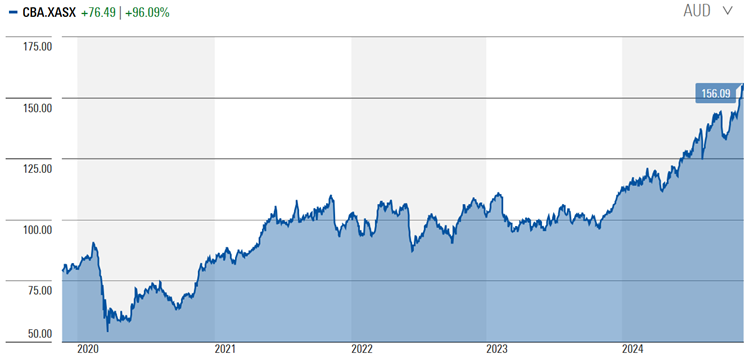

The Big Four banks have had a stellar run over the past 12 months. For instance, Commonwealth Bank (ASX: CBA) is up 56% during the period, and 43% year-to-date. It’s a head spinning move for the ASX’s largest stock with a market capitalization of $260 billion.

Source: Morningstar

Is CBA a $115 billion better business (the equivalent of Westpac's current market capitalisation) than a year ago? Not if you go by earnings, which were down 2% in the last financial year. The prospects for future earnings aren’t impressive either, with most analysts looking for mid-single digit growth over the next three years. And these analysts assume provisions for bad debts remain near all-time lows – a big assumption.

What explains the rampant run-up in bank share prices? ‘Fundamentals’ as we like to call them in the finance industry don’t explain the moves. More likely, it’s liquidity. Mining stocks have been in the doldrums and large fund managers and super funds have essentially been forced to buy the banks to get returns. Passive ETFs have amplified the price rises.

Gone are the good old days

Once upon a time, the banks offered high starting yields (due to lower prices), with steady, growing dividend streams, but that’s now a distant memory. For instance, CBA grew dividends by a compound annual growth rate (CAGR) of 9.2% in the decade to 2003, by 8.9% in the decade to 2013, but by just 1.74% in the decade to 2023. Similarly, Westpac increased dividends by 9% CAGR in the ten years to 2003, by 9.5% in the following ten years, yet dividends declined by 3.1% per annum in the decade to 2023.

The slowing dividend growth is the result of slowing earnings growth, due to a host of reasons. Increased competition for deposits and loans, greater capital requirements, slowing credit and economic growth, and other factors have played a part.

Future earnings growth also looks tepid at best, and consequently so does dividend growth. Even with franking credits, the picture doesn’t appear anywhere near as positive as it did over much of the past 40 years.

Yet, the current share prices don’t reflect this. CBA is sporting a price-to-earnings ratio (PER) of 27.7x, making it the most expensive bank in the developed world, and by a distance. The PERs of the other banks are cheaper, though far from cheap: Westpac (ASX: WBC) at 17.4x, NAB (ASX: NAB) at 17.5x, and ANZ (ASX: ANZ) at 15x.

These high prices have left dividend yields at the lower end of history, with CBA’s yield at 3%, Westpac’s 4.5% NAB’s 4.3%, and ANZ’s at 5.1%.

Looking beyond banks

Banks have been the go-to source of dividend income for investors for years, yet they don’t offer the same prospects for high, growing income that they once did. What should investors do?

The yields on banks aren’t disastrous, so I’m not suggesting that it’s time to cut and run from them. However, it does seem an opportune time to look beyond the banks for better dividend prospects.

Here are some ideas:

Steady compounders. These are potential bank alternatives, offering steady, growing income. I like medical insurers such as Medibank Private (ASX: MPL) and NIB (ASX: NHF), with dividend yields of 4.4% and 5% respectively. Yes, there are risks around hospital cost negotiations, yet these seem to be at least partially priced in. While pricing is set by government, growing demand for private healthcare should ensure increasing earnings and dividends for many years.

Origin Energy (ASX: ORG) is another one in this category. It’s the country’s electricity and gas supplier and its attractive prospects have made it the subject of takeover bids. With a 5.1% yield and reasonable valuations, it deserves a place in income portfolios.

Dividend growers. This group of companies comprises great businesses with relatively low dividend yields but with opportunities to grow those dividends at a brisk clip. Brambles (ASX: BXB) is one, offering a yield of 2.6%, albeit only partly franked. Resmed (ASX: RMD) is another, with a paltry yield of 0.8%, but with a great track record of increasing dividends (more than 7% CAGR over the past ten years). And a personal favourite is Washington H. Soul Pattison (ASX: SOL). It has raised dividends in each of the past 24 years, by 10% per annum. It’s a phenomenal track record that’s unlikely to be repeated. However, the future still appears bright for the conglomerate. Soul Patts offers a 2.7% current dividend yield.

Comeback stories, returning cash. Here are stocks where there is real value and the potential for business turnarounds and for cash to be returned to shareholders. Ramsay Health Care (ASX: RHC) offers a possible opportunity. Better returns should come from an increased focus on its Australian assets. Also, negotiations with insurance funds over costs could prove a catalyst for the stock.

Perpetual (ASX: PPT) is another one. Everyone hates the company given its history. Yet, it’s inexpensive and if a proposed demerger goes ahead, that should result in about a billion dollars finding its way back to shareholders.

What didn’t make the list

There are notable absentees from the stock ideas above. First, there are no miners. I just don’t think miners deserve a large spot in portfolio given their volatile earnings and dividends. Second, the supermarkets are excluded too. Despite recent issues, the shares still seem on the expensive side and dividends aren’t compelling. Government pressure is effectively capping pricing, and they’re still dealing with cost issues.

What about dividend ETFs?

Given ETFs are all the rage, the inevitable question is whether there are ETFs that can provide investors with decent dividend income. My issue with a lot of the dividend ETFs is that they’re loaded with banks and materials companies. For example, the largest dividend ETF, Vanguard’s Australian Shares High Yield ETF (ASX: VHY) has 66% exposure to financials and materials, in line with its benchmark. It’s fine if that’s what you’re looking for. However, if you want to diversify away from banks and miners for yield, then please carefully read the fine print of dividend ETFs.

Are international shares an option?

International shares are an option for those seeking income. However, these shares don’t have the franking credits that are on offer in Australia. For this reason, I’ve always looking for yield in Australia and growth outside of it. It’s a strategy that may not suit everyone and depends on your circumstances.

James Gruber is editor of Firstlinks and Morningstar.