You’re a long-distance runner, on the starting line at the Tokyo Olympics. The games were delayed, the stands are empty, but you cannot let this distract you. The past is behind and you must focus on the opportunity in front of you. Winning is a mix of skill and luck and you want to give yourself the best chance of succeeding. A poor start can cost you the race

Now apply that thinking to investing where how much you pay – the start of your race – will have an impact on your overall success. Overpay, and there is a risk of being disappointed if the future is not as bright as you expect. Underpay and even if the future is only middling, you’ll probably still do ok. High valuations are a handicap on future returns and paying too high a price can put you too far behind the starting line.

Competing for returns is even harder today because valuations across many asset classes are high. Even ‘boring’ assets like bonds and cash seem risky due to low yields and the fear of inflation. This is forcing many investors into more speculative assets which, in turn, pushes their valuations to new extremes.

Time to look again at Japan

With the world now focused on the Tokyo Olympics, we thought it might be interesting to see how and what value investing looks like in Japan.

You may be skeptical. The Japanese stock market has left many investors desolate over the past 30 years. Japan experienced a massive asset bubble in 1990 and, at its peak, Japan shares made up 44% of the MSCI World Index (it's less than 7% now). That bubble exploded spectacularly and since 1990 the Japanese market has returned 6% (yes, just 6%) versus 743% for the MSCI World (both in JPY).

But that’s the past. Looking at the opportunity in front, Japan appears cheap versus its history and against other major markets.

Of course, things are often cheap for a reason and there is no doubt Japan has its fair share of negatives. These include a reputation of poor capital allocation and corporate governance. Versus other regions, Japanese stocks tend to be less profitable and so the valuation discount is justified.

But there are signs of improvement. Rather than amassing excess cash on their balance sheets or splurging on poor acquisitions, many Japanese companies are focusing more on shareholder returns and increasing dividend payout ratios and buybacks. This leads to more income for shareholders.

Also, across the major stock markets, Japan is the most geared to global growth and an economic recovery. This may not seem like a big negative right now given the large amounts of fiscal and monetary stimuli being pumped into economies by major governments and central banks in response to the pandemic. But taking a macro bet on a global rebound can feel speculative.

However, even if Japan continues to lag global markets, history suggests that a contrarian-value approach within Japan may still do well. Contrarian investing does not necessarily mean that you go against the market at every opportunity. Rather, contrarian investors focus on the facts and figures and make up their own minds about an investment. They run their own race.

Is Japan a market for value investors?

Historically, Japan has been a great market for value investors. Since 1975, value has outperformed growth by 4.1% p.a. in the country, far exceeding the 0.9% per annum relative return of value globally.

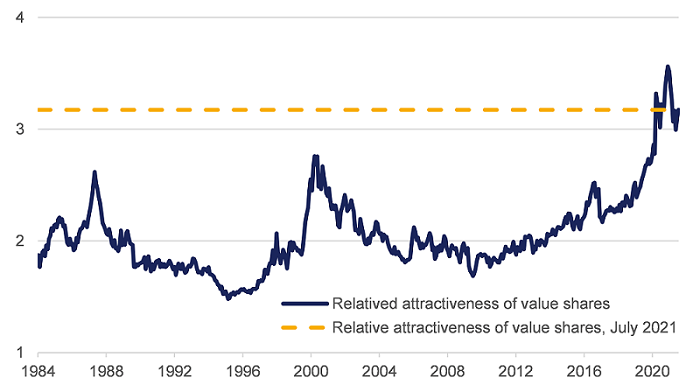

Today, the opportunity for value-driven investors is compelling. The following chart shows the price-to-book valuation of the cheaper (value) half of the market versus the more expensive (growth) half of the market. When the dark line is low, cheap stocks are only slightly cheaper than the expensive stocks. When the line is high, cheap stocks are really cheap and attractive relative to the expensive stocks. This type of spread analysis is the mainstay for value-driven investors and they get very excited when spreads are wide.

During these extremes, taking a contrarian stance and leaning into value stocks has led to higher returns.

The recent bounce in value has brought spreads in a little but they are still very wide.

Valuation spreads in Japan are extraordinarily wide

Source: Orbis, Refinitiv. Statistics are compiled from an internal research database and are subject to subsequent revision due to changes in methodology or data cleaning. Value (growth) shares are those in the cheapest (richest) half to the market on a price-to-book basis. Relative attractiveness is based on the ratio of the relevant market segments.

Mitsubishi Corp is a good example of the sort of company you can find in Japan. Mitsubishi was first established as a shipping company over 150 years ago, and then evolved into a trading company. Trading companies (of which there are currently five) were tasked with securing the natural resources that Japan lacks. Today Mitsubishi is a diversified conglomerate with approximately 40% of its profits from natural resources and the rest from a diversified mix of cyclical and defensive businesses - food, autos, power generation etc. The company has grown its dividend steadily since 2013 and currently yields around 4.4%.

For long-term value investors, the real reason for liking Mitsubishi is (again) valuation. Despite being just as profitable as the average Japanese company, it trades at a discount mainly because investors are put off by the complicated and cyclical nature of its business. In 2020, Warren Buffett announced that Berkshire Hathaway had bought a 5% stake in Japan’s five largest trading companies, including Mitsubishi.

Can Japan help with diversification?

In addition to the low valuation opportunity, adding Japanese stocks to an international portfolio also has the potential to provide increased downside protection in the event of a market crash and it helps spread your bets.

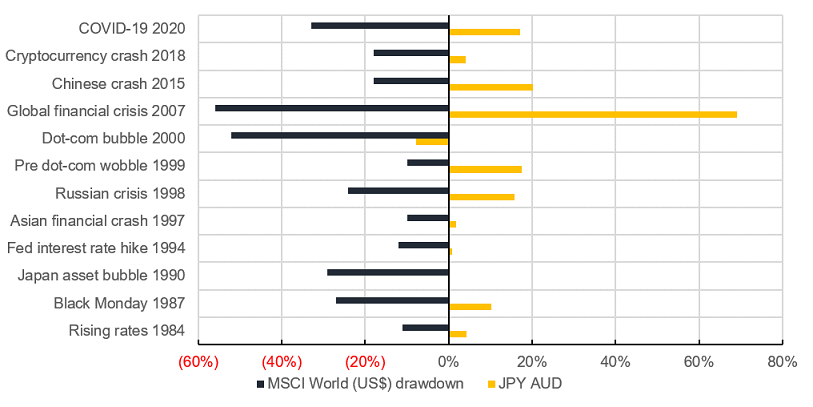

Safe haven yen. When you invest in Japanese stocks and leave the currency unhedged, you gain exposure to the Japanese yen. The yen is countercyclical and can act as a haven when equity markets go down. This is the opposite of the pro-cyclical 'risk-on' Aussie dollar (AUD).

The COVID-19 market crash in early 2020 illustrated this cushion effect. During the crash, the MSCI World index fell 33% (in USD) while the JPY strengthened by 17% against the AUD.

Since the AUD floated in 1983, the JPY has strengthened against the AUD in 10 of the 12 largest stock market declines. The two exceptions were the bursting of the overvalued Japanese stock market bubble in 1990 and the bursting of the dot-com bubble - a period when the AUD had become extremely cheap (it was less than 50 cents vs the USD at the time).

Japanese yen acts as a safe haven during equity market crashes

Source: Orbis, Refinitiv. Charts shows drawdowns of MSCI World (USD) greater than 10% since the Australian dollar was floated in 1983. During each equity drawdown, change in spot exchange rate of JPY AUD is measured. A positive change in JPY AUD indicates strengthening of JPY versus AUD.

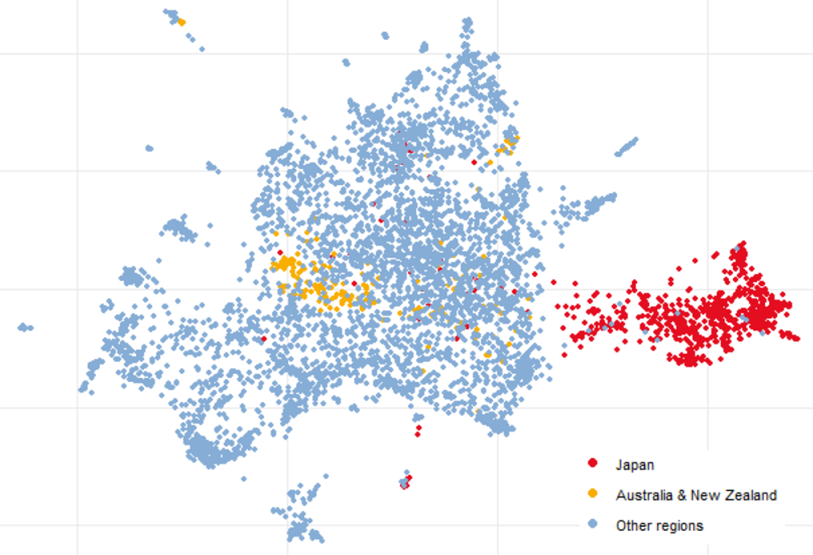

Diversification. Japanese stocks tend to behave differently to their international peers and when included in a global portfolio, have the potential to add diversification. Consider the following visualisation technique from machine learning to form a sort of correlation constellation. This correlation constellation captures how big global stocks (approximately 5000 stocks represented by dots) move in relation to each other.

Without getting bogged down in the math (of the dots), it doesn’t matter where a stock (dot) is located in the constellation. What matters is a stock’s distance from other stocks, i.e. who is in its neighbourhood. If two stocks are close neighbours, they behave similarly, i.e. similar bets. If they are far apart their prices have moved differently, differentiated bets. All else equal, if you invest in two stocks that are far apart, you are better diversified (spreading your risk) than investing in two that are close together (concentrating your risk).

Japanese stocks (red dots) are tightly clustered, almost like an island. Contrast that with the Australian and New Zealand stocks, which are packed in with those from other regions and so offer less diversification.

Correlation constellation – Japanese stocks behave differently to their global peers

Source: Refinitiv. Global large cap equity market depiction using Uniform Manifold Approximation and Projection (UMAP) of 3-year weekly local equity returns. Global large cap approximated as current constituents of the FTSE World and MSCI Emerging market indices.

As the Olympic Games progresses, all eyes are on Japan. For athletes, it represents the culmination of disciplined and patient training. The road to the starting line has been uneven and uncomfortable. But that’s the past. Looking at the opportunity ahead, they will put their best foot forward. Will you?

Claire Gallagher is an Investment Specialist at Orbis Investments, a sponsor of Firstlinks. This report contains general advice or information only and not personal financial or investment advice. It does not take into account the specific investment objectives, financial situation or individual needs of any particular person.

For more articles and papers from Orbis, please click here.