It is little wonder more investors are interested in private credit, but as the asset class grows in profile investors need to be selective in their exposures. For success, investors must keep in mind that quality counts, and that diversification is still the best free lunch available in the asset class.

Globally, the private credit industry has surged since the GFC, having nearly tripled in value over the last 10 years to a US$1.5 trillion market size at the start of 2024. Some forecasts suggest the market could expand to US$2.8 trillion by 2028, with fund manager BlackRock predicting it will grow to US$3.5 trillion.

A good starting point for investors is understanding the difference between private credit in the Australian market and global private credit in markets such as the USA and Europe. Comparing global private credit with local private credit is like comparing apples and oranges.

Globally, the banks’ withdrawal from corporate lending, combined with significant bank consolidation in the USA and Europe, created a major liquidity gap in the market. This liquidity gap is being filled by private credit managers, providing investments characterised by high risk-adjusted returns, floating rate yields, diversification, and capital stability.

Private credit is well recognised and accepted by investors and companies in the US and Europe, and plays an important role in their economies, with 85% of mid-market corporate lending done by investment managers and the balance by banks. The structural gap continues to increase, alongside growth in private equity dry powder, a key source of private credit demand.

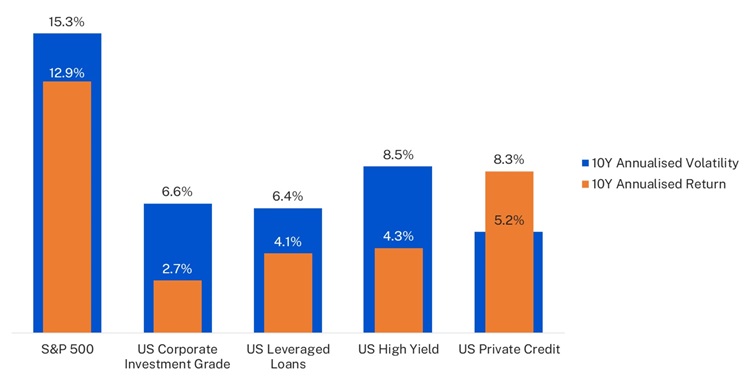

US private credit has shown higher annual historical returns than other growth fixed income asset classes, with no significant realised increase in risk (as measured by volatility, being the Annualised Standard Deviation):

Volatility measured by Annualised Standard Deviation. Returns in USD. Source: S&P 500 Index, Bloomberg US Corporate Total Return Value Unhedged USD, Burgiss - Private Debt (North America), 10-year period from 1 July 2013 to 30 June 2023. S&P, Bloomberg and Burgiss have not provided consent to the inclusion of statements utilising their data. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily a guide to future performance.

‘Annualised Standard Deviation’ is a measure of how much the price of an asset or the return of a portfolio of assets has fluctuated (both up and down) over a certain period. If an asset or portfolio of assets has a high Annualised Standard Deviation, the price of the asset or return of the portfolio of assets has historically fluctuated vigorously. If an asset or portfolio of assets has a low Annualised Standard Deviation, the price of the asset or return of the portfolio of assets has historically moved at a steady pace over a period of time.

Australian private credit is very different. It’s a much smaller market with the Australian banks providing 90%+ of credit lending. The majority of loans are in areas where banks do not have credit risk appetite, for example commercial property and subordinated positions in asset-backed structured finance vehicles, which are yet to be cycle tested.

Current trends in global private credit

We’re seeing several trends in private credit, including:

1. Greater accessibility for all investors

Until recently, global private credit investments have only been available to large institutional investors, such as Australia’s Future Fund and industry superannuation funds.

Even high net worth investors have struggled to gain meaningful exposure because gaining entry to top rated managers with proven track records of performance was very difficult, particularly if you wanted to diversify.

But access is changing. The asset class has morphed from something impenetrable for retail investors, to something which can be accessed via the ASX or via a term account starting from $2,000.

2. An expanding borrower base

The demand for borrowing from middle market and larger companies continues unabated.

The structural liquidity gap, which occurred when banks withdrew from corporate lending, is increasing. For example, in the next 12-24 months there are about $1.5 trillion of leveraged loans which need refinancing that will not have the liquidity to do so. There is also another $1.5 trillion of commercial property to be refinanced – all at higher interest rates.

Private credit will take a large portion of this lending, whether they be direct lender or distressed managers. Many predict this will be a golden age for private credit.

But it’s important to consider risk. Currently, the sweet spot for opportunity is coming from loans to middle market companies. US-based mid-market companies are relatively large by Australian standards, often having a market cap of US$1 billion-plus.

There is also opportunity from non-bank lenders with profitable pools of assets (like mortgage originators or providers of consumer or commercial finance), at sensible loan-to-value-ratios. There is a large opportunity set from these loans, which create a low risk of default and loss and attractive net returns.

3. Increase in more complex and lower quality securities

An expanding borrower base is creating more private credit product including securities of lower quality. The need to sort the wheat from the chaff will only become more important.

There is already evidence of growth in more complex loan products, along with ‘covenant-lite’ strategies, which may be higher risk or reduce underwriting standards.

More complexity and risk contradict the appeal of global private credit in the first place – as a relatively simple to understand investment, delivering premium fixed income returns at low-to-moderate risk. While default rates across global private credit remain very low, any strategies with complex financial engineering or high risk demands caution.

Investors will benefit from doing their homework to understand the nature of the global private credit portfolios, the managers involved, particularly their experience, track record and differentiation, and the risk being taken.

The best managers have long track records of attractive returns and low net losses, with long standing relationships and differentiated origination where they get first look at deals. While the market has strong growth dynamics, the best managers are mature with proven performance.

Key pillars for success in global private credit

The first main pillar for success is simplicity: Private credit is a huge, diverse asset class with strategies including distressed debt, mezzanine financing and structured debt, all of which have varying levels of complexity and risk profile.

We think the real opportunity is for simple approaches, which target quality. Global private credit can be relatively simple when built around bilateral loans, which is the most pure form of private credit investing, simply a loan between a borrower and an investor.

Well underwritten bilateral loans have strong structural protections and information rights, and modest LVRs, which result in low risk of default and loss.

These investments are relatively resilient as the loans are individually negotiated and structured – they generally have seniority and security over a borrower’s cash flows and assets and have the right to force a borrower to take corrective actions to protect the value of the lender’s capital if necessary.

Access to highly experienced managers with long track records of sustained performance is key to gaining the right exposures to these loans. We caution investors to beware of those claiming to have the expertise without track records extending through multiple cycles.

The second pillar is diversification: In global private credit, diversification is still the greatest free lunch for investors.

Diversification is key to minimising downside risk and maximising returns through economic cycles. This means diversifying across geographies, industry segments, managers, strategies and individual loans.

Even though default rates at the quality end of global private credit have been miniscule, a high level of diversification is a proven strategy for consistency of income returns, and to spread risk through a portfolio.

Nehemiah Richardson is CEO of Pengana Credit. Pengana, in association with Mercer, recently launched a listed investment trust, the Pengana Global Private Credit Trust (PCX), along with online term accounts, TermPlus, which provide fixed income from global private credit investments.