97% of super fund trustees say that they’ve improved their understanding of member retirement needs in the last three years, yet only 15% rate that understanding as being better than “good”. Only around 1 in 6 trustees can robustly track how members are faring toward (or in) retirement.

Incomplete member insights and patchy outcomes measurement are just some of the findings of the recent third annual review into the implementation of the retirement income covenant (RIC), released jointly by the Australian Prudential Regulation Authority (APRA) and the Australian Securities & Investments Commission (ASIC).

As the ASIC media release to this 2025 RIC ‘Pulse Check’ bluntly stated:

“The report highlights that despite RIC obligations being introduced over three years ago on 1 July 2022, the gap is widening between trustees actively promoting better retirement outcomes for their members and those that are not.”

Concerning words, given the forecast 2.5 million Australians who will commence their journeys toward retirement in the coming decade, joining over 4 million retirees already there.

Retirement income covenant – a refresher

The retirement income covenant joins a host of other legislative ‘promises’ that super funds must uphold to members (whether explicitly written into their governing rules or not), with effect from 1 July 2022. It does not apply to SMSFs.

In essence, the RIC requires APRA-regulated funds to formulate, regularly review and give effect to a retirement income strategy to help members achieve and balance three retirement objectives:

- maximising their expected retirement income;

- managing expected risks to the sustainability and stability of this retirement income;

- having flexible access to expected funds during retirement.

Strategies may differ for different types (cohorts) of members (e.g. by age, balance, income needs or other factors).

Every super fund must make a summary of its retirement income strategy publicly available on its website to help individuals decide if the suite of retirement measures on offer is suitable/sufficient for their needs.

As to why the RIC was introduced, population dynamics are forcing the hand of governments and regulators, as I recently wrote about in ‘Super crosses the retirement Rubicon’.

The 2025 Pulse Check findings

This newest review follows similar reviews at the first and second anniversary marks of the RIC commencement.

The July 2023 ‘thematic review’ expressed concerns with trustees properly understanding member needs, designing fit-for-purpose assistance and overseeing retirement income strategy implementation.

This was despite clear written expectations by APRA prior to July 2022 on the key areas that trustees should consider in formulating and executing their RIC programmes, outlined below.

Source: APRA, ‘Implementation of the retirement income covenant,’ letter to RSEs, published 7 March 2022

The July 2024 RIC ‘Pulse Check’ noted that while trustees with larger memberships and more members approaching retirement had made better progress, it still found “considerable variability in the implementation approach taken by RSE [registrable superannuation entities] licensees, and a lack of urgency in embracing the intent of the covenant.”

As for this latest, more detailed, RIC ‘Pulse Check’, it involved responses from 39 RSE licensees, representing some 95% of the ~$550 billion in retirement phase assets under APRA regulation.

The high-level findings are best captured in the following passage:

“Some RSE licensees have shown leadership by investing significant effort into meeting the needs of members transitioning to and in retirement, with a smaller number innovating and pushing forward best practice.

Still, far too many have been content with making incremental improvements. In many cases, we have not observed the level of investment in robust governance, innovative retirement income solutions and tailored support for members that regulators and, more importantly, members should expect.”

This is broadly consistent with recent regulatory commentary that RIC implementation is bifurcating into a market environment of ‘leaders and laggards’.

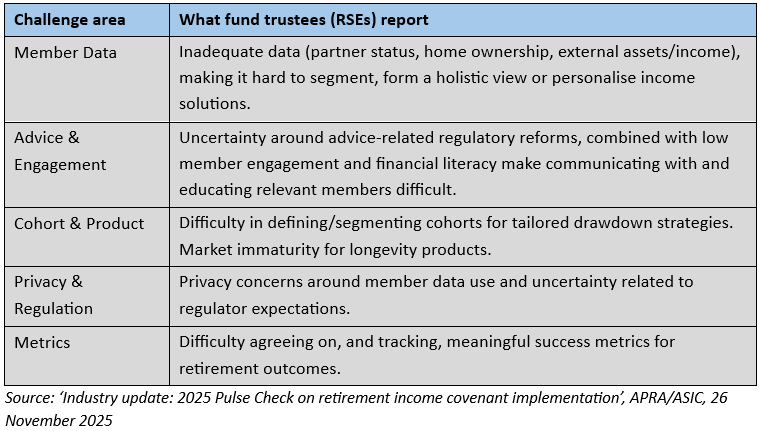

As to why so many trustees are still struggling three years into the RIC becoming law, the below table outlines the challenges some are finding difficult to overcome.

Key challenges RSEs cite in implementing the RIC (adapted from Table 3 – 2025 Pulse Check)

Source: ‘Industry update: 2025 Pulse Check on retirement income covenant implementation’, APRA/ASIC, 26 November 2025

In terms of member data, that this most recent review finds trustees still struggling with developing a holistic representation of member circumstances is highly concerning, as the 2023 review had suggested better practice as:

“… seeking to better understand the financial profile of their membership in different sub-classes beyond superannuation balance, including key information such as home ownership, partner/marriage status, and material assets and income outside of the RSE or the superannuation system.”

Having outlined why understanding the member’s household balance sheet (in particular home ownership and any related debt) is so important to formulating a view of retirement readiness, including here, here and most recently, here, the lack of progress since 2023 is unfortunate indeed.

Tension between the ‘cohort of one’ and ‘just one cohort’

Another area of concern is the lack of progress on cohorts; segmenting members such that there can be differentiated member experiences for information, communications, behavioural nudges, education, guidance, retirement income product solutions and suggested drawdown strategies.

Over half of the trustees surveyed (54%) have reviewed and updated their cohort approach since the 2024 Pulse Check. Around 75% of respondents who used cohorts self-assess their approach as ‘good’ or ‘very good’.

However, on closer inspection the report found that only 28% of trustee respondents currently measure the success of their retirement initiatives against specific cohorts.

And therein lies the tension, with fund trustees caught in a bind between knowing and not knowing their members, due to the legislative complexities of their operating environment.

The regulatory expectations of the retirement income covenant plus improved member outcomes (SPS 515) pulling in one direction, versus the sole purpose test plus best financial interests duty often pulling in the opposite direction, are by no means trivial to navigate.

That said, three years on from becoming law, super fund trustees should now be on notice that the RIC is no longer negotiable, especially when some 20,000 members will start their homeward run to retirement each month on average for the next decade.

Regulatory patience wearing thin

The regulatory tone of this triennial Pulse Check has become noticeably more strident compared to the previous two years, with the media release stating that:

“APRA Deputy Chair Margaret Cole noted ‘ASIC and APRA are committed to holding superannuation trustees to account for improving the experience of members approaching and in retirement, in line with the objective of the RIC.”

Fund trustees would do well to consider the 2021 introduction of the Design and Distribution Obligations regime (DDO), which saw a similar period of implementation reviews and industry engagement, before engagement turned to enforcement for the laggards.

Trustees who move early can treat the retirement income covenant not as a compliance hurdle, but as a design aid - to build richer member insights, interactive tools and journeys that help members make better decisions, before and throughout retirement.

The opportunity is to act now while the regulators are in ‘engage and support’ mode, rather than waiting for the enforcement phase to define the agenda. The future belongs to funds willing to embrace the RIC’s intent, and which design end-to-end solutions driven by quality insights into member retirement needs, circumstances and preferences.

Harry Chemay is a co-founder of Lumisara, a consultancy that assists a range of clients across wealth management, FinTech and the APRA-regulated superannuation sector, with a particular focus on the late accumulation to early decumulation phase of the retirement journey.