Let’s face it. We couldn't predict COVID and we couldn't predict the impact on the economy of the stimulus and which sectors would benefit. We couldn't predict the fact that people would start buying more because they weren't traveling and all the other consequences of the COVID recovery.

What we can do is pick stocks, using a disciplined investment process to find businesses that have sustainable competitive advantages on a three- to five- year view, with strong financials that we believe will preserve investor capital in a crisis like COVID where the market collapses precipitously.

With or without COVID, investors want businesses with predictable earnings and recurring revenues, especially disruptive businesses benefitting from change in the global economy, with a large addressable market.

Here are some examples of what happened during COVID.

Two great Australian companies, ARB and Breville

The first two stocks are companies that we have owned in our portfolios for over 10 years. We believe that over three- to five- years, they will innovate and export their IP from Australia to the world, where they have low market shares relative to their penetration in Australia.

ARB Corporation (ARB) is a 4X4 accessories producer that has spent more than 30 years investing in R&D on its products. It has cash on its balance sheet and a big distribution network in Australia and increasingly, overseas.

Breville (BRG) not only makes toasters and small items but also sells $4,500 coffee makers in many countries around the world. In fact, their sales in the US are 2.5 times the sales in Australia and in Europe, they're 1.5 times. Breville is growing rapidly but they own only a small part of the appliance market globally.

The price charts of the two companies are below.

Source: Factset. Price returns shown. Data 31 December 2019 to 31 May 2021.

Source: Factset. Price returns shown. Data 31 December 2019 to 31 May 2021.

When COVID hit, the market sold ARB as investors thought nobody was fitting accessories to their vehicles. What actually happened - and we couldn't predict this - was that people couldn't go to Bali or Disneyland and they bought second-hand four-wheel-drives because they couldn’t buy new ones. And then they spent $50,000 a pop on 4X4 accessories, and that happened in both Australia and the US generating record earnings for ARB.

Likewise with Breville, as people initially thought stores would close and nobody would replace their home appliances. What actually happened was people stayed at home when the coffee shops shut, or people did not feel comfortable going out, so they bought top-of-the-range coffee makers for their own espresso at home. And they bought rice cookers and bread makers, plus they shopped online in both Australia and the US, either directly or through various other means. The result was worldwide record sales.

Clearly, we couldn't predict what happened. What we did was pick great businesses with a three- to five-year view, and then we bought more as the earnings came through. Many of our peers may have sold out because they thought earnings in these companies would collapse or underperform when stores closed.

But we didn’t make any recovery prediction. We stuck by our opinion and these companies suddenly became incredibly cheap on a longer-term view of two great Australian companies. The businesses were already growing at double digit, and then COVID supercharged them.

Online travel will also recover

We have two long-term travel holdings in our portfolio because they are global, Australian businesses leveraged to the travel market. Corporate Travel Management (CTD) is a global leader in business travel, having invested in innovative software which is driving efficiencies for its customers globally. It's gaining market share but with many company employees not travelling, the share price of CTD has not recovered to pre-COVID levels, as shown below.

Similarly with Webjet, which is a long way off its high. It is better known for its Business-to-Consumer travel in Australia, where people go to the web portal for tickets. This part of the business is recovering, but it's a digital company. On both companies, we take our three- to five-year view despite the hit from COVID. Webjet still has a way to go because holiday travel has yet to recover, but it is a digital platform delivering travel solutions to companies and to consumers.

Source: Factset. Price returns shown. Data 31 December 2019 to 31 May 2021.

Source: Factset. Price returns shown. Data 31 December 2019 to 31 May 2021.

We don't own Flight Centre because we've taken a view around the lack of a sustainable competitive advantage in its business. It is far less of a digital business. We are concerned about the balance sheet liability associated with its significant store lease footprint that we believe will be challenged in the future.

IDP Education as a global provider

IDP Education delivers English language testing globally, especially for students studying at English-speaking universities in the UK and North America. It was adversely impacted by COVID initially, but what actually panned out was that in the UK, the market was open to international students to the detriment of Australia. North America was also open and IDP was able to sell more of its digitally-enabled market-leading university placement products. COVID helped in bringing forward its digital business.

Source: Factset. Price returns shown. Data 31 December 2019 to 31 May 2021.

Australia is still not open to international students but IDP returned to pre COVID price levels quickly. We think this is a great business that is disrupting an industry using its English language client base to start a student placement programme, which is gaining share globally.

What about the higher income from banks?

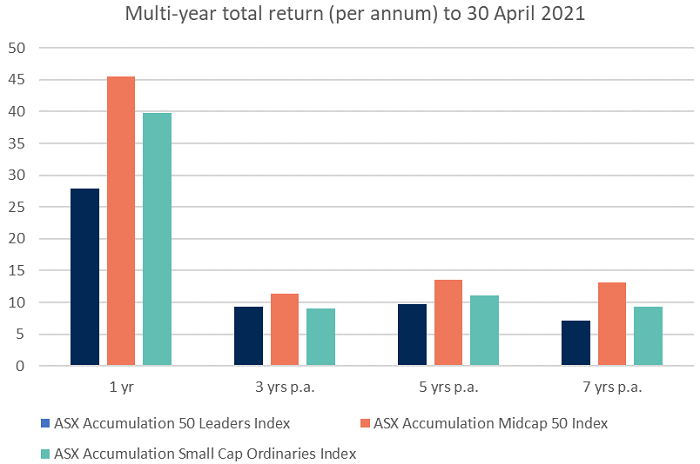

We are often asked questions on banks and bank yields. The following chart shows that despite the heavy position of high-yielding banks in 50 Leaders Index, the small cap and mid cap indexes have done better over any of time periods in the chart. These total returns include the attractive yields that the banks deliver.

The key takeaway is that if an investor can identify businesses that are innovative and growing and can protect capital due to privileged assets with long-term contracted revenue, they should deliver better returns over time.

Bank yields or innovation and growth? Small and mid caps taking the lead.

Source: Bloomberg. Total returns shown to 30 April 2021.

Where are we now in the cycle and outlook for small and mid cap companies?

The answer is very stock specific. We have recently seen some major falls in overpriced companies where investors did not understand the risks. While the Small Cap Index is up about 27% in the year to end-May 2021 and our portfolio has outperformed over the same period, it’s unlikely we will see such results again. There are strong, disruptive businesses but there are also pockets of small caps that are overpriced, especially when they don't have a strong business producing free cash flow and funding their own growth. But businesses with sustainable competitive advantages, strong financials and predictable earnings should continue to do well.

Dawn Kanelleas is Head of Australian Small and Mid-Cap Companies at First Sentier Investors, a sponsor of Firstlinks. This article is for general information only and is not a substitute for tailored financial advice. Any stock mentioned does not constitute any offer or inducement to enter into any investment activity.

For more articles and papers from First Sentier Investors, please click here.