In the iconic Australian film, The Castle, during the classic court scene, the family lawyer, Dennis Denuto, is struggling to make his case, bumbling around with a copy of the Australian Constitution. Finally, he sums up in a segment that has both entered Australian folklore and become required viewing for law students:

“It’s the vibe of it ... It’s the Constitution. It’s Mabo. It’s justice. It’s law. It’s the vibe and … ah, no, that’s it. It’s the vibe. I rest my case.”

The Constitution has little relevance to his case. It was simply the vibe of the thing.

There’s a similarity now with the assumptions used in calculating future superannuation balances. There's a general vibe drawn from prior performance that is now more like wishful thinking. Let’s consider what a realistic long-term return on superannuation should be, and not just a vibe from the past. This article is not a general review of how the calculators work.

Why bother making forecasts?

Retirement planning should start decades before the end of full-time work, to gain an understanding of how much should be saved to achieve a desired living standard. An assumption about nominal and real rates of return will show how much the market will deliver in addition to capital invested.

In a wonderful world of returns well in excess of inflation rates, driven by compounding over long periods, bond and equity markets will provide the financial resources for a comfortable retirement far quicker than if returns struggle to beat inflation.

This article will focus more on the next 10-year horizon than the truly long term, where it may be possible to generate the strong market performance of the past. But that belongs in the category of a ‘nice problem to have’ given the impact of climate change, technology replacing jobs and a rapidly-ageing workforce over a longer-time period.

Superannuation balance calculators usually assume a nominal rate, then discount the future amount by an inflation factor, currently about 2.5%. In this discussion, 7.5% nominal and 5% real are considered approximately the same.

‘Two cents’ worth’ on super projections

The most popular website for starting to understand investing, including superannuation, for many Australians is Moneysmart, administered by the Australian Securities and Investments Commission (ASIC). It is an excellent resource for all aspects of money management, especially for beginners.

It includes a superannuation calculator designed to determine how much super a member will have when they retire. The inputs include age, income, desired retirement age, super balance, employer contributions, personal contributions and fund fees.

The default investment return is set at 7.5% (before taxes, fees and inflation), updated as at 17 April 2020. It uses Treasury’s long-term retirement income models based on 2019 modelling assumptions from this paper. Curiously, as if they realise the number is a stab in the dark, the link is called ‘Treasury’s Two Cents’.

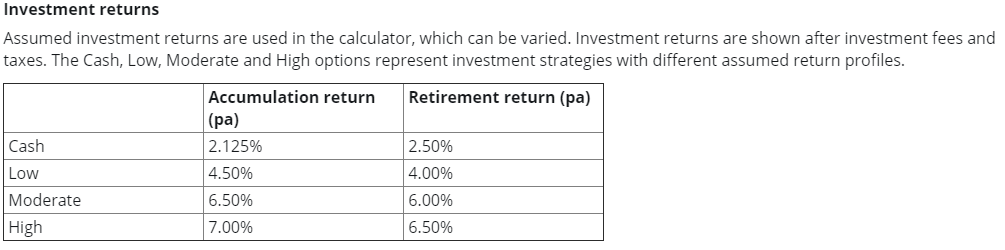

Similarly, every major superannuation fund provides its members with some type of online calculator, such as AustralianSuper, Australia’s largest super fund, updated in April 2020 based on the following assumptions:

Over 90% of AustralianSuper’s members choose the ‘Balanced’ option, with an objective of CPI plus 4% and an investment timeframe of 10 years. This is currently positioned towards 'high' in the table above, so let’s call the return assumption 7%. The option’s permitted asset allocation is wide, allowing a defensive stance of up to 45% in cash and fixed interest or an all-out aggressive stance of 90% to 100% in equities. At the moment, cash and fixed interest is only 15%.

With Moneysmart at 7.5% and a leading industry fund at around 7% for the default option, the question must be asked: Are they dreaming?

Sorry, Millennials and Gen-Z, these returns are in the past

The most obvious factor reducing future returns is the fall in interest rates. Global and Australian markets are at the tail end of a 30-year bull market in bond rates, and in fact, rates peaked at 16.4% for 10-year Australian Treasury rates in 1982. This has not only delivered handsome coupons but strong capital gains on the so-called defensive part of the asset allocation. It has made fixed income and to a lesser extent, cash, an attractive part of the asset allocation.

However, the starting point for future returns is a cash rate and bond rate of 0.25%. The Reserve Bank has signalled ultra-low bond rates for many years to come, driven by the imperative to recover in a post-coronavirus world.

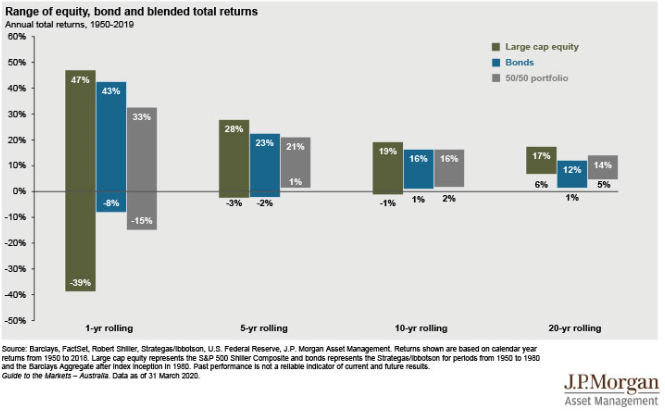

The strong result is that between 1950 and 2019, the 20-year rolling returns (in nominal terms, not adjusted for inflation) for the S&P500 has varied between 6% and 17% per annum and a 50/50 blend 5% to 14% (Australian market returns would be marginally less).

That’s a retirement tailwind that should go straight to the pool room.

In the context of these returns, the assumption of earning 7% looks fine. But these were glorious investment conditions enjoyed by Pre-Boomers, Baby Boomers, and to some extent, Generation-X. Unfortunately Gen-Y (the Millennials) and Gen-Z are unlikely to have it so good.

All that matters now is the future

Anyone investing now cannot live on past returns. While there are as many forecasts in the world as there are economists, let’s draw on four forecasts to glimpse into the future.

1. Elroy Dimson and the London Business School

The Global Investment Returns Yearbook has been published since 2000 and has become a global authority on long-run asset returns. It provides a 120-year review of the risk and performance of the main asset categories in 23 countries in North America, Asia-Pacific, Europe and Africa. It includes a forecast of future returns as an econometric derivation of the data.

Its current edition quotes the lead author, Professor Elroy Dimson (for my 2014 interview with Elroy, see here) forecasting lower future returns because:

“It’s real interest rates that provide the baseline for all risky assets, and when real interest rates are low, so are expected returns.”

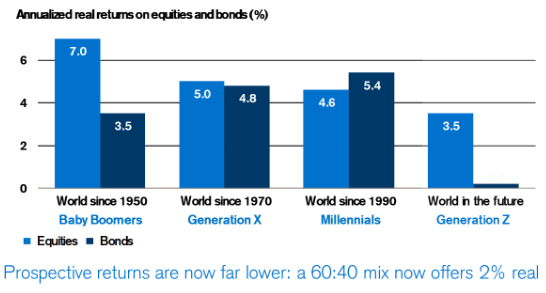

In real terms (adjusted for inflation) interest rates today are effectively negative, other than when credit risk is taken. Professor Dimson, together with his colleagues Professor Marsh and Dr Staunton, expect prospective real returns from equities to be somewhere in the region of 3.5%. However, in a typical 60/40 balanced portfolio used for the default option in most Australian super funds, 40% of the portfolio in fixed interest will probably contribute little.

This means the future balanced portfolio may deliver a real return of only about 2% a year.

Dimson argues that in this low-return environment, it is even more important for investors to reduce the amount they pay in fees. The Yearbook provides the following chart to show how the generations have fared. Returns have fallen over time, but the future is the worst.

Global Investment Returns Yearbook, 2020 edition, likely future returns

Reproduced with permission from The Global Investment Returns Yearbook, written by Elroy Dimson, Paul Marsh and Mike Staunton. Copyright © 2020. See acknowledgement at the end.

2. Robert Shiller's implied future market returns

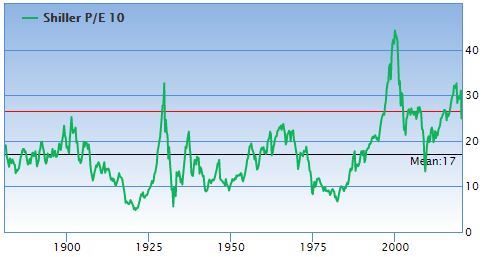

Nobel Laureate, Professor Robert Shiller of Yale University, invented the Shiller Price/Earnings (P/E) Ratio and it has become a standard to measure the market's valuation. This is not the place for a full study of it, but further details are available here and his data base is here.

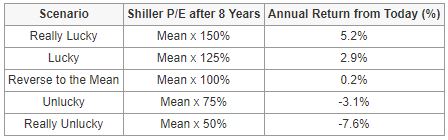

The Shiller P/E 10 in the table below eliminates some of the fluctuations caused by business cycles (10 refers to the average of 10 years of earnings).

As at 4 May 2020, the current Shiller P/E of 27 was 57% higher (the red line above) than the historical mean of 17 (the black line above). An estimate of the future stock market return then comes from three factors:

- Contraction or expansion of the Shiller P/E to the historical mean

- Dividends

- Business growth

Based on the current Shiller P/E level, using this method to calculate the future stock market return, gives around 0.2% (real) a year. (For source and more information see Gurufocus).

The 0.2% is derived from reverting to the mean, and it will take a 'really lucky' result of 150% of the mean to deliver a nominal 5% from today's levels, as shown below. 'Really unlucky' does not bear thinking about.

The market is expensive and this will reduce future returns. However, Shiller places it in the context of the alternative of the extremely low rates on bonds. He wrote in The New York Times on 2 April 2020:

"On balance, I’d emphasize that the stock market is not as expensive as it was just a month ago. Based on history, we would expect to see it to be a reasonable long-term investment, attractive at a time when interest rates are low."

3. Research Affiliates' interactive forecasts

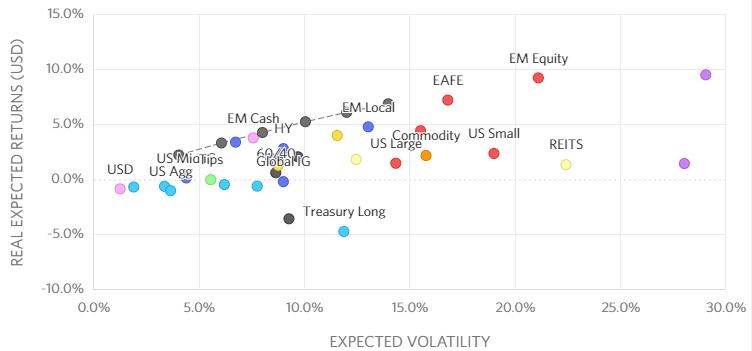

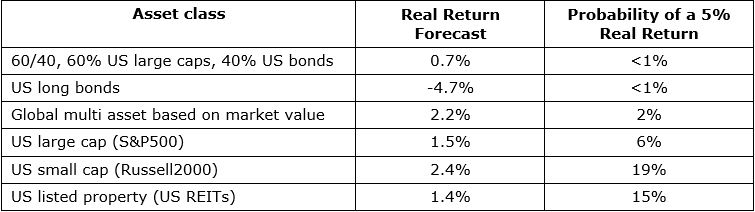

The work of Research Affiliates and its expected return models is notable for its interactive website, allowing investors to check forecasts across a wide range of asset classes, as well as standard deviations and the probabilities of forecast accuracy.

Here is a sample of its 10-year expected returns, plotted against expected volatility. While there are some assets above the 5% real return line, they are mainly in Emerging Markets (EM) where Australians rarely invest. Most traditional markets offer small real returns.

Research Affiliates’ Selected Returns for 10 years, as at 31 March 2020

These real returns offer little prospect of achieving the 4% to 5% assumed in superannuation calculations.

4. Schroders Australia

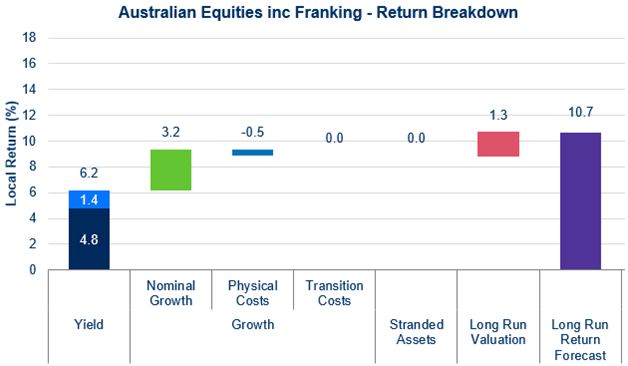

Differences of opinion make a market, and for every buyer, there's a seller. So we reached out to Schroders Australia for a local perspective, and they are more optimistic.

For Australian equities over the next 10 years, updated as at end of April 2020, the forecast is 10.2% (nominal), made up as follows:

In other asset classes, forecasts are 4% for US equities, 6% for global equities, 7.5% for A-REITs and 1% for Australian Government Bonds. This means an allocation of 60/40 (say 30% global equities, 30% local equities and 40% bonds) is forecast to deliver about 5.25% nominal, or 2.75% real.

What should a superannuation member do?

The first step when using a calculator to plan for a future retirement is to be realistic. For all the expert opinions, personal judgement is the final arbiter. For extra security in retirement, instead of expecting 5% above inflation (or a vibe of 7% to 7.5% nominal), aim for closer to 2% to 2.5%.

Planning should not be based on a short-term buying opportunity in the pandemic, but taking a longer-term view across many investment cycles. Shares are down only about 15% and back to early 2019 levels. Markets are trading above their long-term price-to-earnings ratios, and are likely to produce relatively poor returns for at least a decade.

The outlook affects all generations, but in different ways. Baby Boomers who have already built their retirement savings will need to watch drawdown levels, as spending 5% of a pension fund might erode capital quicker than expected. Millennials and Generation Z who are saving may need to put more into superannuation or work longer than their parents to achieve the same balances.

This comes at a time when the costs of bailing out countries from the coronavirus will need to be repaid. In Australia, the $400 billion of virus deficits will hang over future economic growth as governments look to repay debt. While the spending in 2020 is right to support the economy and people in need, the federal government cannot continue to pay the wages of millions of unemployed. Australia will swing back towards a period of fiscal restraint. It’s also likely that spending on health and aged care will ramp up, at the same time as Australia wants to return to a market economy.

The potential for future tensions is obvious. Many people in older generations have benefitted from negative gearing, tax-free capital gains on their family homes, favourable property prices, strong stock and bond markets and lightly taxed savings in the form of superannuation. The calls for increasing pensions, health and aged care spending also predominantly benefit retirees. The social contract between generations will be challenged.

The reality is that return for risk payoffs are now lower. The average long-term expected outcome is reduced but the range of possible outcomes is just as wide, which means a larger proportion of potential outcomes may be unacceptable. But de-risking involves a greater acceptance of a lower average return.

The best way to minimise the impact is to ensure as much financial self-sufficiency as possible, which begins by not deluding ourselves about future returns.

Here's some final words from Robert Shiller's April article:

"As a practical matter, my advice is to look at your portfolio to make sure that it is not so heavily weighted to stocks that further losses would be unbearable. Otherwise, I’d try not to worry too much about the stock market. Most likely, it will do moderately well in the coming years, even if there is a risk that you will need to be very patient."

If someone offers a 7.5% future return on a balanced fund, while there may be a temptation to say "That’s going straight to the pool room", in reality, it should be "Tell 'em they're dreamin'".

What do you think? Use the comments section to add your view.

Graham Hand is Managing Editor of Firstlinks. This article is general information and does not consider the circumstances of any investors.

To obtain permission to reproduce the Yearbook chart, contact the authors at London Business School, Regents Park, London, NW1 4SA, United Kingdom. At a minimum, each chart and table must carry the acknowledgement Copyright © 2020 Elroy Dimson, Paul Marsh and Mike Staunton.