February is ‘Groundhog Month’ for credit market nerds. Moody’s publishes its annual default study each February and for seven out of ten years, not much happens. This year was one of those, which is good because it means it's been a boring year. Nothing that was investment grade at the start of 2017 defaulted during the year and only around 3% of sub-investment grade issuers defaulted. Overall default rates were just over 1%, which is around median levels.

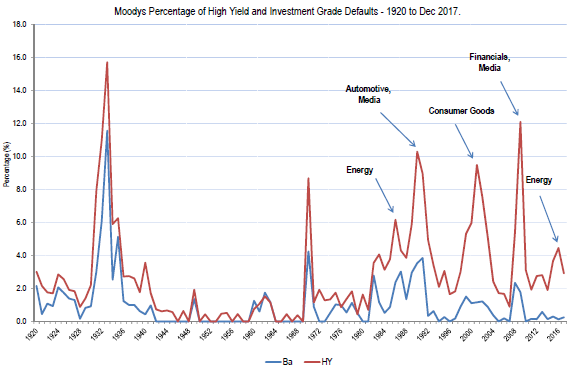

However, over the last few decades, the overall default and high yield default rates have been boosted by a higher proportion of lower-rated issuers who default more often. The chart below shows this with default rates of ‘Ba’ and ‘high yield’ since 1920. We have also shown the industries which were over-represented during default spikes.

Watch for the once-a-decade jump in defaults

Since the 1970s, there’s been a once-a-decade spike in defaults for investment grade and the upper end of the high yield market. Defaults in those sectors invariably coincide with recessions. For the lower end of the high yield market, there are always defaults, and they become chunky in recessions. Interestingly, there are always industry clusters of defaults. Energy is the most cyclical of industries and the large majority of defaults over the last three years have been due to energy (particularly shale energy) when the oil price fell. However, other sectors which have been disproportionately represented in high-yield defaults include media, construction and finance (during recessions).

Two of our forward indicators are indicating another sleepy year. Moody’s uses a model to predict high yield defaults and it is forecasting that default rates will fall to 1.7% in 2018. If that occurs, it will be the second lowest default rate since 1981. The chart below shows the Kamakura Troubled Company Index, which has been an excellent predictor of the default rates 12 months ahead. It forecast the GFC default avalanche over a year before it happened, and also it picked the peak of defaults in 2009 about 12 months before.

Currently, conditions are in the best 28% of observations since 1990 and it is predicting subdued default activity over the next 12 months.

So where are we?

The standard position for an investment grade credit investor is to remain invested, because the margin over risk-free rates is sufficient to compensate for the default risk. If an investor bought every 5-year ‘BBB’ bond at the start of every year, they would have outperformed the risk-free government bond for that 5-year period in every year but one since the 1950s.

The default cost on that cohort of bonds has (almost always) been less than the additional yield investors receive on ‘BBB’ bonds over the risk-free government bond rate. It's more cyclical lower down the credit spectrum, but over the long run there is always a gain. However, for anyone who can correctly forecast a recession or near recession, selling can be extremely profitable.

Notwithstanding the positive non-recession forecast, there are some issues, including:

- The non-default cycle is now very long-lived and over the post 1970s pain-free average (but still well below the 1940 to 1970 experience)

- There has been an overall increase in leverage and other negative debt metrics over the past few years, and valuations are expensive

- There's no recession in sight and if that continues, we'll see little stress on investment grade or high non-investment grade debt

- We can't see any obvious industry bubbles and the two largest debt widow-makers (energy and commercial real estate) seem within normal valuation parameters.

However, take a look at the first chart, and see those spikes in defaults every decade or so. High yield defaults around 10% and investment grade around 2% to 4% are not uncommon.

Campbell Dawson is Executive Director at Elstree Investment Management Limited. This article is general information and does not consider the circumstances of any individual investor.