Within the Listed Investment Company (LIC) and Listed Investment trust (LIT) sectors, premiums and discounts to Net Tangible Asset (NTA) values are reactive to market conditions, with negative sentiment usually exacerbating on the downside.

The MSCI All Country World and Growth indices are down 17% and 25% respectively YTD, creating opportunities in high quality managers trading at attractive prices in what appears to be a de-risking event.

Discounts can vary significantly

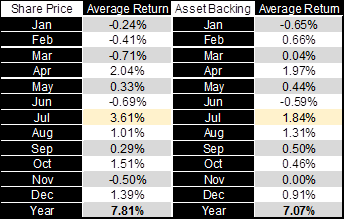

In general, average sector discounts tend to be the widest during May before reverting to narrower levels over the second half of the calendar year. July is on average the best performing month for LIC/LITs when coupling the uplift to share price and asset backing.

Figure 1: July on average is a standout month for LICs & LITs

Source: company reports, IRESS, Bell Potter. From March 2007 to March 2022.

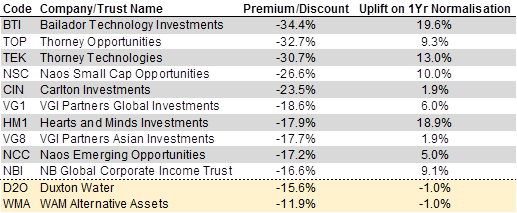

Some well known managers are now trading at wide discounts to NTA, beyond their long term 'normal' levels. Investor support has waned as markets have fallen and their share prices have dropped more than the value of the underlying assets.

Figure 2: Widest indicative discounts

Source: company reports, IRESS, Bell Potter.

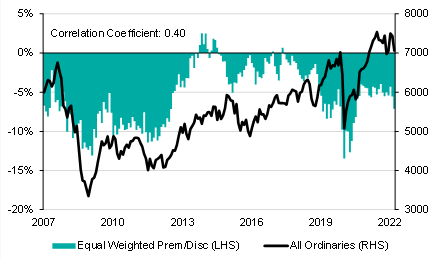

As shown in Figure 3 below, the equal-weighted sector discount now stands at 6.8% based on our indicative figures. Purchasing at these levels has the potential to add further accretion when accounting for the normalisation effect after market dislocations.

Figure 3: Discounts are reactive to the market

Source: company reports, IRESS, Bell Potter. As at 13 May 2022.

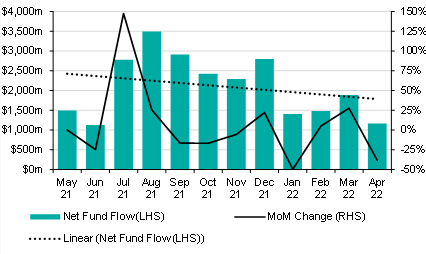

Add to this the fact that net inflows into Australian open-ended funds (ETFs) are decreasing, where retail investors tend to mistime the market. Discounts on alternative asset exposures with the potential to weather a stagflation situation are still yet to tighten.

Figure 4: Net flows into Australian open-ended funds are trending down

Source: ASX, Cboe (Chi-X), Bell Potter.

A note on indicative NTA calculations. They work best with LICs that have a high percentage of investments concentrated in its Top 20, regular disclosure of the Top 20 holdings, lower turnover of investments, regular disclosure of its cash position and the absence of a performance fee.

For more detailed tables on a wide range of LICs and LITs, including current discounts and premiums compared with longer-term averages, see the latest reports in the Firstlinks Education Centre.

Hayden Nicholson is an ETF/LIC Specialist at Bell Potter Securities. This article and attached documents have been prepared without consideration of any specific investment objectives and is general information only based on prices at time of writing.