The Australian fixed income landscape is very different to a year ago. At the onset of 2022, investors scouring the globe for yield opportunities were continuing to stretch risk and liquidity budgets in their pursuit of reasonable prospective returns.

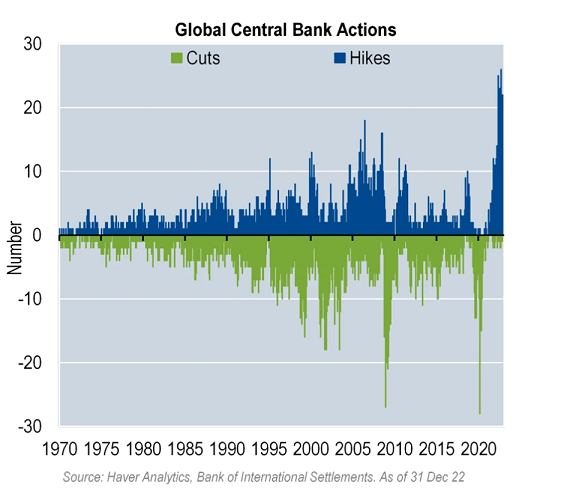

By the end of March 2022, negative yielding debt outstanding had fallen to US$3 trillion, after peaking at US$18.4 trillion in December 2020. In hindsight this was a preliminary sign of the conclusion of the ‘easy policy’ era. Central bankers, who had driven yields to near zero or beyond to provide cheap funding and promote growth, were being forced to reverse course. Then, rising inflationary pressure linked to aggressive monetary and fiscal stimulus, COVID related supply chain disruptions and energy supply shocks all combined to push inflation to record levels.

The war in Ukraine only exasperated these challenges on the energy and agricultural fronts and central bankers’ policy rate normalisation quickly followed suit. By the start of 2023, the balance of negative-yielding debt evaporated following Japan’s unexpected policy shift and more widely, the yields on fixed income assets had hit compelling levels.

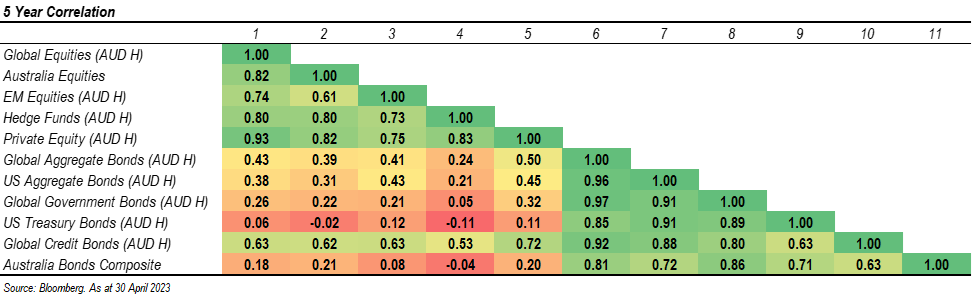

While a huge challenge for fixed income investors, coordinated central bank actions caused a remarkable reset for the asset class. With that, the asset class’ key attractions, including high income and total return potential, diversification benefits via a low to negative correlation with growth assets, and defensive attributes linked to potential capital appreciation in times of stress, are back after a long period of rate manipulation that started post GFC.

Income and total return potential is back, especially in select credits

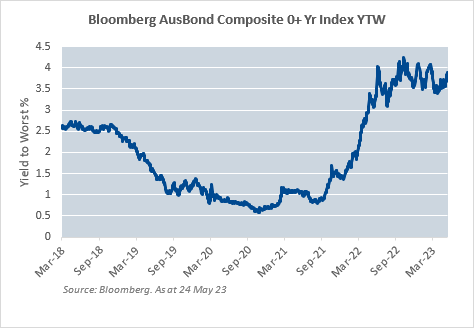

Comparing the yield on the Bloomberg AusBond Composite Index at approximately 3.7% as at the end of April 2023, to a yield close to 1% just 19 months ago illustrates how far yields have moved in a short space of time.

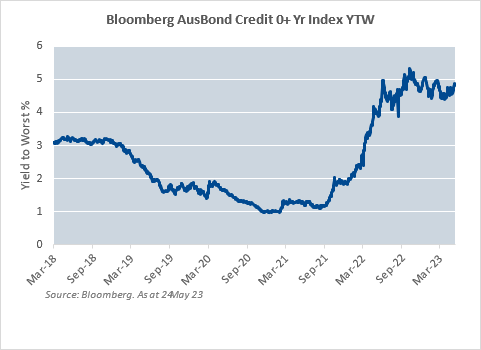

The yield on the Bloomberg Aus Bond Credit 0+ Year Index of 4.5% as at the end of April 2023, paints a similar picture, with that index also yielding close to 1% just 19 months ago.

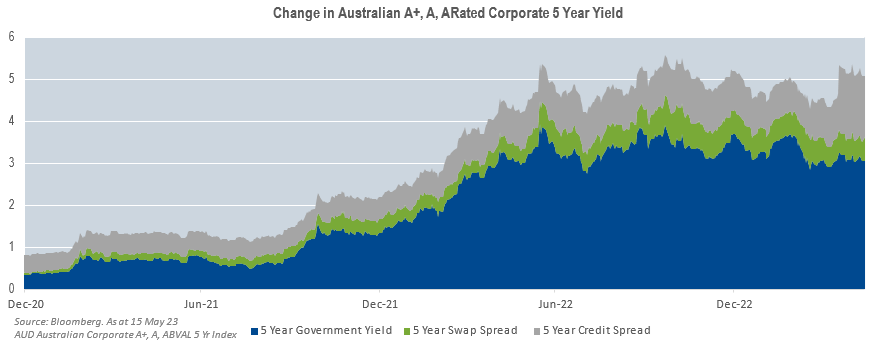

Along with the higher rates caused by the aggressive monetary policy shift, index yields moving higher in Australia are tied to two additional factors.

The first was swap spreads widening across the curve, as liquidity tightened, and rate volatility impacted trading markets.

The second was credit spreads widening as investors re-evaluated the earnings profile of corporates in a rising rate environment. In combination with higher yields, the path for returns was a challenge.

In combination, these moves present fixed income investors with an opportunity to achieve higher prospective returns, without taking on additional credit or illiquidity risk. For investors in Australian fixed income and credit, the opportunity set is particularly compelling.

Credit spreads, which represent a credit investor’s compensation for the increased risk of default above risk free government securities of equivalent terms, are trading at similar levels in Australia compared to offshore markets. This comes despite Australia boasting a relatively high-quality issuer base and a fairly unique market structure.

Australia’s higher quality market is tied to Australian credit being dominated by investment grade issuance and a limited high yield market. Increases to the cost of capital that result from downgrades to sub-investment grade are particularly punitive in Australia. Issuers therefore are conscious of adhering to debt covenants to appease rating agencies and maintain investment grade ratings - which is comforting for investors.

The unique structure of the Australian market is linked to the monopolistic and duopolistic nature of a range of industries commonly issuing into the domestic market. Especially valuable for more highly levered BBB rated issuers in the infrastructure and utility sectors, this brings about pricing power allowing inflationary pressures to be passed on to consumers.

Identifying the businesses best placed to deal with the current economic picture and those trading below fair value requires both in-depth credit analysis and active management which we believe will prove particularly worthwhile as we move toward a likely economic contraction.

Defensive attributes for growth uncertainty

As discussed, 2022 was a standout year not just for the magnitude of the moves in equity and fixed income markets but also because it reminded investors that fixed income and equity markets can decline in tandem. 2022 appears to be the exception rather than the rule as the COVID policy backdrop pushed interest rates exceptionally low and equity markets reached near all-time highs due to cheap financing and the ongoing hunt for returns.

A historical low to negative correlation between stocks and bonds is driven in part by the fundamental structure of each asset class’s cash-flows. Equity cash-flows/dividends are not contractually guaranteed and are therefore subject to the fluctuations of the business cycle. Whereas fixed income securities’ cash flows are predetermined and contractually guaranteed.

In times of stress, growth expectations typically fall, and equity valuations follow. Customarily, market stress also causes a coincident reassessment of the path for rates, with expectations of monetary easing by central banks to promote growth causing bond prices to rally. The move higher in yields recently promotes greater capital appreciation potential in such times of stress and correlation benefits. Recent financial stability issues serve to highlight this.

The month of March 2023 was characterised by a drastic recalibration of cash rate expectations and terminal rates for central banks off the back of financial sector concerns caused by issues at Silicon Valley Bank and subsequently Credit Suisse. Fixed income rallied strongly in that environment.

Revisiting asset allocations

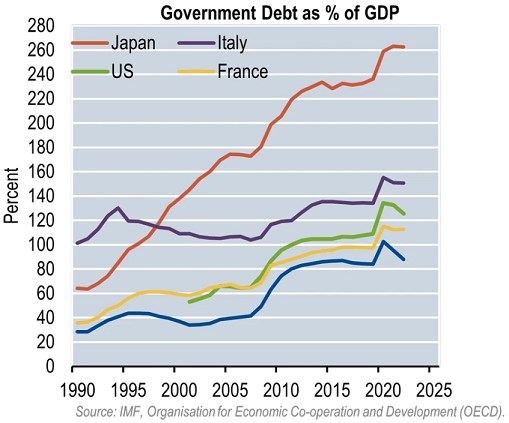

After a rapid and challenging reset, there is growing evidence to suggest that central bank actions are having their intended consequences, slowing economic growth to balance demand and supply and moderate inflation. Our analysis also indicates that the forces that preceded the recent inflation shock, including high government debt, ageing demographics and technological displacement will ultimately reassert themselves.

With that in mind, higher yields and wider spreads offer compelling investment opportunities for fixed income investors. A combination of higher income and potential capital appreciation, matched with renewed diversification benefits and the likelihood of a more stable return profile going forward, sees the asset class well placed to deliver the attributes sought out by investors.

Fixed income remains a critical building block for portfolio construction and investors should always consider the advantages of the differentiated cash flow characteristics offered. Investors should be encouraged to revisit their strategic allocations.

Anthony Kirkham is the Head of Investment Management Australia at Western Asset Management, a Franklin Templeton specialist investment manager. Franklin Templeton is a sponsor of Firstlinks. This article is for information purposes only and does not constitute investment or financial product advice. It does not consider the individual circumstances, objectives, financial situation, or needs of any individual.

For more articles and papers from Franklin Templeton and specialist investment managers, please click here.