least 2,000 companies that entered the auto business. In 2009, there were three left, two of which went bankrupt.

"There's a lot more to picking stocks than figuring out what’s going to be a wonderful industry in the future. The Maytag company put out a car. Allstate put out a car. DuPont put out a car. I mean, Nebraska, there was Nebraska Motor Company. Everybody started car companies just like everybody’s starting something now where you can get money from people.

But there were very, very, very few people that pick the winner."

The average person can't pick stocks successfully

During the Q&A portion of the meeting, Buffett was asked whether long-term Berkshire shareholders should continue holding their stock or diversify their risk across an index. The question comes after Berkshire Hathaway's stock underperformed the S&P 500 index by -18.5% in calendar year 2020. Buffett expressed a preference for holding the market.

"I recommend the S&P 500 index fund, and have for a long, long time, to people. And I’ve never recommended Berkshire to anybody, because I don’t want people to buy it, because they think I’m tipping them into something no matter what it was selling for. And I’ve made it public. On my death, there’s a fund for my then-widow, and 90% will go into an S&P 500 index fund, and 10% in bonds."

"…I like Berkshire, but I think that a person who doesn’t know anything about stocks at all, and doesn’t have any special feelings about Berkshire, I think they ought to buy the S&P 500 index.”

Buffett's take on hot-button issues

Bitcoin: On Bitcoin, Buffett refused to engage. Vice-Chairman Charlie Munger was more forthcoming, saying that investors should steer clear:

"I hate the Bitcoin success and I don’t welcome a currency that’s so useful (for) kidnappers and extertionists in our stores and so forth, nor do I like just shuffling out a few extra billions and billions and billions of dollars to somebody who just invented a new financial product out of thin air. I think I should say, modestly, that I think the whole damn development is disgusting and contrary to the interests of civilisation, and I’ll leave the criticism to others."

Trading apps: Asked what he thought about Robinhood and other trading apps that allow investors of all ages and experiences to participate in the stock market, Buffett said that they were a driver of the 'casino aspect' of the market dealing in puts and calls. He was also concerned about how they handle their sources of income and communicate with customers about fees.

"They’re gambling on the price of Apple over the next seven days or 14 days. There’s nothing illegal about it. There’s nothing immoral. But I don’t think you would build a society around people doing it. If you cater to those gambling chips, when people have money in their pocket for the first time, and you tell them they can make 30 or 40 or 50 trades a day, and you’re not charging them any commission, but you’re selling their order flow or whatever, I hope we don’t have more of it."

Anything else?

Buffett and Munger also discussed key issues facing investors including inflation, bank stocks, Elon Musk's SpaceX, stock buybacks, insurance firms, interest rates, SPACs, selling Apple and airline stock, Berkshire's succession planning, energy companies and ESG risk, ESG reporting and the Fed's 'extraordinary' action amid the COVID-19 crisis.

You can check out the full recording here. Don't be put off by the length. The session starts around 01:10.

Buffett himself admitted to a few mistakes, including selling some of the firm’s Apple stock last year, and the healthcare venture he started with JP Morgan and Amazon that folded this year. He praised the swift actions of the Federal Reserve and credited the institution with the US recovery.

Emma Rapaport is Editor Manager at Morningstar, owner of Firstlinks. This article is general information and does not consider the circumstances of any investor.

A Morningstar Premium free trial is available on the link below, including access to the portfolio management service, Sharesight.

Try Morningstar Premium for free