A summary of the survey on attitudes to stamping fees (commissions) paid to advisers on LICs and LITs is presented below, including a selection of comments. For a review of the issues, see the articles listed here.

The results will be shared with Federal Treasury as part of the public consultation into stamping fees.

The survey split respondents into adviser and non-adviser groups. Of the 730 respondents, 16% were advisers.

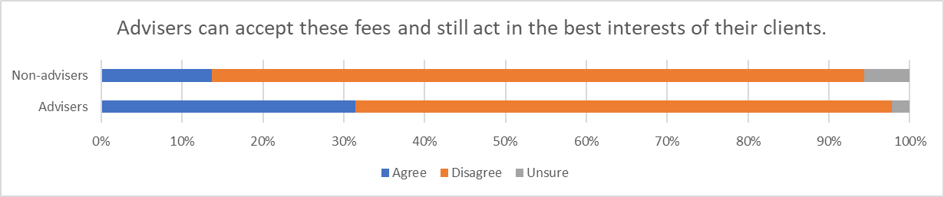

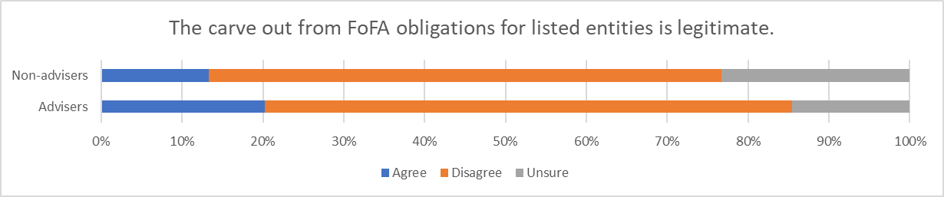

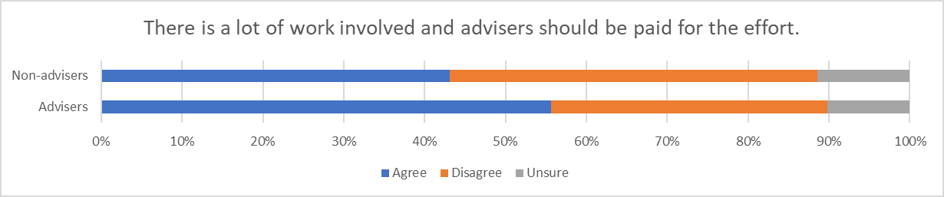

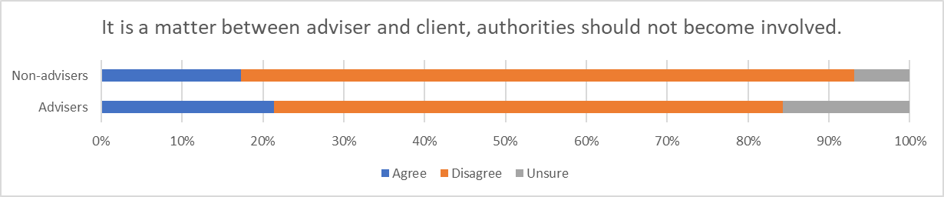

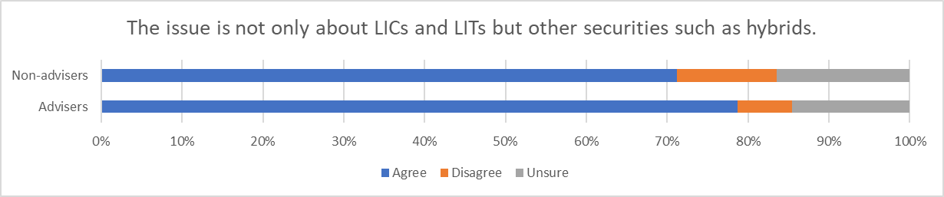

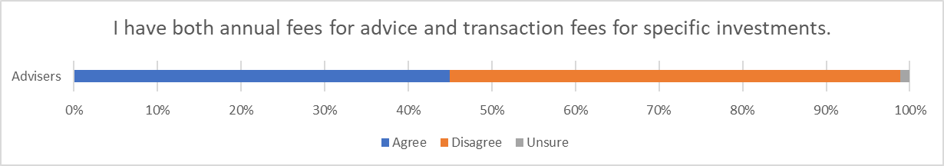

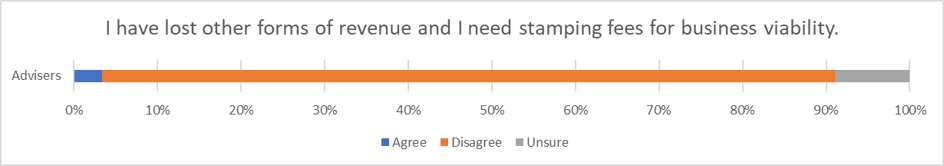

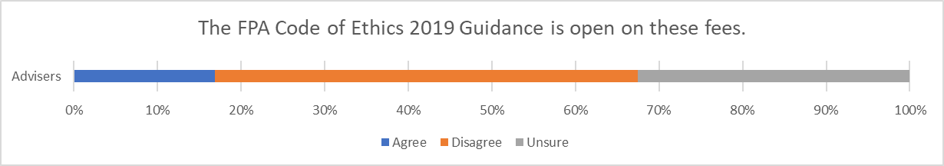

Reactions to different statements

The first five of the following statements were shown to both groups, and the differences in their responses are shown together in each chart. The remaining five statements were shown to just one group, as indicated.

If you are a financial adviser, do you accept stamping fees?

Among the advisers, asked if they accepted stamping fees, 17% said yes, 74% said no, and 9% said it depends.

Here are some of the comments from this question:

- It is a clear sales commission to sell a product to clients. I have seen it in operation in many businesses, where they target the selling of these products purely to generate revenue.

- Absolutely unethical. No justification for ever accepting such fees.

- Neither are products I would recommend

- We are a 100% fee for service firm

- We need a fair playing field. I can't accept stamping/commission on a regular unlisted managed funds, so why the difference with listed LIC's/LIT's.

- We rebate all stamping fees and any other commissions/rebates to clients accounts. You can even get 0.20% from some term deposit providers, just crazy. Keep it simple, clients should be the only ones paying for the advice, not the product providers to be put higher up on Advisor radars.

- It simply is a conflict of interest

- I think this remuneration is conflicted which causes a conflict of interest under the new FASEA code of ethics.

- I support a cap in stamping fees of 0.50% which is fair and reasonable.

- We rebate the fee to clients

- we charge flat $ retainers, so rebate all commissions

Selected comments on the results

From advisers:

- These fees should absolutely be stopped immediately to stop the selling of what can be inappropriate investments to clients. The motivation is nearly always the sales commission... if it wasn't then there would be no opposition to it being removed.

- No commissions, stamping fees or even any percentage-based fees can be justified.

- Serious consideration is taken into account when deciding to recommend any investment, whether that be an LIT, LIC or Hybrid. Each client’s personal circumstances are considered, and work is put into discussing to each client how it suits their investment goals and why I recommend it for them specifically. Therefore, we should be paid for such work.

- It's not simply black and white. There is extra work involved. Advisers offering this service either need to price it into their fees or charge one off fees (although this is a pain). But better to do either of these than have the conflict (where payment is linked to value of placement rather than time/effort).

- I am not opposed to stamping fees but concerns with those Institution with in-house products and promoting these to their private clients.

- Stamping Fees cause many advisers to recommend investments that in most cases they would not otherwise recommend and a lot of these LIC/LIT's then trade at a discount to NAV.

- If stamping fees are removed I will be forced to increasing my fee structure.

- I think you have to get paid for the work you are doing one way or another. I would prefer that it be a visible fee rather than an invisible one, but so long as the overall fee is not excessive and service is being provided then I'm ok with it.

- Definite conflict and should be banned. Much better to charge the client a flat fee for doing it.

- While the wording of the code of ethics is really poor, the worked examples make it clear that the fees can be received. Where they cannot be received is where they cause a change in the adviser's behaviour e.g. when the adviser chases stamping fees because he needs to pay his kid's school fees. I don't understand how there are still any questions around this.

- Get rid of them so the underlying investment stands on its merits. Equally with the maddening compliance world to process a LIC IPO many will just go its too much work which is rightly so.

From non-advisers:

- Remuneration that is not obvious to the client is always going to be an incentive to succumb to temptation or self-justification.

- Like most of these issues, the fee-paying bias occurs frequently but not everywhere - some advisers genuinely seek recovery for the extra work involved in a raise, where they deem the product appropriate - HOWEVER, the potential conflict should be eliminated to ultimately protect investors!

- Advisers should on all occasions be acting in the best interest of their clients and not on the amount of stamping of commissions that a product provides.

- No commissions, only fee for service paid directly by client should result in better outcome for clients

- All commissions, whether fixed fee or % or best estimates thereof must be disclosed to the clients in writing before they commit to any investment.

- I don't use an advisor, so I'm not fully around this issue, but I am really against the LICs market price being inflated by the laziness of advisors.

- Disgraceful that this issue has not been actioned before now - asleep at the wheel again

- Government should set an upper limit for commission to prevent overcharging the clients. Financial advisers already receiving fees from clients, fees on Lic and Lit only adding another layer of fee.

- It’s a conflict of interest which has no place when advice is given

- Conflicted remuneration has the potential to distort advice in every circumstance. There is absolutely no reason why this exemption should exist.

- Transparency is the key. Honesty is then on show.

- Any form of incentive from providers of products is prone to cause conflict of advice.

- Incentives provided to sellers of products never results in the best interest for the buyer. Also as a customer you cannot be sure that the advisor acted in yours or their best interest. So it brings into disrepute the industry.

- clients will never pay a fee for advice enough to make advice a viable business. If the stamping fee was a fixed amount for all securities, there would be no conflict of interest.

- The problem seems overblown to me. It only applies to new issues and floats, so why is the media demonising all LIC's. Brokers have always got a fee for new floats, so would they no longer be allowed to suggest new floats to clients. How else are clients going to know the floats are available?

- Happy to pay fee for service. Will never use adviser I know is getting a commission! (by whatever name!!!)

- Fees should be based similarly to other professionals such as accountants and solicitors - nominally on a time basis and hourly rate

- Stamping fees ultimately lead to lower returns for clients and is often not obvious to them due to a lack of transparency.

- Advisors should be paid a portfolio management fee however that can be structured, not a fee for recommending a product that is for sale.

- Some advisers do no work and just recommend based on payment but others do a lot of research and evaluation work prior to recommending. Better education of investors and a capacity to recognise return on investment will make investors more discerning.

- Advisers must be impartial and give totally independent advice. It must be free of any perks.

- Clients should pay for the services they receive. Advisers should never receive a payment from a product provider.

- We pay annual fee for advice and management, as do all the other clients. The job is to keep an eye open for opportunities for all clients. That is their day job.

- Advisers' should only be paid by their clients.

- It is quite clearly a conflict of interest and various reports on this have shown the link conclusively between commissions and how they have affected a planner’s advice to their clients

- If you are taking a sales commission, you are a salesperson not an adviser.

- As long as fees and commissions are explicit and known to clients and are taken into account in the justification of the investment recommendation, then I do not see an issue.

- Removal of stamping fee long overdue

- The fees for rights issues and placements should also go

- Stockbrokers have always been conflicted by these fees but that is just the way it has always been. Seems too hard to change.

Do you think the ban on receiving stamping fees should extend to stockbrokers?

The final question, asked of all respondents, showed that over 70% believe stamping fees should be banned completely: Yes 71%, No 18%, Depends 11%.

Here are some of the comments regarding this issue:

- the broker is recognised as a seller, buyer beware

- Clients believe that their advisers and stockbrokers are providing them with advice. Due to the conflicted payments in most situations client are being 'sold' something rather than being provided advice.

- If it's a conflict for us then it's a conflict all around: stockbrokers, real estate agents, general insurance brokers, doctors accepting paid conferences from drug companies…

- I do not believe a ban should be implemented for anyone

- Investors can't differentiate between "advisers" and "stockbrokers" - they all believe that their adviser/broker acts in their best interest so let's ensure they do!

- advisers & brokers have a fiduciary duty to their clients, any commissions etc. should be refunded to the client.

- It is like commission which they receive anyway

- Same rules (whatever they may be) should apply to both.

- All advice should be subject to the ban otherwise it distorts the market

- Definitely not. Stamping fees are an integral part of the capital raising process and removing it in LIC/LIT will create market distortions.

- A Stockbroker is a salesman not an adviser.

- I believe the level of fiduciary duty is less than for financial advisers, as clients understand the stockbroker is there to buy and sell securities. The concern would be if the stamping fees became way over the top compared to other issuances, this would create a disproportionate incentive.

- Depends on if you are using the broker as an advisor or just an access point to the market

- stockbroking clients should pay for advice directly to advisor

- Brokers are salespeople. Advisers should act in the best interests of their clients

- Any incentive to steer a client towards a particular investment which benefits the stockbroker or financial advisor should be eliminated in favour of a time/project-based fee paid by the client.

- Complicated issue. Probably should if the broker is providing advice to a client about how to construct an equities portfolio. In that sense the broker is acting as a financial advisor rather than as a provider of stock broking services and products to enable clients to access the Stock Market

- As long as they are disclosed I don’t see any issue in receiving these type of fees. I just don’t agree with different rules for Brokers

- Provided no personal financial advice relationship exists.

- Unless a Broker is also an Adviser, he/she has no other way of being remunerated.

- Depends on how clear it is to the stock broker's clients that the broker is a sales person not an adviser. The public should clearly understand this point but I suspect many do not.

- No, but only if this is their only source of income and it is explicit

- brokerage is sufficient on its own

- The sooner that brokers are remunerated as employees the better all round

- The model for brokers is long established and appropriate given the amount of work that is required to assess products.

Leisa Bell is Assistant Editor of Firstlinks. This article is general information and does not consider the circumstances of any investor or adviser.