Cuffelinks received the following reader question from Ron Myers about 'alternatives', an investing category which means different things to different people. In this response, we focus initially on hedge funds, in Part 1 showing the advantages and in Part 2 addressing the criticisms. A later paper will consider other definitions of 'alternatives'.

“I am an avid reader of Cuffelinks and would like to hear more about 'Alternative Investments'. They seem to be becoming more and more popular as a de-risking strategy in balancing equity risk, however like most investments there appears to be just as many comments against as there are for, so would appreciate hearing from a source which I find presents such issues in an easily understood manner with good appraisal summaries.”

-------------

Investing in hedge funds is one of the more polarising topics in the investment world. There are strongly-held views at each end of the spectrum, with little in-between. The advocates of hedge fund investing paint a rosy picture without acknowledging the negative aspects, while the critics paint the opposing view without acknowledging the potential benefits.

Benefits and challenges

The potential benefits of investing in hedge funds include improved portfolio risk/return characteristics, a reduction in the severity and frequency of losses as well as access to new and otherwise unavailable return streams. However, in order to achieve these benefits we have to address issues such as alignment of interests, higher fees, less liquidity, lower transparency and how to efficiently implement our exposure. As active investors in hedge funds, we know that if we can manage these issues successfully, we're able to provide investors with the advantages mentioned above. The accompanying graphs show a range of these benefits, by comparing various performance metrics for a typical portfolio of hedge funds to the median Australian growth superannuation fund since 1990. The portfolio of hedge funds is represented by the HFRI Fund of Fund Composite Index, hedged into Australian dollars. This should be a fair representation of most investors' experience, because it includes multiple levels of fees and reduces survivorship bias.

The median Australian growth superannuation fund is taken from the Morningstar Australian Superannuation Survey – Multisector Growth universe, and draws on all funds in the survey which have a history dating back to 1 January 1990, a universe of eight underlying funds.

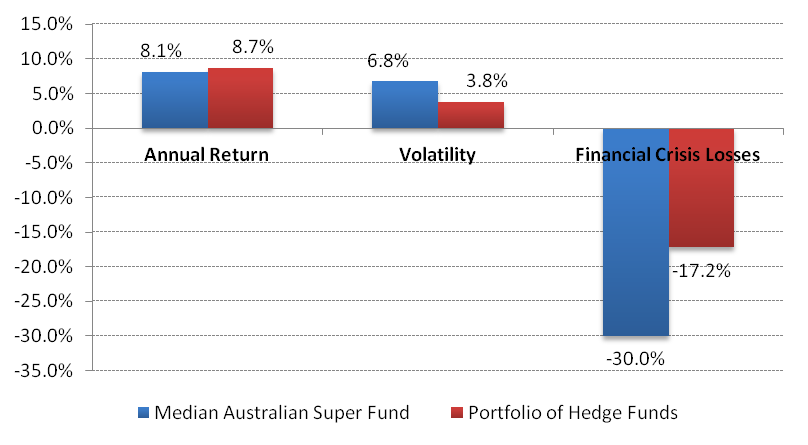

Figure 1. Returns, Volatility and Maximum Losses During GFC for Portfolio of Hedge Funds and Median Australian Growth Superannuation Fund, 31 January 1990 – 31 March 2015.

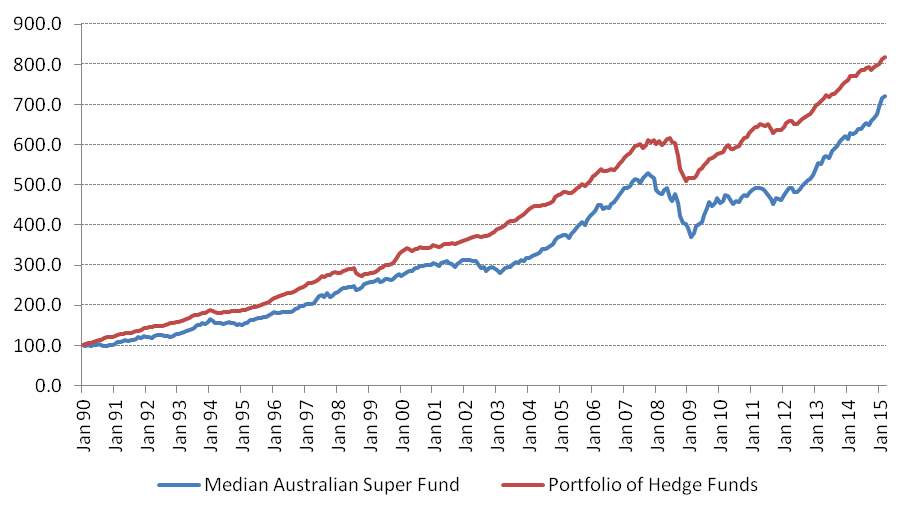

Figure 2. Value of A$100 invested in Portfolio of Hedge Funds and Median Australian Growth Superannuation Fund, 31 January 1990 – 31 March 2015.

Figure 1 shows that over this period, the return from the portfolio of hedge funds has been higher (8.7% compared to 8.1%), with substantially less volatility. The median superfund also sustained losses that were over 70% greater during the recent financial crisis. As a result, the portfolio of hedge funds returned to its pre-crisis value well before the median super fund (Figure 2).

An initial issue to address is the poor general perception of hedge funds. The press frequently portrays hedge funds as speculators that are determined to destabilise markets, and media accounts of hedge funds losing money are common. Our experience of investing in hedge funds is that these characterisations are inaccurate, while not denying that certain investors have experienced losses from investing in hedge funds. This highlights the importance of due diligence, which we regard as a critical part of the investment process in order to avoid investing in hedge funds where there may be catastrophic trading losses or fraud.

Potential benefits of hedge funds

In the following paragraphs we detail some of the potential benefits of investing in hedge funds, before addressing some of the common concerns in Part 2.

Ability to reduce losses

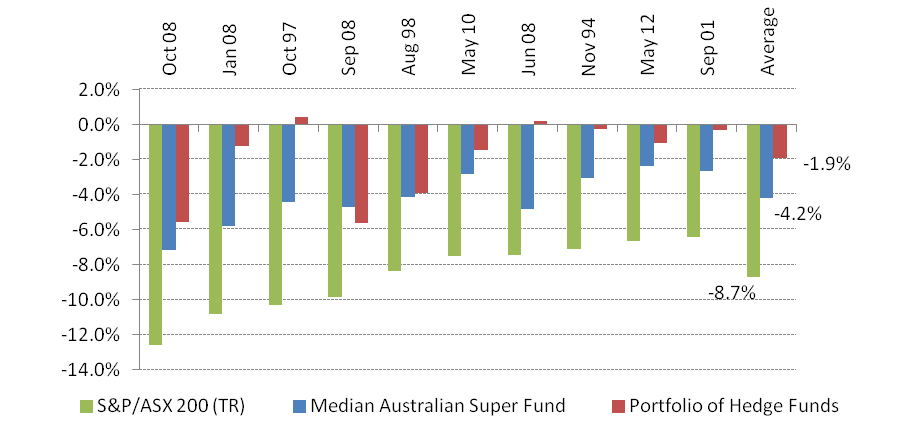

Some hedge funds have an ability to reduce losses during share market selloffs. This is illustrated in Figure 3, which compares the performance of the median Australian growth superfund to a portfolio of hedge funds during the worst 10 months for the S&P/ASX200 Index since January 1990. During these months, the portfolio of hedge funds lost less than 2%, although the loss for the median superfund was over double that (-4.2%), and the loss from the share market was more than four times higher (-8.70%).

Figure 3. Monthly returns of Portfolio of Hedge Funds, Median Australian Growth Superannuation Fund, and S&P/ASX200 Total Return Index during 10 worst months of share market performance over 20 years to 31 March 2015.

Capital preservation

Hedge fund managers think about risk in terms of loss of capital, and actively manage risk to try and limit their losses. A traditional fund manager, by contrast, tends to think about risk in terms of performance deviation from a benchmark, and will generally lose as much as the market does in difficult times.

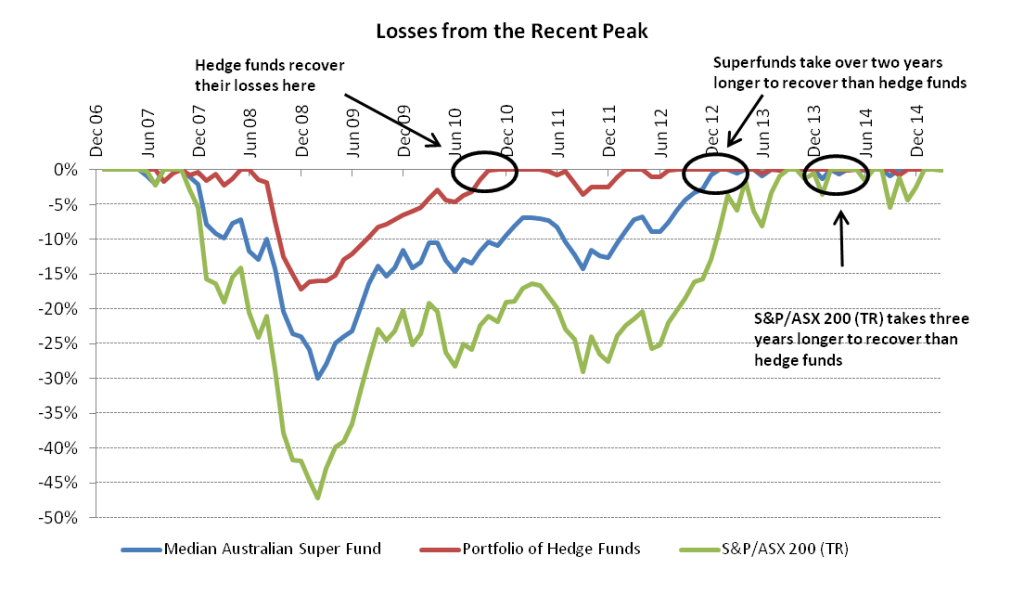

Figure 4. Portfolio of Hedge Funds, Median Australian Growth Superannuation Fund and S&P/ASX200 Total Return Index, losses from 31 January 2007 – 31 March 2015.

Figure 4 shows why we think investing in hedge funds makes sense from a capital preservation perspective. The graph shows the loss that each index experienced from 31 December 2006. This was the worst example of hedge fund losses that we could find, and shows that the hedge fund portfolio lost around 17% over a period when the median Australian growth superannuation fund lost 30% and the Australian share market fell more than 45%. The graph also shows that the portfolio of hedge funds recovered from its losses by November 2010, although the median super fund took a further two years to do so, and the ASX 200 took a full three years to reach its prior high.

Diversification

By reducing exposure to general market movements and only targeting specific risks, a hedge fund can produce a return stream that has a low level of correlation with, and a lower level of downside volatility than general risk assets like equities. This has valuable benefits in portfolio construction, and can lead to a more consistent return profile in a diversified portfolio.

Our data shows that the performance of the median superfund is approximately 90% correlated to movements in the Australian share market, whereas the portfolio of hedge funds is only around 30% correlated (more on this is Part 2). Pleasingly, correlations for hedge funds have dropped toward lower levels which should result in higher benefits to portfolio construction.

Targeted risk-taking

Another key advantage of hedge funds is the ability to target specific risks and hedge unwanted risks (in a similar manner to a person 'hedging their bets'). An example would be a hedge fund which holds a portfolio of favoured stocks but at the same time wants to protect the portfolio from a general fall in the share market. This allows the hedge fund to target risk-taking to the areas where the manager's expertise is strongest.

New return streams

Hedge funds are also able to provide exposure to return streams that are generally not available from traditional funds. Hedge funds can invest in assets or strategies whose returns are driven by different factors to those that drive bond and equity returns. An example is investing in companies that are being liquidated, where the returns are driven by a fairly well-defined legal process, or having exposure to strategies that may require arbitrage or relative value techniques beyond the reach of traditional funds.

Benchmark-unaware

Hedge funds do not generally use index benchmarks, so the concept of tracking error does not constrain them as it does with a traditional manager. Being benchmark-unaware, hedge funds are free to invest in their best ideas and to avoid assets with a poor outlook. Contrast this with a traditional benchmark-aware fund which is compelled to hold overvalued assets that are part of the benchmark index.

How much should be invested?

The question of how much of a portfolio should be invested in hedge funds depends on the specifics of each situation, in particular the initial structure of the portfolio as well as the investor's goals and competing opportunities. It's worth repeating that we don't recommend an allocation to hedge funds for the sake of it, and similarly, we are not advocates of large allocations to hedge fund replication strategies. For most portfolios, we think it makes sense to start with an allocation of 5% to 20%.

Craig Stanford is Head of Alternative Investments at Ibbotson Associates and is Chair of the Investor Education Committee for the Alternative Investment Management Association in Australia. Ibbotson Associates Australia is a Morningstar company and part of Morningstar’s investment management division. Information provided is for general information only, and individuals should seek personal advice before making investment decisions. The objectives of any individual have not been considered in this article.