Please note that after the publication date of this article, the Government made these announcements on 22 March 2020. It moves policy in the direction requested by Olivia in the article that follows.

Early release of superannuation

The Government will allow individuals in financial stress as a result of the Coronavirus to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in 2020-21.

Eligible individuals will be able to apply online through myGov for access of up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for another three months. They will not need to pay tax on amounts released and the money they withdraw will not affect Centrelink or Veterans’ Affairs payments.

This measure is estimated to cost $1.2 billion over the forward estimates period.

Temporarily reduce superannuation minimum drawdown rates

The Government is temporarily reducing superannuation minimum drawdown requirements for account based pensions and similar products by 50 per cent for 2019-20 and 2020-21. This measure will benefit retirees by providing them with more flexibility as to how they manage their superannuation assets.

-----

Without a doubt we are in very scary times. I was at the airport yesterday and it was eerily empty. Shops and food outlets were fully stocked and waiting for customers and there were none. Cabs lined up at the taxi rank, again no customers. At least five people I spoke to in one day didn’t know how they were going to make their next mortgage payment.

The Federal Government’s stimulus package is generous, without doubt, but they’ve forgotten about one important segment of our community: the self-funded retiree drawing a superannuation pension.

Once a super fund member moves into pension mode, they are required to draw a minimum amount out of the pension account each year which is a percentage of a member’s pension balance based on their age. This forces people to reduce their superannuation balances and dispose of investments to satisfy minimum drawdown requirements, unless large cash balances are held.

Reduced drawdowns during the GFC

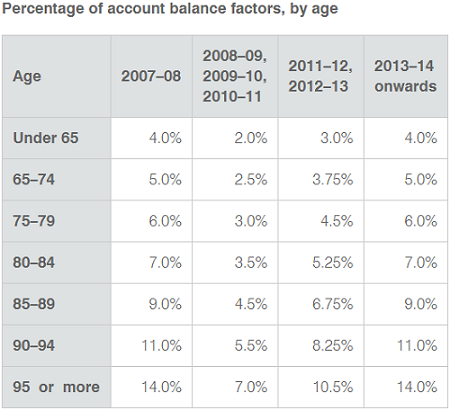

During the GFC in Australia (2007-2009), the Government made the welcome decision to decrease the minimum pension withdrawal requirement for retirees in pension mode. This measure of relief was then extended over several financial years. Minimum pension payment amounts were halved for certain pensions and annuities for the 2008-09, 2009-10 and 2010-11 years. It was then increased for the 2011-12 and 2012-13 years but did not return to the pre-GFC levels until 2013-14, as shown below.

Source: ATO Pension Standards

As the table indicates, pensioners over the age of 80 must drawdown a substantial 7% of their balance, rising to 14% for the over-95s. This is a large amount in a market where prices have collapsed over 30% in the space of a few weeks.

Many pensioners who don’t need to live off their pension savings wait until the end of the financial year to make the drawdown from their fund. But this year, following the severe impact of coronavirus, a significant number of Australian pensioners will be required to liquidate investments to satisfy the pension minimum. In many cases, the values of shares or investments have plummeted. How is this fair?

I’m delighted to see the Government making stimulus handouts but let’s extend the focus to the superannuation sector.

I’d like to see the Government repeat the precedent set during the previous GFC and decrease minimum pension requirements. Give pensioners the opportunity to sit on their investments until market conditions (eventually) recover.

Other items for retirees to consider

1. Postpone drawdowns

I’d suggest that anybody that doesn’t need to draw down their pension consider holding off to see if the Government announces any relief.

2. Pension stop and restart

People with pensions that want to preserve their money in the super environment may consider commuting their existing pension and commencing a new one with a lower balance. If their investment value has decreased, it will mean that the pension value is lower. The percentage they will then need to drawdown will then be lower. Consult an adviser before adopting this strategy.

3. Arrange an Enduring Power of Attorney

An Enduring Power of Attorney (EPOA) is a legal agreement that enables you to appoint another person or people to make financial, personal, medical or property decisions on your behalf in the event you are unable to act. It’s important to note a Power of Attorney is effective if you have mental capacity. If in any event you lose mental capacity, a Power of Attorney ceases to operate.

As we cannot foresee our future, all SMSF trustees in particular should have an EPOA in place for their SMSF operations as once a trustee loses capacity to act, an EPOA cannot be put in place.

4. Check your trust deed is up-to-date

My final tip for SMSF trustees is to ensure your trust deed is up to date. If it doesn’t allow you to utilise any of the strategies in this article, you can’t do it.

Olivia Long is Managing Director, SMSF at Prime Financial Group. This article is general information and does not consider the circumstances of any individual.