There is confusion about which method to use when calculating the tax exemption on income from assets supporting superannuation retirement pensions. This confusion stems from changes to the superannuation law that took effect from 1 July 2017 and the Tax Office’s interpretation of the tax law. Let’s clear this up.

The difference between segregated and unsegregated assets

As SMSF members will usually retire at different times, and because the tax treatment of income from SMSF assets differs between accumulation and pension phases, the correct proportion of tax-exempt and tax payable income needs to be determined. There are cases where specific SMSF assets are held for the benefit of specific members, meaning there is a segregation of assets. Or the assets can be unsegregated, where the SMSF’s assets and income will be supporting all members, retired or not. The existence of segregated or unsegregated assets determines how the tax exemption is calculated.

Unsegregated versus segregated method

If an SMSF has a member with a total super balance in excess of $1.6 million (as at prior 30 June) across all of their super funds, and the person is in receipt of a retirement pension, then the SMSF can only calculate the tax exemption using the unsegregated or proportionate method. This is regardless of whether the SMSF’s pension assets were segregated at any time during the current financial year.

If an SMSF has members in receipt of retirement pensions and each of these member’s total superannuation balance does not exceed $1.6 million across all their superannuation funds at 30 June of the previous financial year, then the SMSF can claim the tax exemption using the relevant segregated and/or unsegregated method.

For fund members with a total superannuation balance not exceeding $1.6 million, the Tax Office’s interpretation of the tax law is based on whether the SMSF had pension assets that were segregated at any time throughout the financial year. If so, then the SMSF must calculate the tax exemption using the segregated method for that time period.

If, during a financial year, an SMSF did have pension assets that were segregated but at a later time it no longer had segregated pension assets, then it must use the segregated method to calculate the tax exemption for the time period where the pension assets were segregated. It must use the unsegregated method to calculate the tax exemption for the period the SMSF’s assets were no longer segregated.

Prior to 1 July 2017, SMSF trustees and professionals were simply using the unsegregated method to calculate the tax exemption when SMSFs had segregated pension assets at some time during the financial year, and unsegregated assets at other times during the same financial year. They did this to simplify the tax exemption calculation. Unfortunately, the Tax Office has stated that using the unsegregated method for those situations is no longer an option from 1 July 2017.

Let’s look at an example

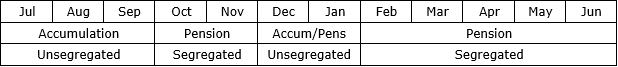

Assume an SMSF has two members in the accumulation phase on 1 July 2017. On 1 October 2017, both members commenced retirement pensions with their total superannuation balance of $1 million each. Then on 1 December 2017, one of the members makes non-concessional contributions into the SMSF and on 1 February 2018 commences a second retirement pension account.

This means the SMSF was completely in the retirement pension phase during the periods 1 October 2017 to 30 November 2017 and 1 February 2018 to 30 June 2018. However, the SMSF was not entirely in the pension phase during 1 July 2017 to 30 September 2017 and 1 December 2017 to 31 January 2018. The SMSF trustee will need to take into account four accounting periods. They must apply the segregated method of a 100% tax exemption on investment earnings of pension assets during the period the SMSF was completely in pension phase and apply the unsegregated method to the other periods when the SMSF was not totally in pension phase.

The calculation of the tax exemption is certainly more complex now and it is most important that SMSF trustees and professionals are aware of this.

Monica Rule is an SMSF Specialist and author. See www.monicarule.com.au.