Aside from a brief look above the US 70-cent area in January 2023, the Australian dollar has been generally stuck in a range of 65-70 cents since August last year. What is going on with the little Aussie battler? Are the days of the strong Aussie dollar behind us and are we entering a longer-term structural period of weakness?

There is reason for optimism. In terms of the large factors that tend to be influential on the Australian dollar, pages could be written but we can point to three of the major ones to help explain the recent period of weakness and also why these could recede as headwinds.

It’s always the big dollar

The Aussie dollar has been relatively weak against the US dollar. This is not to be downplayed given that ~70% of global trade is still conducted in US dollar and it matters for an open economy like Australia’s. But a quick examination of major currency pairs shows that it’s not so much just the Aussie that’s been weak, so has the Japanese Yen, Pound Sterling, the Euro etc. The Kiwi has been especially weak. In short, US dollar strength explains a good part of the Aussie’s challenges over recent times.

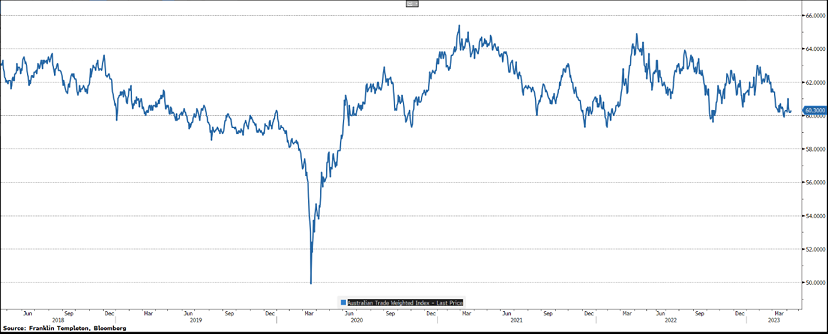

Measured on a trade-weighted basis, the Aussie is hovering around its longer-term average and actually above where it was pre-pandemic, which is why the RBA rarely talks about the currency of late and why, when they do, they usually refer to the trade-weighted index to rebuff any concern over the AUD-USD currency.

The US dollar is the problem

The aggressive Fed and an economy that has held up well have been positive factors for the US dollar. The interest rate differential between Australian and US short end rates is one factor that might explain the outperformance. In fact, over the last 10 years as the Australian dollar has lost its ‘high yielding’ advantage the currency has generally depreciated against the US dollar. The chart below shows the Aussie dollar versus US 2-year swap yield with the bottom panel the A$/US$ currency. At present, the Aussie has a yield disadvantage relative to the US dollar.

But interest rate differentials don’t explain everything. New Zealand is one example where short-end rates are now higher than the US and much more so than Australia but still has a languishing currency. Part of the reason is that the New Zealand economy is headed for a hard recession and markets are looking more toward that. We will come back to this.

China to the rescue?

China’s much looked forward to reopening post the COVID lockdown era has been more of a whimper than a bang. There isn’t going to be any debt fuelled infrastructure pump priming as in times gone past. The property sector remains a disaster and whilst headlines around major developer defaults have abated, the sector is a shadow of its former self.

But one positive for the Aussie is exports and, perhaps, services in the form of education and tourism where open borders have seen a surge in foreign arrivals. Some ~400,000 net migration last year and an estimated ~350,000 this year are huge numbers. Yes, we closed the borders for two years but we sure are making up for it rapidly. So, we regard China and the export story for Australia as positive but not a return to the boom times of 10 years ago. The China Manufacturing PMI isn’t a bad proxy for general growth and it has recently recovered strongly to be back to ~2020 levels. That is probably another positive sign for the battler.

Relative economic strength and outlook

One of the bright lights for the Aussie in the coming quarters is likely to be the relative performance of the domestic economy. The Reserve Bank of Australia has made a strategic decision to seek to curb inflation but not crash the economy. They continue to emphasise the employment gains of the last two years as a trophy to be preserved as inflation is brought back into check. They also have indicated a willingness to tolerate inflation above the target as long as its heading in the right direction in order to avoid a recession. In short, there is a good chance achieve a short landing.

In contrast, the US Fed has probably already overtightened and the number of recession signals continue to grow (deeply inverse yield curve, contractionary readings on the ISM indices, rapidly tightening bank credit conditions, etc, etc). In addition, Australia’s economy is likely to materially outperform New Zealand over the next 12 months with the Reserve Bank of New Zealand now openly forecasting a recession.

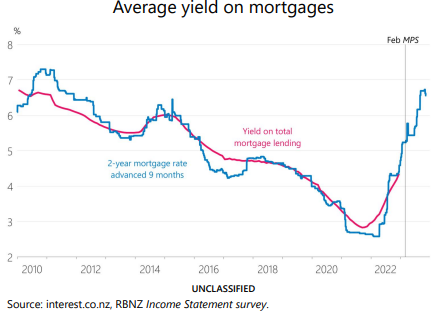

Part of RBNZ’s challenge is the way policy gets clogged in the system. The RBNZ, when it moves interest rates, is essentially targeting the 2-year interest rate swap yield from which the majority of mortgages are priced. Very few (~15%) of Kiwis take out floating rate borrowings with the overwhelming majority holding 2-year fixed loans with the 2-year swap yield acting as the effective base rate. When the RBNZ moves the overnight cash rate the direct impact on households is very limited. By contrast, when the RBA moves the cash rate the benchmark rate from which most mortgages are priced, the 3mth BBSW rate, moves almost basis point for basis point. The transmission is very strong and swift as we are now seeing domestically.

The upshot of this is that New Zealand has one of the longest lags between policy changes and household response in the world whilst also enjoying amongst the most expensive house prices/income and highest levels of household borrowing. The chart below shows the RBNZ’s estimate of the current average mortgage rate across the economy versus where it will be once mortgages reset in line with current market pricing. The lag is ~9 months.

To make a long story succinct, the New Zealand economy is heading towards serious indigestion as more than 500bps of rate hikes start to actually show up in household bank statements as we move through 2023. Hence the RBNZ is forecasting a recession to start later in 2023 and last until ~mid 2024 with unemployment forecast to move from 3.4% to 5.5% over this time. That will hurt.

In summary, we don’t think the Aussie battler is down and out. There is likely to be some upside versus the US$ as the US economy moves toward recession and the Fed likely is forced to cut. The RBA somewhat ironically could easily go from zero to hero in this story, threading the needle between cooling inflation without crushing the economy in the process. To be sure, downside risks for Australia remain in place but relative to some other economies, the local economy may perform ok. We particularly like the AUD against the NZD, where the macro-economic outlook looks bleak over the next year. Don’t count the battler out just yet.

Andrew Canobi is a Director within the Franklin Templeton Fixed Income team and a Portfolio Manager for the Franklin Templeton Australian Absolute Return Bond Fund (ASRN 601 662 631). Franklin Templeton is a sponsor of Firstlinks. This article is for information purposes only and does not constitute investment or financial product advice. It does not consider the individual circumstances, objectives, financial situation, or needs of any individual.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.