We highlighted in April 2018 in Cuffelinks how cheap the hybrids market looked, and the sector has since bounced back. Over the first 21 days of June, the Solactive ASX Hybrids Index, which is a market capitalisation-weighted benchmark of all listed subordinated bonds and hybrids, has risen 1.01% (or 101 basis points) compared to the RBA cash rate increase of 8 basis points.

Effects of new supply

A tsunami of $3.1 billion in new hybrid supply over February and March 2018, courtesy the Westpac and CBA issues (WBCPH and CBAPG), combined with Bill Shorten’s threats to remove cash rebates from franking credits, hammered the listed hybrid market down 1.49% over those months.

The market then bounced up 0.69% in April only to endure headwinds again in May after Macquarie launched an unexpectedly large $1 billion hybrid issue, which resulted in the sector suffering a 0.17% total return loss in that month.

By the end of May, major bank hybrids with five years left until final maturity (or call date) were paying franked spreads above the quarterly bank bill swap rate (BBSW) of 4.06%. This meant that total franked yields were as high as 6.6%, which compares favourably to the franked dividend yield on the ASX200 Index, which at the time was 5.44%. On an unfranked or cash basis, total yields at that time were a similarly chunky 4.9% on hybrids like CBAPD, which was above the 4.07% cash yield on the ASX200 Index despite the fact that hybrids have historically displayed one-quarter to one-third the volatility and downside risk of shares.

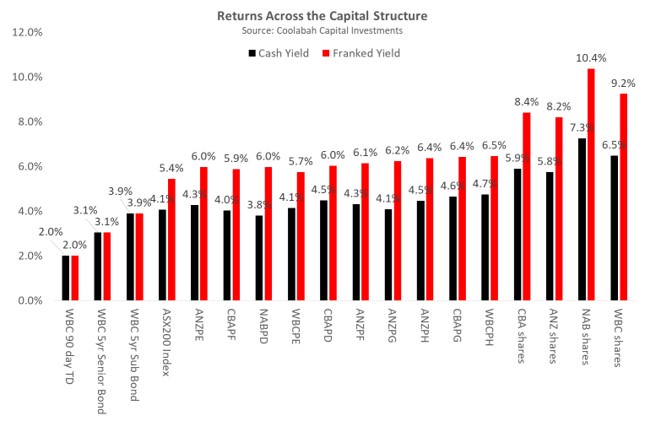

After the 1.01% total return over the first 21 days of June, where do valuations stand? The chart below shows the cash yields and franked yields on key ASX hybrids compared to the comparable yields on the ASX 200 index, and the major banks’ term deposits, senior bonds, subordinated bonds, and ordinary equities. This gives a sense of the returns available right across the capital structure with each sector obviously having different levels of risk.

Transfer of wealth from equity to bonds and hybrids

Since 2013, I’ve argued that the major banks needed to significantly deleverage their balance sheets, which they have done, reducing leverage from over 25 times six years ago to around 19 times today. This reduces their returns on equity, which have fallen from 17% to about 13% today. As the return on equity falls closer to their circa 11% cost of equity, the majors also have to trade much closer to book value, which is what has happened. Price to book value ratios have slumped from 3.0 times to around 1.5 times, in what should have been a direct transfer of wealth from the major banks’ equity holders to their bond and hybrid holders.

However, the surprising thing is, the much lower risks that the major banks carry today (as reflected by, amongst other things, vastly improved equity capital and liquidity coverage ratios), reinforced by the sale of risky non-core businesses, has yet to manifest in the form of tighter credit spreads, or a lower cost of debt capital.

At the end of 2006, CBA issued a 4-year senior bond at a 0.1% spread above BBSW that today would require spreads that are about eight times wider. In May 2007, CBA priced a lower-ranking subordinated bond with a 5-year call at just 0.24% above BBSW: similar bonds today trade six times wider.

CBA issued its PERLS IV hybrid in 2007 on a spread of 1.05% above BBSW, which is one-quarter of the spread CBA hybrids pay on the ASX today.

The investment thesis

In a world in which most assets, like equities and housing, remain very expensive by historical benchmarks (price/earnings multiples are above 2007 levels), these are pockets of opportunity.

Since the GFC was a financial credit crisis, the best value investments tend to be assets that were most adversely affected by this shock, such as the bonds and hybrids issued by banks and insurers, which are trading well wide of their 2007 levels in credit spread terms.

Christopher Joye is a Portfolio Manager with Coolabah Capital Investments, which invests in fixed income securities including those discussed by this article. This article does not address the individual circumstances of any investor.