Six months ago, the tone of the February 2022 reporting season was overall positive, with the onset of reflation and higher rates being reflected in earnings upgrades, and a tilt away from the market’s desire for Growth towards the Value-style stocks expected to benefit from the economic reopening.

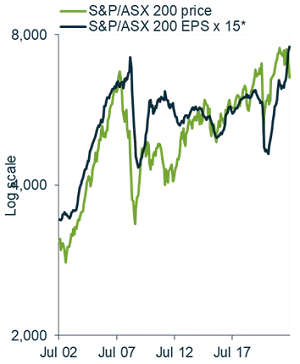

Fast forward six months, and we have now seen blow-out inflation readings, central bank rate rises, a new Australian Government and a severe market correction in June. Australian share prices were down -10% since the start of the year to 30 June, yet earnings for S&P/ASX 200 companies are up at record levels as can be seen in the chart below. And while global economic growth indicators have been slowing for the last year, such as the purchasing managers index (PMI), they are still up above neutral levels.

Australian share market indicators

Past performance is not guide to future returns. Source: Martin Currie Australia, FactSet; as of 30 June 2022. *Long term average P/E ratio for market.

Demand and profit expectations appear to be holding up despite inflation impacts growing, but the real question this reporting season will be, for how much longer.

To us, it is increasingly likely that headline inflation will soon peak and will be lower in 12 months’ time, but rate rises are just beginning. Companies have, however, been slow to update guidance and we are yet to see the full impact of inflation expectations in their earnings and outlooks. We think we are in for a reporting season where supply and demand pressures will come further into focus.

Differing short- and long-term impact on margins

While inflation is broadly good for equity profits in the long term, the short-term impacts will vary markedly across companies and have significant impact on margins for companies that lack pricing power for this environment. It is clear from all companies that we have been talking to that cost increases are a big issue.

At their core, many industrial businesses convert a primary material (bauxite, lime, clay) plus energy (gas, coal, electricity) into an end product (e.g., bricks, cement, alumina, steel). Where companies don’t have direct pass through of cost inputs, they could face significant margin pressure.

Other industrial businesses, such as Amcor and Brambles, faced early-cycle inflation pressure from input costs in their US businesses but are also likely to see better profit margins as costs have started to roll over as the US brings inflation closer to target. We will also be interested to see if businesses with domestic supply chains that compete against imports can demonstrate a cost and supply advantage in the current environment to help them win share.

On the other hand, some contractors and real asset businesses have revenue contracts linked to CPI, or wage costs that are based on enterprise bargaining agreements (EBAs), are less inflation sensitive and hence will demonstrate strong margin expansion in the current environment.

For the banks, we expect higher rates to boost Net Interest Margins (NIM), especially the ‘exit NIM’ for the July or September quarters. Banks with large retail deposit bases will benefit the most. For general insurance, we are concerned by the significant supply chain and claims cost inflation, but premiums are now starting to outpace strong inflation. Financials in general will continue to face pressure on IT and wage rises next year will continue to impact their cost outlooks.

Rate rise are still at early stage

The idea of central bank cash rate rises is really only eight months old, and the first Reserve Bank of Australia (RBA) move was just three months ago. We expect the RBA to tighten further in August and September, and as this will occur during reporting season it is likely to impact company outlook statements.

Australian rates (%)

Past performance is not guide to future returns. Source: Martin Currie Australia, FactSet; as of 30 June 2022.

Consumers and housing are highly sensitive to rates given high house prices, high indebtedness, and exposure to variable rates. There are already issues for profitability of house builders from cost increases, but the next issue will be falling new demand especially as immigration rates remain low.

Some types of REITs will also suffer demand destruction from higher build costs and falling new project return economics.

Full employment causing further inflationary pressure

We are also facing full employment, both in Australia and offshore, with low underemployment versus history. Wage inflation will be a multi-year issue to normalise and will require a significant slowing in employment demand to bring it under control and back towards the trend line shown on the graph.

We see that service companies and businesses with high wage costs will be the ones facing the largest wage inflation pressure for the longest period. We already saw tech companies suffering from wage pressure in February 2022 results. We expect to hear more this time around from Australian companies in this space.

The new Australian Government will hold a Jobs Summit in September which will likely focus on training and low skilled employment shortages (especially important for childcare) but this can do little to really readjust the pressures from full employment. To further slow the demand pressures on the economy, we expect that the next Australian budget in October will be contractionary, with expenditure cuts versus the last three years of expansionary budgets.

Confidence hit, taking spending with it

Plummeting business and consumer confidence highlights the consumer’s sensitivity to inflation and interest rate issues. The consequences for the economy and companies have barely begun, but we certainly expect it to change consumers consumption mix, especially as we are yet to see the tight labour market discussed above translate to real wages.

While we believe the international travel recovery is just getting started and hence will be less economically sensitive, we believe higher living costs will result in declines in consumer discretionary categories that are trading well above pre-Covid trends.

CBA real-time credit card data highlights spending categories beginning to roll over to lower levels. Inventory levels will also be a potentially big cashflow issue for retailers, industrial and materials companies that held high inventories to protect against supply chain pressures but now may be stuck with excess stock as demand falls.

China concerns continue, but hopes from energy transition

China growth indicators also look terrible on the back of the burst property bubble. The only hope we can see is for their government to direct stimulus to the infrastructure sector and towards the consumer.

While we remain bearish on Australia’s iron ore sector due to these China growth concerns, the resources super cycle is in fact benefiting from the Net Zero transition. We are keen to see significant improvements in the energy, construction and decarbonisation project pipeline that will benefit contractors such as Worley, Downer EDI and Monadelphous Group. Wage shortages and inflation are also expected to have a significant impact on miners' costs and new project capital expenditures.

We expect to hear a lot more discussion around the domestic energy crisis and energy transition. Results for electricity generators face a wide range of outcomes given risks around hedge books, contract positioning and supply disruptions. Whilst these issues will dominate FY22 and FY23 earnings revisions, by FY24 these companies will have large earnings upgrades given energy pricing.

Investment style implications from the shift

We discussed a continuation of the performance reversion for Value in a paper in April 2022, the tide continues to turn for the value-growth dynamic, and we expect that we will hear more positive earnings per share (EPS) stories from Value companies than Growth companies when they report in August.

Value stocks, typically resources, materials, financials, and utilities, are better placed for inflationary pricing power in a supply constrained world with growing demand.

The most attractive companies will be those that can insulate costs from inflation while enjoying an uptick in revenue from the rising prices across the economy. We will be particularly focusing on how management update their guidance in the face of short- and long-term inflation pressures.

Reece Birtles is Chief Investment Officer at Martin Currie Australia, a Franklin Templeton specialist investment manager. Martin Currie currently manages over $31 billion including $8 billion in Australian equities (as of 30 June 2022). Franklin Templeton is a sponsor of Firstlinks. This article is general information and does not consider the circumstances of any individual. Past performance is not a guide to future returns.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.