The 2021 year was exceptional for many investors. The ASX200 gained 12%, excluding dividends, and the S&P500 rose over 25%, including an almost unprecedented 70 all-time-highs. But not all stocks soared, and some that did have come down to earth. Many are at or near their 52-week lows, having stayed flat or even fallen dramatically over the last 12 months.

Buying when stocks are down

Many long-term investors will be familiar with the Dogs of the Dow strategy, which involves buying the poorest performers of the previous year in the Dow Jones Index. This strategy is far from foolproof, but many nabtrade investors are keen to buy high quality stocks at a discount.

Here are some of the most popular stocks among our investors that are currently trading at or near their lowest price over 12 months, by sector.

Many stocks in the healthcare sector suffered during Covid19, as companies were unable to treat patients or otherwise access their key markets. Two of Australia’s most successful healthcare companies, both leaders in their field, are currently trading close to their 52-week lows, with CSL (ASX:CSL) trading a little over $250 at the time of writing, well off its 12-month high of nearly $320, and even further from its pre Covid high of $350.

CSL has been frustrated in its efforts to collect blood plasma in the US and Europe due to Covid19 distancing restrictions, and has undertaken the high value acquisition of Vifor Pharma which was both debt and equity financed, putting the share price under pressure. Broadly, however, CSL’s long term fundamentals do not appear to have changed.

Cochlear Ltd (ASX:COH) shares are trading below $195, which is above its 52-week low of $178 but well off 52-week high of $257. Both CSL and Cochlear have typically traded on high multiples due to their consistently high growth rates and relative strength in their target markets.

In financials, three of the big four banks have rebounded strongly from their Covid lows, however Westpac (ASX:WBC) has struggled to win market share and control costs, with its annual results in November disappointing shareholders and sparking a 10% sell off. The share price hasn’t really recovered, at around $22 it is a little off its lows of $20 but well off its 52-week high of around $27. Westpac remains the most bought of the big four banks on nabtrade.

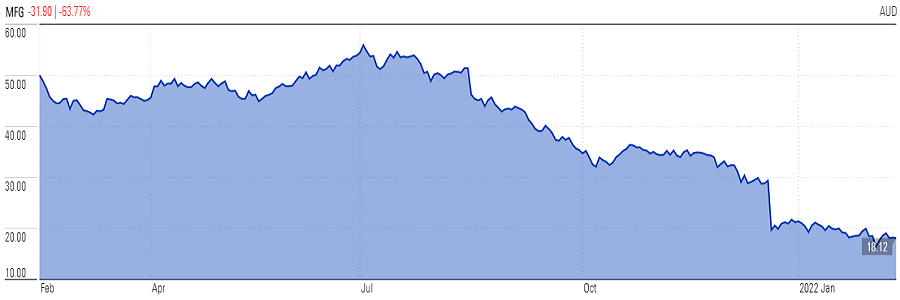

Magellan Financial Group (ASX:MFG) has suffered a series of blows over the last 12 months, including the resignation of its CEO, the loss of its largest institutional mandate and now the leave of absence taken by its Chief Investment Officer and key man, Hamish Douglass. Magellan is down over 60% year-on-year, as shown in the chart below.

Magellan (MFG)

Source: Morningstar, as at 16 February 2022

Former blue-chip AMP (ASX:AMP) has bounced nearly 10% from its low of 85 cents but is still down nearly 40% over 12 months and has lost more than 90% of its value since the GFC.

Retailers, particularly online retailers, were one of the biggest winners from Covid19 as consumers were forced to change their spending habits. Harvey Norman (ASX:HVN) was also the beneficiary of a significant boost from JobKeeper payments, but some view the reopening as a negative for Harvey Norman, as consumers are more likely to spend on travel and experiences rather than goods. At the time of writing, HVN shares were off their 52-week lows but still 20% off their recent highs and down over 12 months, significantly underperforming the ASX.

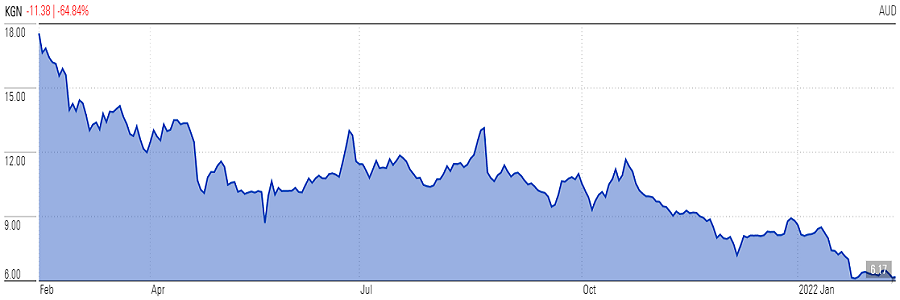

Well-known online retailer Kogan (ASX:KGN) has had a wild ride. It is down again in 2022 and has lost over 60% in 12 months. Rising inventory and costs have worried shareholders and analysts.

Kogan (KGN)

Source: Morningstar, as at 16 February 2022

Tech comes back to earth

The sector most at risk of rising interest rates is technolgy, as the valuations for many high growth tech stocks are underpinned by an extremely low cost of capital and low discount rates for profits far into the future.

Australia’s most popular tech sector remains buy now, pay later (BNPL), which has seen extraordinary growth but valuation setbacks recently. The leader in the sector, Afterpay (formerly ASX:APT) has been bought by US payments giant Block (formerly Square, SQ.US). The combined entity now trades under the code ASX:SQ2 on the ASX. SQ2 has lost 17% of its value since listing, and Afterpay had lost nearly 50% of its peak value prior to the transition. Zip Co (ASX:Z1P), one of nabtrade’s most popular stocks in recent years, has lost over 60% of its value over 12 months, and is now at close to its 2020 trade price. Competitors in the BNPL space OpenPay (ASX:OPY) and Sezzle (ASX:SZL) are down over 80% and 75% respectively and are at or near their lows.

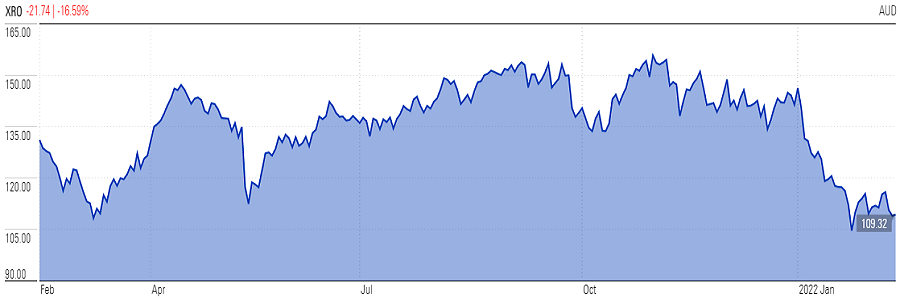

Also in the tech sector, accounting software provider Xero (ASX:XRO) is currently trading around $110 after peaking at $156 in 2021. However, Xero is still up 500% over five years and trades at a significant premium to the market. Another of the WAAAX stocks, Appen (ASX:APX) suffered a hit with Meta’s recent disappointing results, and while off its lows is still down nearly 60% over one year. ELMO Software (ASX:ELO), which provides payroll solutions, has fallen 40% over 12 months, and is now at 2018 prices.

Data centre operator Next DC (ASX:NXT) is down 15% over a year, and while it has bounced from its sub $10 52-week low, is substantially off its 2021 high of over $14. Former rocket Nearmap (ASX:NEA), which traded above $4 in 2018, is now near its lows at $1.30, while online marketplace provider Redbubble (ASX:RBL) is off over 70% over 12 months.

Xero (XRO)

Source: Morningstar, as at 16 February 2022

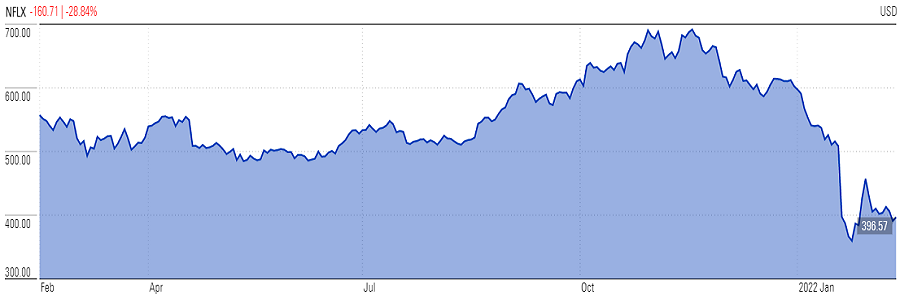

For those willing to look beyond the ASX, the Nasdaq has a multitude of stocks trading substantially off their highs, with two of the FAANG stocks, Meta (formerly Facebook, FB.US) and Netflix (NFLX.US) down 11% and 25% respectively over 12 months. While Apple (APPL.US) and Microsoft (MSFT.US) are up over 25%, Paypal (PYPL.US) has halved, Zoom (ZM.US) has fallen more than 60% and the US-listed Block (SQ.US) is down 55% over a full year. Beyond the big players, there are many more tech names whose investors have suffered huge (paper) losses over 2021 and into the harsh January of 2022.

Netflix (NFLX)

Source: Morningstar, as at 16 February 2022

Worth a look?

So are these weak stocks a great buying opportunity, or a value trap for the unwary?

It depends upon the company. The large cap names with consistent earnings whose circumstances were affected by Covid are worth closer study. A company such as AMP, however, is hard to fathom and the oft-promised turnaround may never materialise. For the more speculative end of the market, the days of heady valuations that made more sense when cash rates were close to zero are probably over.

Gemma Dale is Director of SMSF and Investor Behaviour at nabtrade, a sponsor of Firstlinks. Stock prices as at 7 February 2022. This material has been prepared as general information only, without reference to your objectives, financial situation or needs.

For more articles and papers from nabtrade, please click here.