With the upheaval of last year it is easy to overlook huge changes taking place in how the world generates and consumes energy. It has been a long journey to get here.

The concerted push for emissions reduction and a decarbonised global economy has not been easy nor has it been quick. Climate scientists fought for decades simply for acknowledgement of the impending crisis. It took nine years for the UN to ratify the first global agreement combating climate change, the Kyoto Agreement. Another watershed moment was the release of Al Gore’s ‘An Inconvenient Truth’ in 2006, which garnered global mainstream recognition of the climate crisis.

Understandably cleantech investing in the mid-2000s was a ‘hot’ sector though one that failed to live up to the hype. Climate change pundits are now calling this initial wave of investment Cleantech 1.0. It had mixed success for various reasons, namely the widespread adoption and initial success of oil fracking, the GFC and simply because it was too early from a technological standpoint.

We are now in a different world

Recently we have seen global mobilisation across governments, economies, and communities in the fight to address the climate crisis. The Paris Climate Agreement was signed by nearly 200 countries in 2015 and focused on limiting global temperature increase this century to less than two degrees. And just two years ago, Greta Thunberg inspired six million people worldwide to march in the Climate Strikes.

Yet it is the steady advancement of renewable energy technology that has trumped competing energy generation sources.

Enter Cleantech 2.0. Against a backdrop of volatile and structurally challenged oil and thermal coal markets, iteration of existing technology has driven wind and solar to become the cheapest modes of energy generation, and investment in new renewables technologies is ramping up.

This article explores how renewable energy has evolved, where we see it going, and how we have positioned our strategy in the space.

How has renewable energy changed?

Simply put, incumbent and non-renewable sources of energy generation have been ‘priced out’ by renewables.

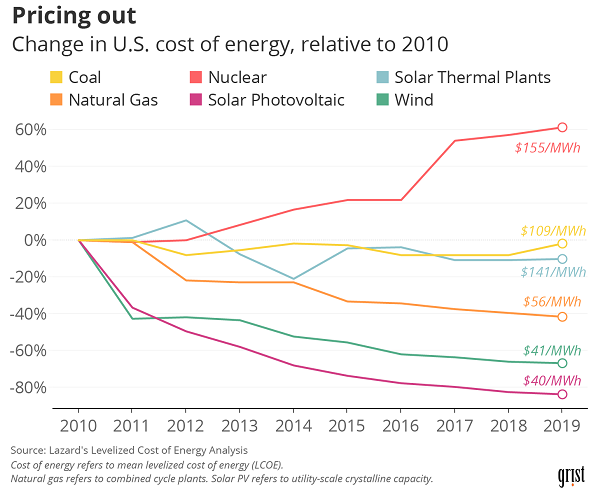

From Figure 1 we can see that the cost of wind and solar energy generation has drastically declined over the past decade. The comparative data provides a complete picture capturing the upfront cost of building energy generation as well as ongoing fuel and operational costs, called ‘levelised cost of energy’ (LCOE).

Figure 1 – Historical unsubsidised levelized cost of energy comparison (utility-scale; global)

Source: Grist, Lazard

LCOE for renewables has declined as existing solar and wind technologies matured and the ability to access those fuel sources is stable over time. They are endlessly available. Comparatively, non-renewable energy sources are increasingly complex and costly to extract despite spending and innovation in those sectors.

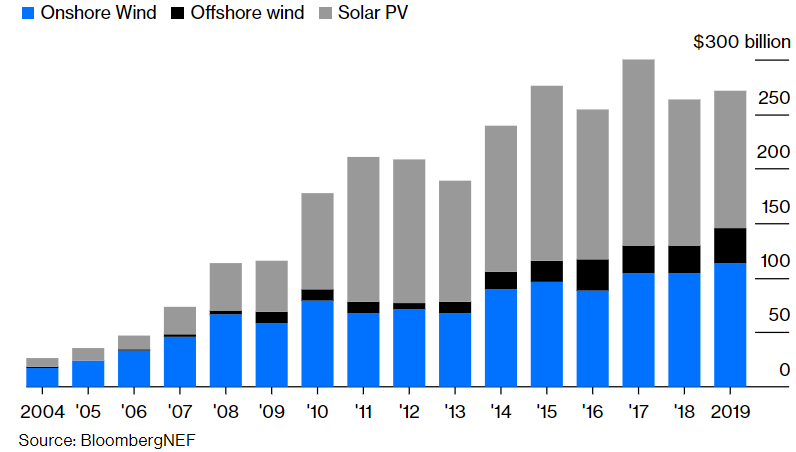

Continual cost reduction in renewable generation has not been a result of major scale ‘venture’ investment. The boom and bust of Cleantech 1.0 stalled major investment in new cutting-edge renewables technologies by venture and early-stage risk capital. Instead, positive iteration of existing renewables technologies has been driven by major increases in asset financing (Figure 2). Annual global investment in wind and solar generation assets has increased 12-fold in the past 15 years.

Figure 2 – Global asset finance investment in wind and solar generation (nominal US dollars)

Source: Bloomberg NEF

A key lesson for those early venture investors was that many cleantech companies developing new technologies were poorly suited for venture capital investment. They required significant upfront and ongoing capital, had long development timelines, and were frequently unable to attract corporate acquirers.

So capital contributions and the types of investors in renewable energy changed following Cleantech 1.0. Venture investors moved away, while asset financiers backed the sector in a big way. As a result, existing and well-known clean technologies related to generation have matured, while spending on delivery of additional new clean technologies has suffered a long hiatus (until now).

How will renewable energy continue to evolve?

This time, the renewables revolution looks different. Three key trends in today’s energy landscape will dictate how the medium term plays out.

1. Clean energy corporate and innovation financing will be more targeted this time round

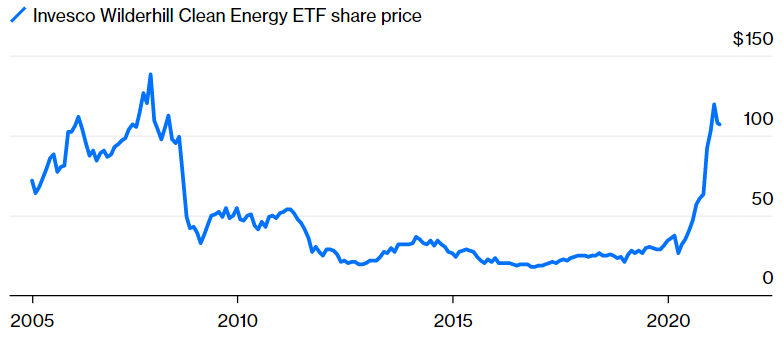

A clear delineation between asset financiers and corporate backers emerged from the collapse of Cleantech 1.0. Corporate interest in clean technology companies and innovation lapsed for over a decade but has now returned. Figure 3 shows the longest running index that tracks stocks and sectors focused on clean energy and climate-change solutions, and investor interest in corporate climate-change solutions has recently exploded.

Figure 3 – Wilderhill Clean Energy ETF share price

Source: WilderShares. Note past performance is not indicative of future performance.

While investor inflows into clean energy companies have clearly recovered, corporate and venture investors are now largely focused on capital-light sectors in specific niches such as wind and solar services, electric vehicles, and battery technology. Niches that are also adjacent to existing and mature wind and solar technologies.

Investment in clean technology innovation will continue its recovery, and we expect adjacent technology niches (such as different battery storage sectors) to attract the most capital and interest.

2. Asset financing is driving increasingly distributed energy markets

Structural inefficiency is embedded in the traditional model of a centralised energy system, where a large power station typically generates electricity far from where it is used. Transmission of energy over distances creates losses and transmission networks require ongoing capital charges to continually refresh the poles and wires infrastructure.

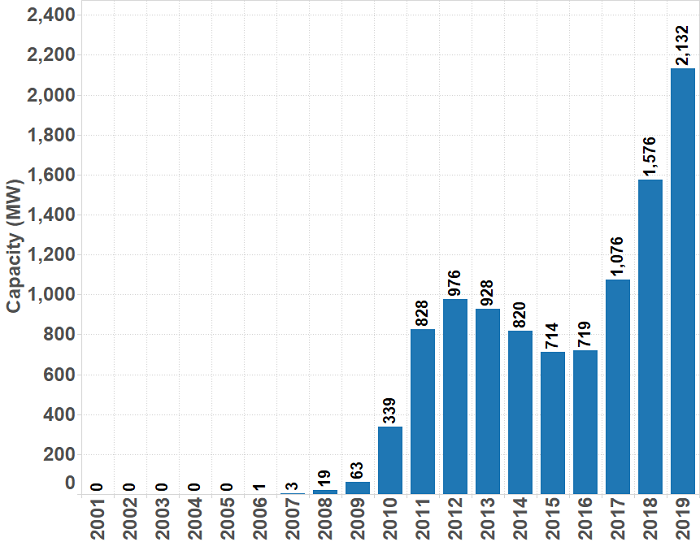

The continual improvement in wind and solar generation technologies discussed earlier in this article have enabled miniaturisation and decentralisation of renewable generation sources. As a result, rooftop solar deployment has rapidly escalated globally, and Australia is no exception (Figure 4).

Figure 4 – Annual installed rooftop solar capacity (Australia)

Source: PV Magazine Australia

Solar panel efficiency will continue to increase as costs continually reduce, and in our view the trend of increasing distribution of energy generation still has a long way to go.

3. Increasing investor focus on ESG and wariness towards greenwashing

A huge driver of capital inflows into climate assets and tech has been the increasing popularity of responsible investments. Last year’s pandemic further heightened scrutiny of corporate and individual footprints in carbon and protection of natural capital.

Investor focus on identification and measurement of actual underlying ESG factors and impact is also sharpening. There is a proliferation of new platforms for upfront measurement and ongoing tracking of ESG, and investors are asking more and more social, governance and sustainability questions of businesses. Investors are also much less forgiving of businesses creating adverse social and environmental impacts. Recent community and investor reactions to mining companies prioritising profits over cultural heritage sites and natural capital serve as stark examples.

How do we invest in the changing energy paradigm?

There are many challenges when investing in such a rapidly-evolving space, so there are a few ways we have refined our approach to renewables investment.

1. Focus on a specific and defensible niche that is well understood

Our decarbonisation investments are focused solely on solar assets that are co-located with customers for the provision of renewable power. We enter long-term agreements with those customers to provide contractually locked-in returns and protections. Those returns are also inflation linked to ensure the relative value of those returns for our investors are not decreasing over time.

We have avoided assets that sell renewable energy into the Australian electricity market (‘in-front-of-the-meter’) because future electricity spot pricing, curtailment and marginal loss factors are just a few areas that are difficult for any investor to accurately price for risk in our national market.

Another important consideration for risk mitigation is diversification. A distributed solar portfolio that is highly concentrated in a single geographic region or with a concentrated group of counterparties has a higher degree of idiosyncratic risk.

2. Continually build domain expertise in a niche, supported by great partners

Our investment strategy is predicated on working with best-in-class operators for our assets within our investment sectors. We build as much domain expertise as possible as active investors. That approach strengthens our partnerships and ensures the best coverage of our portfolios.

In distributed renewables we currently work with two well-known partners in the space – Solar Bay and Green Peak Energy – and have deployed distributed solar across more than 40 assets to date.

3. Understand new technologies, focus on adjacent ones, and avoid the hype until they’re ‘proven’

We are not venture investors. We create positive social and environmental impact and market rate returns through investment in real assets. Our target returns also include a large component of ongoing cashflow generation for investors. That means we do not invest in new technologies with potentially long development timelines, and uncertain outcomes.

But as with anything in our target impact areas, we spend months and even years understanding the need, and the sector that seeks to address it, to make investments that can combine both impact and financial returns.

Alex Debney is a Partner at Conscious Investment Management, a Channel Capital partner. Channel Capital is a sponsor of Firstlinks. This information is not advice or a recommendation in relation to purchasing or selling particular assets. It does not take into account particular investment objectives or needs.

For more articles and papers from Channel Capital and partners, click here.