Every investor should think in advance how they are likely to react to a shock impact on their portfolio. For example, it's often the investors who sell after a market fall who suffer the worst performance. Part of the risk assessment should include understanding the 'factors' which adversely affect certain types of assets.

Here's a useful way to think about factors and portfolio risks, and it comes from a text book that has become a standard in many investment courses.

Think of assets like foods

Over the recent holidays, I skimmed through Andrew Ang’s seminal book, Asset Management. I say ‘skimmed’ because it’s 700 pages of technical analysis, subtitled, ‘A systemic approach to factor investing’. I’ve met Ang a couple of times, and he’s a friendly and highly-approachable business school professor and consultant to a range of sovereign wealth and pension funds.

It was in the skimming that I found a fascinating idea which will help anyone better understand investing and their portfolio risks.

It’s simple: assets are like foods.

Ang says the two most important words in investing are bad times. Optimal portfolio allocation requires investors to take account of how their portfolio and themselves will react in bad times. The long-term returns on assets are compensation for taking the risks that will occur in these bad times.

Ang believes we should focus not on the assets in our portfolios, but on their exposure to underlying risk factors. It is the factors which drive returns.

Factors include interest rates, economic conditions, macro trends, inflation and exposure to different investment styles such as value, growth or momentum. Each asset has a different risk due to exposure to these factors.

For example, a fund manager might hold a portfolio of 1,000 carefully-selected stocks, but if they are highly-correlated individual bets in a value-oriented investment style, they become one large bet on a single factor. As Ang says:

“An equity manager going long 1,000 value-oriented stocks and underweighting 1,000 growth stocks does not have 1,000 separate bets; he has one big bet on the value-growth factor.”

He has an analogy in farming:

“A farmer, for example, may certainly be able to select a farm with the best soil and conditions for planting (farm security selection). But if there’s a severe drought, having chosen the best farm is not going to help (rain is the factor).”

And so starts the food comparison.

Factors are to assets what nutrients are to food

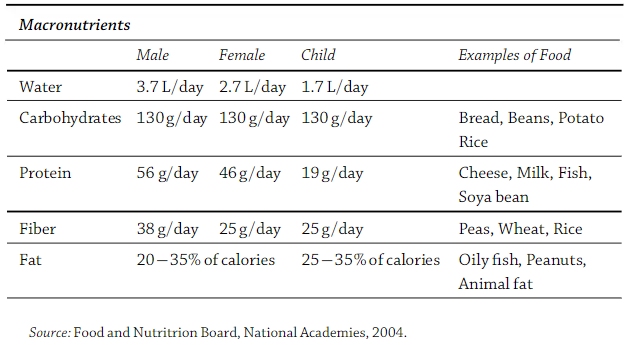

The table below from the US Food and Nutrition Board recommends intakes of five macronutrients – water, carbohydrates, protein, fibre and fat – for the average male, female and child. Certain foods deliver the nutrients we need, such as protein from meat and fibre from wheat and rice. Some foods contain more than one nutrient.

Depending on our health and lifestyle, we have different nutrient requirements, and the underlying nutrients deliver the sustenance we need.

In the same way, while we invest in assets, it is the underlying risk factors which determine the returns. The factors are like nutrients. For example, in the table below, our bodies benefit from protein in the same way our returns might benefit from a rising stockmarket or falling inflation.

Nutrients and food

The comparison between food and assets

Andrew Ang draws out three similarities:

1. Factors matter, not assets (nutrients matter, not food)

People could lead a healthy life gaining all their nutrients from boring, tasteless products grown in a laboratory. Similarly, it’s the factors affecting the assets that are important for returns, and investors should look beyond the assets to the factors.

2. Assets are bundles of factors (foods are made up of bundles of nutrients)

Some foods contain only one type of nutrient, such as rice and carbohydrate, but most contain many nutrients. Water is considered both a food and a nutrient. Similarly, some factors such as equities or government bonds are factors in themselves, while others such as corporate bonds or hedge funds might contain different types of factor risks, such as volatility, credit and interest rate risk.

Volatility is a factor which can be damaging in bad times, but for those prepared to embrace it in good times, it can deliver exceptional returns.

3. Different investors need different risk factors

We eat differently and invest differently. Some long-term investors can expose their portfolios to leveraged equity risks as they can tolerate fluctuations in their portfolio values that most find unacceptable. Similarly, some athletes eat large amounts of protein and carbs to feed their energy requirements. No one diet of nutrients or factors suits everyone.

And I’ll add a fourth:

4. Factors and nutrients can be good and bad

Ang says nutrients are inherently good, but too much of almost anything can be unhealthy. A certain level of fat is beneficial but too much can be bad.

Factor risks are bad, and enduring the poor consequences is rewarded by better returns. Bad times for factors and investments include low economic growth, high inflation and falling stock markets.

And much like the sum of all the nutrients we absorb determines our level of health, so the assets we own deliver factors which behave not in isolation but in relation to all the other factors we own.

A balanced portfolio as defined for most investors

While it is possible for a government department to make recommendations on diet, the same level of scientific integrity does not apply to investing universally.

The appropriate portfolio differs for everyone, based on many factors such as goals, risk appetite, age and financial resources. There is no one meal fits all.

However, there are some principles common to all good investment plans, such as diversifying risk, starting early and saving consistently. Employees who do not make an explicit investment choice for their superannuation are usually placed into a MySuper fund, which has a default asset allocation selected by an experienced fund manager supported by an investment committee.

Like a recommended diet, the asset allocation for all MySuper funds is shown in the table below. While this allocation may not suit a retiree who values capital preservation before earnings maximisation, it is a recommended diet of factors to suit most people who are saving at an earlier stage of their lives.

It mainly includes growth assets - perhaps the meat and other protein in a diet - but with some defensive protection - perhaps like a good helping of vegetables.

As with nutrients determining the benefits in a diet, so a better appreciation of risk comes from knowing the factor exposure of an investment portfolio. What would be the impact of a rise in rates, a fall in equities, a swing from value to growth or a widening of credit spreads? Look through to the factor exposures that matter.

Food for thought

In the same way you might balance your diet with an intake of the different nutrients you need, so you should select assets based on the underlying factors.

And while you might enjoy the beer and chips and pizza in the good times, in the same way a surging equity market is fun while it lasts, it’s the consequences in the ‘bad times’ which determine the long-term health of investment returns. Is your portfolio fit for a healthy lifestyle?

Graham Hand is Managing Editor of Firstlinks. Andrew Ang’s ‘Asset Management’ is published by Oxford University Press.