Google recently joined the trillion (US) dollar valuation club, of which Apple and Microsoft are already members at around US$1.3 trillion each, with Amazon close behind at over US$900 billion. Apple has more than doubled since 1 January 2019.

Tesla winning over doubters

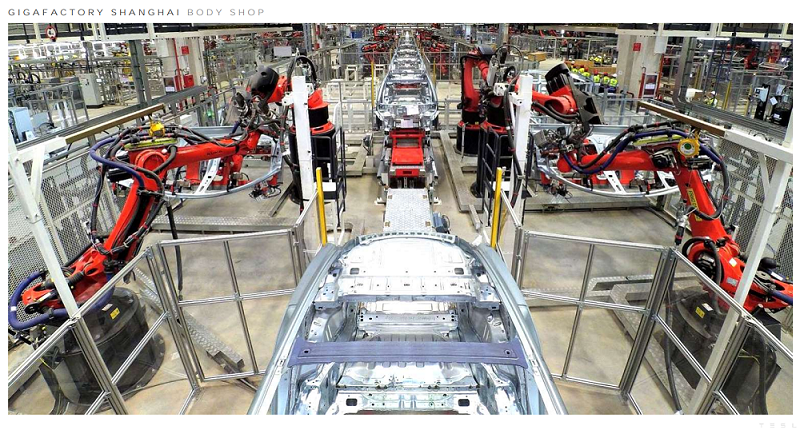

Tesla, too, has been on a tear, doubling in just three months. In California, and now Shanghai, and shortly Germany where it is building its third factory, Tesla is on track to deliver 500,000 cars this year, and a million a year or two later, as we have noted several times over the past two years. The company has already generated US$3.1 billion of operating cashflow since 1 January 2018. It is now the second most valuable car company in the world, worth more than BMW, Ford, Daimler, and of course VW. Only Toyota is bigger.

Source: Tesla

Meanwhile, the stock price of VW is trading at 70% of the value it held before what will come to be known as its most critical failure ever, the diesel scandal. It is on a PER of only 6.5x.

Profound disruption across all industries

There is a land grab quality to all this, but frankly, the disruption that is rolling through all industries is profound, making obsolete the business models of companies that have been the largest in the world for decades - like the car and oil companies, but also telcos, retailers, tv broadcasters and increasingly banks.

It is difficult to understand the pricing of some of these disruptive companies unless we see the big picture of the changes in direction by government and society to these whole-of-world issues.

For example, London will charge diesel vehicles an extra tax amounting to between £12.50 and £200 per day when they are used on its roads. Paris already bans pre-2005 diesel cars from the city centre on weekdays between 8am and 8pm. And diesel cars are set to be outlawed entirely from the centre of Paris from 2024, followed by petrol in 2030. In total, 24 European cities with 62 million inhabitants are phasing out diesel cars in the long term, 13 of which want to ban petrol vehicles too. Prominent examples include Paris, Madrid, Copenhagen as well as London and Rome, Bloomberg has reported.

Hundreds of British and European towns and cities have already restricted older model diesel vehicles from the city limits.

Avoiding becoming another Nokia

Volkswagen Chief Herbert Diess last week warned senior management that the company needs to overhaul its business to avoid becoming another Nokia - the company which lost its dominance first to Blackberry and then Apple.

VW owns, and provides the manufacturing platforms for Audi, Bentley, Seat and Porsche. Porsche has already discontinued the diesel of its popular SUV models Macan and Cayenne.

The root of the problem for VW can be traced to the culture that thought it was acceptable to cheat on emissions tests for its diesel cars. At the time, many thought the problem would simply go away, with VW paying a fine and moving on. After all, VW was selling over 10 million vehicles per year.

The company did pay a fine (already in the billions, with more expected) and is moving on, but not in the direction hoped. Following the discovery, VW admitted that it did not have the technology to field a new, cleaner diesel motor.

Diess comments should be seen in this context, and are frankly chilling.

“The era of the classic car makers is over. Volkswagen needs to get a grip on software and electronics as well as producing a raft of electric vehicles and batteries so it can comply with stringent anti-pollution rules. In summary this is probably the most difficult challenge Volkswagen has ever faced.”

The world has seen the problems of fossil fuels, and at the same time been presented with an alternative which isn’t just equal to, but better than those with combustion engines. Meaning faster, of course, but also cheaper to build and cleaner. Battery technology is sufficiently well advanced that energy density is all but irrelevant.

All TV will be streamed?

Another example: consumers are living the changes that are taking place in television viewing – streaming on demand (essentially time shifted viewing), ad-free or ad-supported, etc. Netflix already has more subscribers in the UK after 10 years than Sky UK had after 30, and it continues to grow more quickly.

One of the streaming players has already noted that in the future all television will be streamed, including the plain old TV of today, which is now known as linear tv. They may be exaggerating, but not much.

Netflix is not some chancer in the field. Its quarterly numbers, released last week, were positive at the Earnings Per Share line, as they consistently have been. The fact that the company borrows to invest in content, which it then amortises through its income statement, is no more remarkable than the business model of a railroad laying track or buying bogies. Yet there is still criticism that the company makes no money!

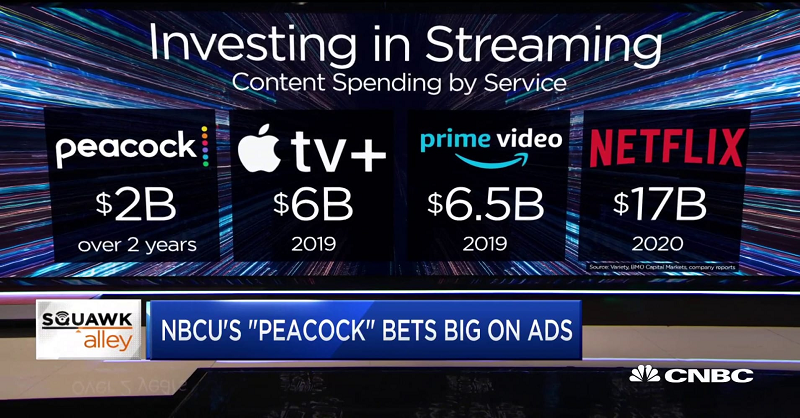

The largest media companies in the world have all announced significant changes to their business models (ie they will stream tv like Netflix), including Time Warner/HBO, Disney, Comcast (owner of NBC Universal Studios). Disney especially should be taken seriously, however a cursory look at its inventory reveals a lot of Marvel and Star Wars content that’s newish (rather than new) and a back catalogue of admittedly excellent animation, but with nothing like the depth of programming of Netflix.

HBO is also a strong contender, but following the acquisition by AT&T, the company has significant balance sheet issues, which will limit its chances of rolling out the quantity of programming required to beat Netflix. The difference here isn’t about production, but the sales channels which will be dismantled, meaning the cable tv bundle, with the significant loss in profitability that this entails.

No such issues exist with Apple and Amazon (or Netflix) which are already adding significant subscribers.

Other examples are everywhere

Look at connectivity and tools to assist agricultural crop yields, virtual banking, transport and the like.

Many investors talk about machine learning, or cloud based infrastructure, but we have investments in this area that have already generated a quantifiable level of return, measure-able from the group of companies within the portfolio which are a part of these thematics.

Meanwhile, the value players (who most likely have been buying VW) have been badly damaged. Advertising, media, banking, retailing, energy, carmaking – all are in the firing line, and it isn’t a cyclical downswing which is hurting, but rather profound structural change.

There is nothing wrong with value investing – there is a time and place for it – but not now, at a point in time when the pace of technology is remaking entire industries (which have taken decades to evolve) in just a few short years.

Alex Pollak is Chief Executive, CIO and Founder of Loftus Peak. This article is for general information only and does not consider the circumstances of any individual.