Gold investors have enjoyed a stellar 2020, with the yellow metal rising by 16% in USD terms and 19% in AUD terms in the first six months of the calendar year. On 27 July, gold reached an all-time high in nominal terms of US$1,944 a troy ounce. Since the cyclical bear market bottom seen in late 2015, the gold price in USD terms has increased by more than 80%.

Investment demand continues to rise, seen most clearly through the more than 700 tonnes of inflows into gold exchange traded products (ETPs) in the first six months of 2020. Whilst the United States and Europe dominate these figures in terms of total tonnage, demand is also strong in Australia. Inflows into Perth Mint Gold (ASX:PMGOLD) have seen total holdings rise by more than 50% in the first half of this year.

The increase in demand locally is driven by self-directed investors like SMSF trustees, as well as financial intermediaries looking to allocate a portion of their client portfolios to gold. Nevertheless, some investors are still grappling with the question of where gold fits within a portfolio. In many cases, investors are assessing whether gold should be seen as a growth asset or a defensive asset.

What kind of asset is gold?

It’s easy to understand why some investors see gold as a growth asset. It is a commodity, and commodities are almost universally seen as growth assets. Gold has also historically exhibited price volatility that is similar or even slightly higher than the equity market. Gold also delivers no income stream, with capital growth the only way it can provide a return to investors.

Given defensive assets are expected to generate regular income, and typically display lower volatility than equity markets, some investors struggle to view gold as a defensive asset.

However, gold does have some defensive asset characteristics. Physical gold is a zero credit-risk instrument, meaning there is no default risk. This is one reason why central banks hold almost 35,000 tonnes (worth over US$2 trillion in value) of the metal as part of their reserve assets. These central bank gold holdings have been growing for more than a decade, indicating gold is still seen as an important monetary asset amongst these institutions.

Gold also behaves differently to traditional commodities in terms of its interplay with risk assets. Not only does gold have a low overall correlation to equity markets, but this correlation usually turns sharply negative during the worst equity market sell-offs.

Commodities, on the other hand, are positively correlated to equities, with this correlation rising in the worst equity market sell-offs.

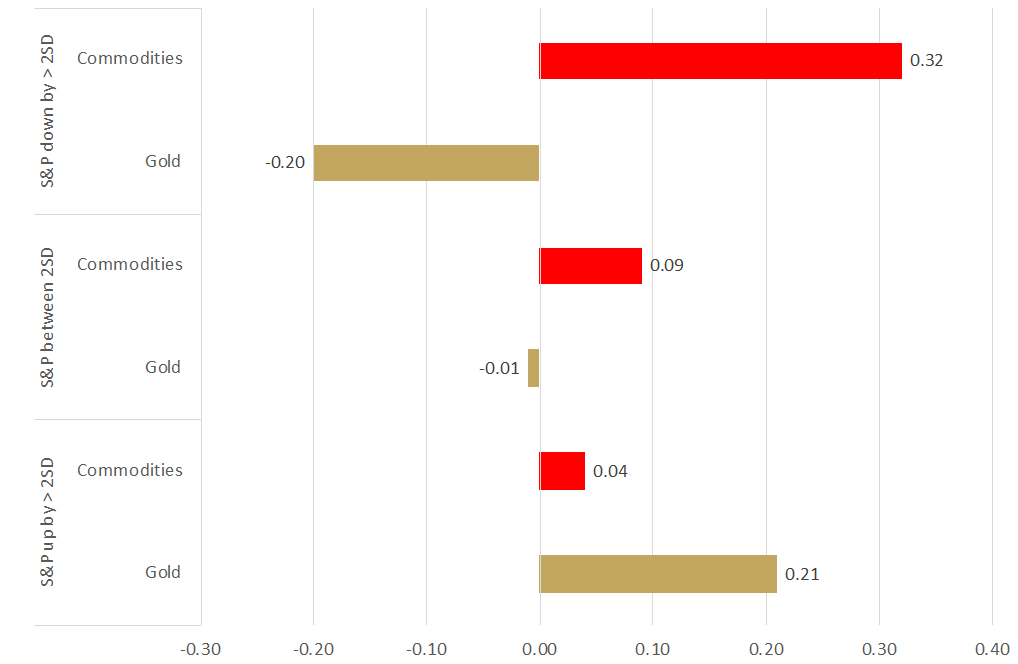

The chart below illustrates these differences, highlighting the correlation of gold (LBMA PM gold price) and commodities (Bloomberg commodity index) to equity markets (S&P 500) based on weekly returns between 1971 and 2019.

The chart shows:

- Correlations when the S&P500 falls by more than two standard deviations (top bars)

- Unconditional correlations over the entire time period (middle bars)

- Correlations when the S&P500 rises by more than two standard deviations (bottom bars)

Gold and commodity correlations to equity markets

Source: World Gold Council

The results show if an investor wishes to reduce overall portfolio drawdowns (losses) during periods of equity market stress, then history suggests gold is an asset to turn to, rather than a commodity basket.

Unlike other commodities, gold has historically delivered positive returns in low inflation environments and during deflationary scares.

Gold trades more like a bond

Furthering the case that gold can be seen as a defensive asset is the fact that the precious metal tends to trade like a bond and has many attributes similar to types of bonds.

It has no maturity date like a perpetual bond, a credit risk of zero (like most sovereign bonds) and no coupon like a zero-coupon bond. History shows that investors have been willing to pay more for such an asset in environments where the real yield available on zero credit risk (but not zero inflation risk) bonds is declining.

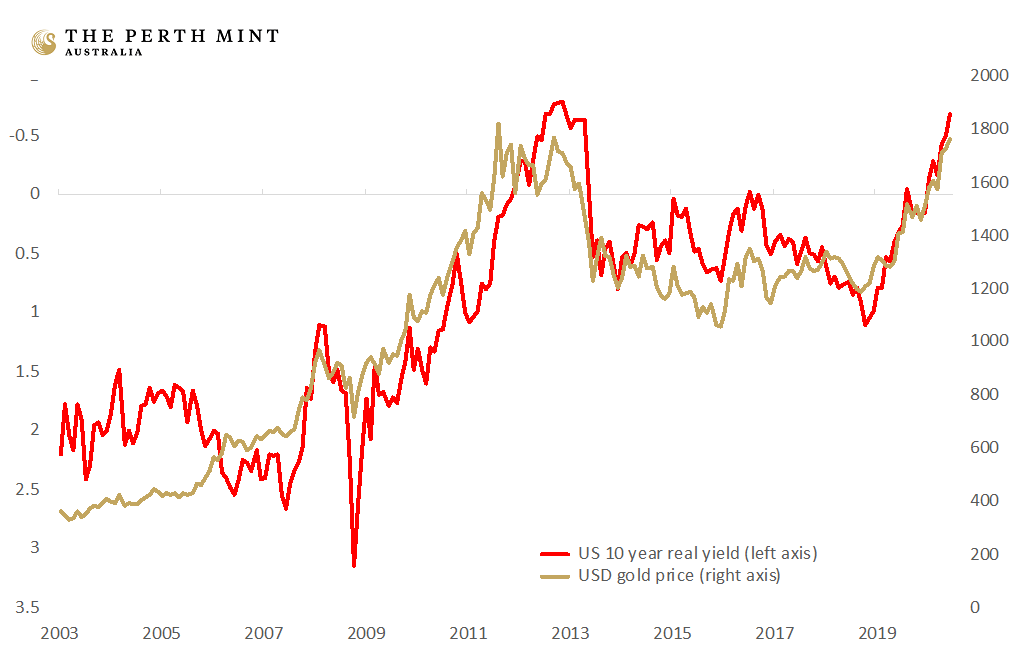

This is demonstrated in the following chart, which plots the correlation between the USD gold price and the real yield (which is inverted on the chart) on United States 10-year Treasury bonds from January 2003 to June 2020.

USD gold price and real yield on US 10-year treasury bonds

Source: The Perth Mint, United States Treasury

While it is not a perfect correlation, the chart is evidence that the lower real yields on Treasury securities fall, the higher the gold price tends to go.

Given the above relationship, it is natural that investors who are worried that real yields may stay below zero or continue to decline for the foreseeable future are turning to gold today.

What do self-directed investors think?

Self-directed investors largely seem to see gold as a defensive asset. In a recent webinar for the Australian Investors Association, we asked attendees whether their motivation to invest in gold was driven primarily by a desire to preserve wealth or to generate a profit.

More than 75% of those who responded stated that wealth preservation would be the primary motivation for making an investment into gold. Indeed, this theme was addressed in a Firstlinks article written by Noel Whittaker last week. Titled Hedging for capital preservation, the article discussed three options an investor looking to protect a portfolio from equity market drawdowns could consider. Investing in physical gold was one of those options.

Irrespective of whether gold is considered a growth asset, a defensive asset or a hybrid of the two, the precious metal has attributes that can be beneficial to investors managing a balanced portfolio, especially given the challenging economic and monetary environment that investors are expected to face for many years.

Jordan Eliseo is Manager of Listed Products and Investment Research at The Perth Mint, a sponsor of Firstlinks. The information in this article is for general information only and should not be taken as constituting professional advice from The Perth Mint. You should consider seeking independent financial advice to check how the information in this article relates to your unique circumstances.

For more articles and papers from The Perth Mint, click here.