Two weeks ago, Viva Energy (a portfolio of 425 Shell service stations) listed on the ASX. This was a very successful IPO, well-managed by its investment bankers, who structured the deal astutely to create institutional investor demand. The stock gained 16% on its first day of trading. The success of this IPO has prompted Woolworths to look at spinning out its portfolio of service stations into a property trust with an expected valuation of between $1.3 billion and $1.5 billion.

We are usually sceptical of IPOs for reasons so eloquently outlined by the father of value investing, Ben Graham:

“Our recommendation is that all investors should be wary of new issues – which usually mean, simply, that these should be subjected to careful examination and unusually severe tests before they are purchased. There are two reasons for this double caveat. The first is that new issues have special salesmanship behind them, which calls therefore for a special degree of sales resistance. The second is that most new issues are sold under ‘favorable market conditions’ – which means favorable for the sellers and consequently less favorable for the buyer.” (The Intelligent Investor 1949 edition, p.80)

But occasionally a great one comes along, either for a long-term investment or for making a short-term gain on its opening trading day. This article examines the machinations of institutional investors during a hot IPO’s roadshow and listing, and the game of ‘Liar’s Poker’ that goes on between fund managers and the investment banks running the IPO.

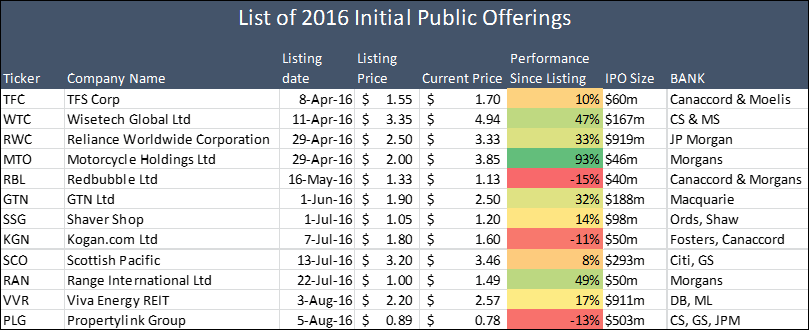

Source: IRESS

Ignore, a quick trade or a core position?

An investor needs to decide, on receipt of a prospectus and the research reports from the sponsoring investment banks, whether an IPO is:

a) a core part of their portfolio

b) not investment grade at the offered price, or

c) maybe a profitable short-term trade.

Most IPOs fall into the second category, as IPO vendors know the business far better than investors and are choosing the most favourable time to maximise the price when they list. The third category occurs where the float is in a sector currently in favour (such as lithium or fintech), is similar to other recently-listed companies that have performed well, or the IPO is priced relatively cheaply compared with other listed companies.

Liar’s Poker

This term refers to the dance that goes on between institutional investors and the investment banks prior to an IPO, especially one where the pricing is yet to be determined. The investment banks listing the company are incentivised to both exaggerate demand and the superior investment merits of the company. The institutional investors, on the other hand, will downplay their interest as they attempt to develop a picture of the real underlying demand. This process will involve numerous conversations with the sponsoring investment banks and with other large institutional fund managers to gauge their interest. The Liar’s Poker dance is of the greatest importance in a hot IPO, where the fund manager is looking to sell their allocation on the day it is listed for a profit.

Getting noticed

For the Perpetuals and Colonials of the funds management world, getting noticed by the company is not an issue, but for the bulk of fund managers getting noticed and showing interest is part of the process in helping secure an allocation in a potentially hot IPO. This involves attending management briefings, and writing nice letters to management thanking them for their time, while constantly emphasising your fund’s long-term interest in their company. The thought process behind this dance is the hope that when the allocations are done in some dark smoke filled back-room, your fund may get a better allocation than another fund manager who did not show any interest.

Banks use allocations as a big client carrot

One of the reasons investment banks are keen to run IPOs and capital raisings (other than the fat fees) is to reward good clients (and use it as a lever to attract new ones) when allocating holdings. From my observations, large allocations tend to go to the funds that generate the largest brokerage commission, which are often high-turnover hedge funds rather than long-term owners of the company.

In 2009, Bendigo Bank conducted a deeply discounted capital raising, which had a high probability of delivering capital gains to participants (BEN traded up 30% when it resumed trading post listing). At the time I was helping to manage an Australian equity fund on behalf of Bendigo Bank and I was extremely surprised to find out that the investment banks gave the bank’s own fund a very small allocation to their own raising. This was ultimately changed after some muscular discussions with the bank’s management and the investment banks involved. Occasionally the company runs the allocation process, as Amcor did in their 2009 $1.6 billion capital raising conducted at $4.30 per share, which mainly went to loyal long-term shareholders.

Underwriting and sub-underwriting

In many IPOs and also large capital raisings, a key reason why a particular bank is awarded the mandate by the company (and the associated fees) is its ability to underwrite the deal. This removes the risk for the company or the IPO vendor that they are unable to raise the expected amount. Underwriting is where the bank effectively uses their balance sheet to guarantee that the company will receive a fixed amount for the shares being sold.

Post-GFC, few banks want to take the risk that a global catastrophe could occur that could cause investors to walk away from an otherwise desirable float, potentially leaving the bank’s shareholders with several hundred million dollars’ worth of equities that are worth less than the underwritten price. To mitigate this risk, investment banks will call some of their better clients and offer them the opportunity to sub-underwrite the issue. Here unitholders will generally receive 0.5% of the amount sub-underwritten, for ‘loaning out’ their fund’s balance sheet to the investment bank. In a desirable issue, this can be a great way to augment portfolio returns, as there is little chance that you will actually have to take a large amount of unwanted stock.

Bidding and Shakespearian drama

When I started in the industry the thought process for a hot IPO was to work out what you really want and then bid for five to 10 times that amount. Then when your fund is allocated a fraction of the original bid amount, the fund manager can either stoically accept the allocation or engage in high Shakespearian drama shrieking at the bank running the IPO of how their unitholders have been slighted, while secretly being satisfied. The investment bank running the IPO process is happy to indulge in this charade, as they can point out to the company that the issue was say five times oversubscribed, implicitly highlighting the bank’s superior relationships with the capital markets. The current thought process is to give a more realistic bid of twice what you actually want, and highlight to the investment bank running the IPO that this is the ‘real number’.

In any IPO or deeply discounted capital raising it is an extremely poor outcome to actually get the allocation asked for, as this is an indication not that the company is keen to have your fund as a shareholder, but rather that the fund manager has misread the actual demand for the IPO and that the bank is struggling to fill demand. In this situation, the IPO inevitably performs poorly on listing, as shareholders dump their excess allocations.

Hugh Dive is Senior Portfolio Manager at Aurora Funds Management. This article is general information and does not consider the circumstances of any individual. Disclaimer: The author was unhappy with the minute size of his fund’s allocation to the Viva Energy IPO.