Australia is known as the ‘lucky’ country. Our attractive weather and natural resources are some of the many positive attributes of the nation. Currently, global positioning away from the rest of the world’s problems, especially in the age of COVID-19, could be viewed as the most important health risk mitigant for the near future.

There's another benefit in investing. Unhedged exposure to gold, that is, an Australian investing in gold without hedging its USD price (Gold/AUD), provides attractive properties for portfolio risk management including equity market and inflation hedges. Further, for portfolios that have a focus on re-balancing as an added source of return, equities versus gold provides an attractive pair to harness volatility.

For lucky Australian investors, gold relative to the Australian dollar can be a powerful addition for equity-heavy portfolios.

Inflation and currency debasement

Over the past several months as central bankers have rushed to provide unprecedented liquidity and balance sheet expansion, a growing consensus is emerging around gold for its ability to protect portfolios from currency devaluations and to provide a stable store of value.

Gold continues to make new all-time highs against many global currencies, including the Australian dollar.

An expanding list of recognised names including Paul Singer, Ray Dalio, Stanley Drunkenmiller, Crispin Odey, and Paul Tudor Jones have pointed to their increased gold positioning as a way to protect wealth from potential consequences of global government monetary and fiscal actions.

While inflation has so far only shown up within financial asset prices, the level of unprecedented intervention from monetary and fiscal policy may spill into the real economy. Central banks have showcased their game-plan with seemingly limitless appetite for expansion as the potential solution to a massive global debt overhang and global economic weakness.

Gold and other ‘real assets’ with scarcity value tend to perform well in inflationary periods and diversified exposure to inflation hedging may prove to be prudent if investors lose confidence in the global central bank playbook and their ability to control the inflation genie once out of the bottle.

Protecting future purchasing power and real returns should be in focus.

Gold/AUD as equity market protection

While physical gold is a non-yielding asset, many still view gold as a currency, albeit one with limited ability to print like fiat currencies.

The gold price is often quoted against the US dollar. However, for Australian investors using Australian dollars for their holdings in gold, the Gold/AUD (i.e. gold in AUD terms) has held an asymmetric relationship with equities, providing attractive protection qualities for an equity portfolio in severe market stress events.

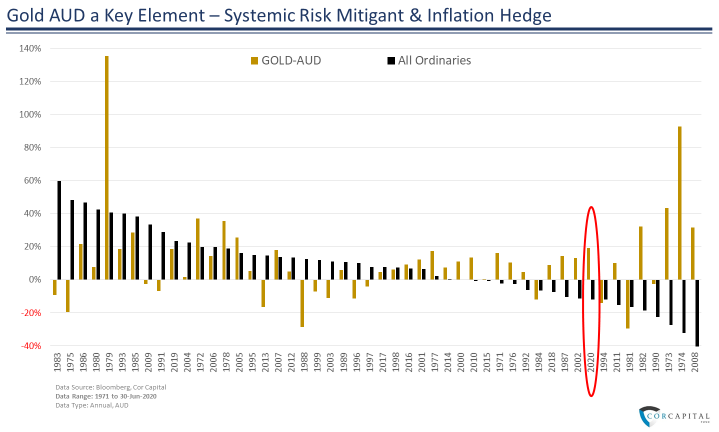

Figure 1 displays calendar year performance of All Ords Index and corresponding Gold/AUD ranked in descending order of equity market performance.

Figure 1

Source: Cor Capital P/L

For six months ending 30 June 2020, the All Ordinaries Index fell by -11.8% whilst Gold/AUD gained +19.4% over the same period.

Similarly, during most of the major equity market selloffs, Gold/AUD typically provides relief and negative correlation. Notably, in periods of both equity falls and high inflation, Gold/AUD has provided protection for an equity portfolio, such as during the 1973-1974 equity market crash driven by Bretton Woods and the oil crisis.

Gold typically provides ‘safe haven’ resilience while the Australian dollar tends to weaken with risk assets. In severe market sell-offs, Gold/AUD has often provided a boost when needed.

Importantly, in periods of rising equity markets, Gold/AUD has not held this negative correlated relationship, granting Australians an attractive put against equities with a limited drag in an upward moving equity market. In fact, over many periods both gold and equities rise together.

Harnessing volatility through portfolio re-balancing

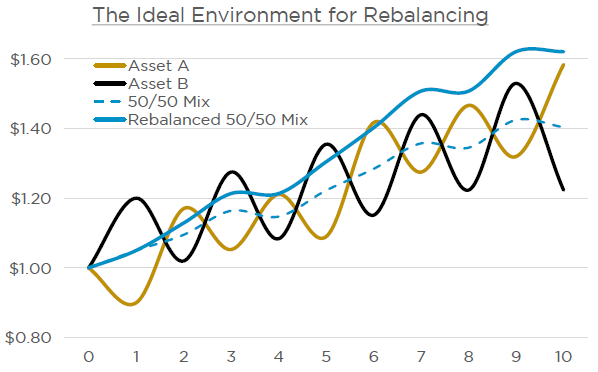

Within portfolios that regularly re-balance for added return, the ability to combine volatile but uncorrelated assets in constantly re-balanced proportions can add substantially to overall portfolio growth. This is well researched in academia and employed by Melbourne based multi-asset manager Cor Capital.

Normal volatility is harnessed through the trimming of winners and topping up of relatively poor performing assets (buy low/sell high) for added return relative to passive asset allocation. Further, as volatility increases the opportunity set increases.

Figure 2 depicts the stylised scenarios where re-balancing can add to static asset class return.

Figure 2

Source: Cor Capital P/L

Historically, equities and Gold/AUD have held a negative relationship in falling equity market periods with low correlation in all periods. Both assets have recorded roughly mid-teen (15% annually) long term volatility, creating an attractive pair of assets to harness normal volatility between the pairs.

Equity-centric portfolios have the potential to hedge for extreme events, protect future purchasing power and earn a unique source of return without taking on more equity or credit risks. Exposure to unhedged gold in Australia is readily available, for example, through unhedged gold ETFs listed on local exchanges.

Michael Armitage is Director of FundLab Strategic Consulting ([email protected]). This material is intended to provide background information only and does not purport to make any recommendation upon which you may reasonably rely without further and more specific advice. Past performance is not a reliable indicator of future performance, and no representation or warranty, express or implied, is made regarding future performance.