When I reflect on the Australian equities industry over a number of cycles, I believe that the small cap sector is still fundamentally misunderstood in terms of investor outcomes. Small caps are normally seen as either an opportunity for phenomenal growth outcomes – a way to add ‘spice’ to more conservative portfolios – or, as prone to absolute carnage and wealth destruction. It is uncommon for investors to see smalls as part of a sustainable long term strategy, for apparent good reasons.

Small cap index returns disappointing

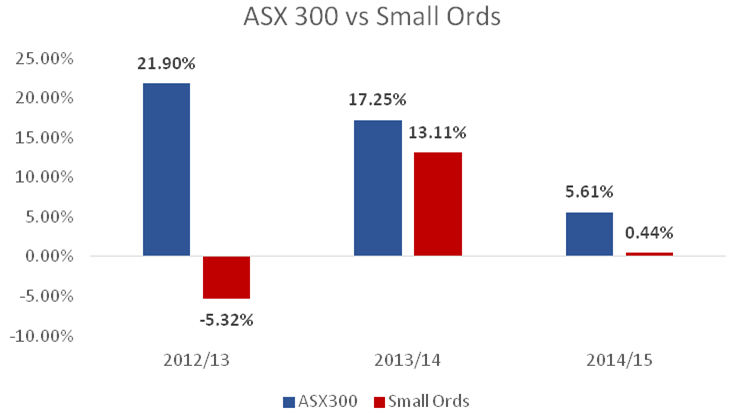

The small cap index has been basically flat over the last three years, during which time the broader ASX300 has gained over 9% per annum. Looking back further, over the last 10 years (as at 30 September 2015) the Small Ords Accumulation Index has delivered investors close to a zero return. It is no surprise then that investors push back when advisors recommend an allocation to small caps.

What explains this underperformance of the small cap index? This index, by its very nature, is more susceptible to market fluctuations due to the fact it includes less tested and more trends-based stocks, such as newly-listed Initial Public Offers. It is also an index that can change rapidly in composition over time. As the mining boom took hold, for instance, investors saw the small cap miners grow from a small percentage of the index to over 40% at the peak of the boom. Most stocks associated with mining recorded strong capital gains as they were bid up to extreme valuations with demand exceeding supply. Investors were chasing the dream of ongoing capital appreciation. Then, as commodity prices fell, the anticipated profits of these companies largely evaporated, destroying investor wealth.

Similarly, the tech wreck of the early 2000s was driven by hope and an indiscriminate belief that every company would experience ongoing capital appreciation.

How is it possible then that over the same period of time some well-credentialed fund managers have delivered solid investment returns?

Not all small caps are created equally

The first lesson is investors should not tar all small caps with the same brush. The sector should be approached with a disciplined investment philosophy, in line with their large-cap objectives. Smaller does not have to mean lower quality. A bottom-up research process can reveal a number of small companies with attributes that can generate sustainable long term returns – competitive advantage, predictable earnings and sound management – trading at a reasonable price.

Sustainable long term returns are a function of both capital growth and growing dividends over time. Consistent and growing dividends are not typically associated with small cap investing. However, from our perspective, this income is an attractive feature of many higher quality smaller companies and is not something investors should forsake for being active in this space.

Steadfast and Pact Group are excellent examples of companies with these quality long term investment characteristics.

Steadfast is an industry leader in Small to Medium Enterprise insurance broking and underwriting with 750 offices across Australia, New Zealand and Singapore. Its broker business has strong bargaining power with insurers, providing them with a distribution channel which cannot be easily replicated. The broking relationship is sticky with client renewal rates over 90%, underpinning a resilient earnings stream. Its underwriting agencies are complementary to the broker business. Going forward, investors can expect earnings growth to come through further acquisitions of brokers in its network, as well as acquisitions of underwriting agencies.

Pact Group is the largest manufacturer of rigid plastics in Australia and New Zealand, with a small presence in the fast-growing Asian region. The majority of Pact’s customers are manufacturers of well-known household and dairy products, including Unilever and Fonterra. Pact also benefits from a dominant market position in a game where scale has significant benefits in the procurement of raw materials, reducing overheads and maintaining a national network of infrastructure and expertise. The real opportunity for Pact is to continue their successful track record of growing through sensible bolt-on acquisitions. The company has grown this way for many years with 43 completed since 2002.

There are many other quality stocks in this sector of the market, which together in a well-constructed portfolio present investors with the ability to generate sustainable earnings growth in the current low growth environment.

Investors should not be put off by the anaemic returns recorded by the small cap index over the last few years, but focus on what active management can achieve with a disciplined process.

Simon Conn is Senior Portfolio Manager at Investors Mutual Ltd. This article contains general financial information only and does not consider an individual’s personal circumstances.