For years, the superannuation industry has grappled with how to offer members simple, attractive and affordable solutions together with longevity protection. Certain tax and legislative barriers have made it difficult for some products to be introduced.

The Financial System Inquiry recommended that superannuation trustees should pre-select a Comprehensive Income Product for members’ Retirement (CIPR). It suggested that these CIPRs should have certain features including a regular and stable income stream, longevity risk management and flexibility. Before designing a product (or products) for Australian retirees, are there lessons we can learn from overseas practice?

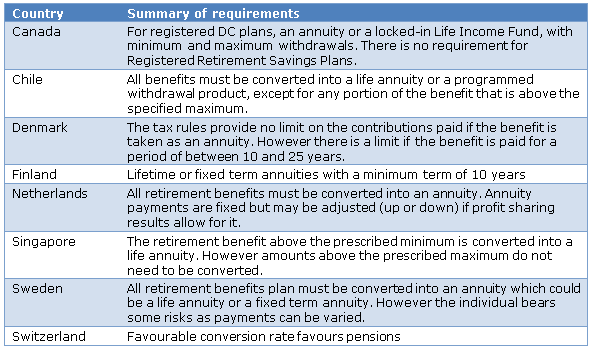

The following table summarises the requirements for retirement income products in eight of the top ten countries from the 2014 Melbourne Mercer Global Pension Index. The two countries excluded are Australia and the United Kingdom, which from April 2015 removed the previous requirement to use at least 75% of retirement funds to purchase a lifetime annuity. Their system is now similar to Australia with no requirements (i.e. total freedom).

It is clear that most of these systems have a lifetime income focus with a concentration on lifetime or long-term annuities. Generally, there is a collective approach which means those who live longer receive greater benefits than those who die earlier. This is in contrast to the Australian norm where superannuation assets are often considered to be ‘owned’ by the individual for their sole benefit.

The income requirements only apply for benefits above a certain level in Singapore and do not apply when the benefits exceed the prescribed maximum in Chile or Singapore. Both approaches make sense as there is little value to be gained in requiring annuities for small benefits and once a reasonable income level has been attained, the Government may have little interest in how the balance of the benefit is used.

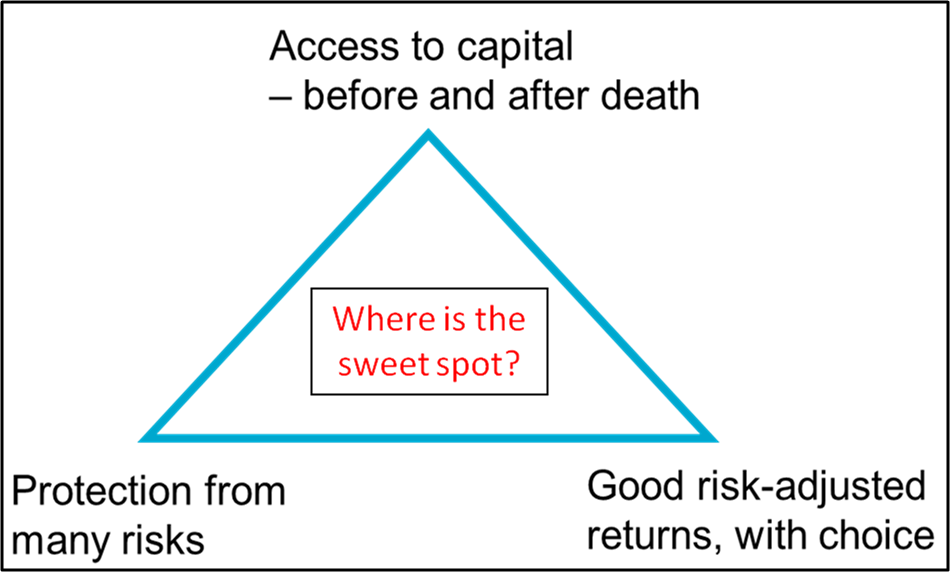

The retirement trilemma of what retirees want

The development of the best retirement product is not straightforward; indeed, the post-retirement years are much more complex than the pre-retirement years, when many individuals continue to receive a steady income.

In short, most retirees seek:

- Access to some capital, both during retirement for those unexpected and significant capital expenditures, and after retirement as a bequest

- Protection from risks, which can include inflation risks (after all, they remember the 1970s), market risk (as they have seen many market downturns) and longevity risk as they become increasingly aware of increasing life expectancies

- Good returns from their investments, often in an account-based pension, which also provides flexibility

However the ‘best’ product which responds to these divergent needs is not the same solution for every individual. It will depend on the individual’s investment risk profile, health condition as well as their family and housing situation. Furthermore the best solution is likely to change during their retirement years as they pass through various phases of retirement.

A single lifetime annuity is unlikely to be the best solution notwithstanding the requirement in many pension systems. Retirees are now seeking more flexibility than provided by a single lifetime annuity. Whilst an annuity provides longevity protection it does not provide access to capital and investment choice. A combination of products or a single flexible product with several features is more likely to respond to the needs of retirees.

Pooling of risk is big difference between Australia and other countries

We need to move away from products that are solely focused on the individual; some risks are better managed when shared. There is an urgent need to find a better balance between the individual orientation of a defined contribution plan and a collective (or pooled) approach where there is some sharing of risks within and between generations.

The most obvious area to pool risks is in respect of longevity risk. Whilst annuities represent one form of such pooling, the Financial System Inquiry showed that other forms of pooling (such as through group-self annuities which require no capital) can deliver significantly higher retirement incomes while also reducing the risk of outliving retirement savings.

If, or indeed when, CIPRs are introduced into Australia’s superannuation landscape, the key to success has to be a definition that enables a wide range of solutions to be available, including a general acceptance that the pooling of risks will normally provide a more efficient outcome.

Dr David Knox is Senior Partner at Mercer. See www.mercer.com.au.