In a major development arising from the coronavirus-inspired market crash, John Pearce, Chief Investment Officer at the $85 billion Unisuper, told Firstlinks that he has suspended its stock lending programme. Pearce said on Friday:

“I suspended our stock lending program today and I’m hoping that other superfunds follow. My position is that we are comfortable with lending stock to promote market efficiency in ‘normal’ times but these times are clearly abnormal. I think it’s the responsibility of funds to do what they can to bring some order back to the market.”

Stock lending is an arrangement where a holder of shares provides them to a borrower for a set period of time, for which the lender receives a fee. It allows the borrower to ‘short sell’ the stock to benefit from price falls.

Hedge funds that manage long/short funds often go ‘long’ shares they expect to rise in price, and ‘short’ shares they expect to fall. They must borrow the shares they don’t own to facilitate the shorting.

The practice comes under some criticism because it creates selling pressure in shares the traditional investor holds in the expectation the shares will rise in price. However, Pearce is a strong supporter of stock lending in normal market conditions, as it adds to liquidity and generates revenue in the lending programme. For example, Pearce told The Australian Financial Review on 25 September 2017:

"In general conditions – and I would call these days general market conditions – the presence of short sellers is extremely important for the liquidity [and] price discovery process in the market. They play a very important role. As a matter of fact, you would have a dysfunctional market if you didn't have short sellers."

Encouraging other super funds to suspend

As Pearce now says, these coronavirus times are far from normal, and he sees the suspension as helping some order to return to the market. It discourages short-side activity of hedge funds in particular selling to push the market down at such a vulnerable time.

It is known that many of the major super funds, such as AustralianSuper, QSuper and Hostplus participate in lending programmes. If Pearce is successful in gaining widespread support, a major source of access to shares will be withdrawn. He added:

“We are only one fund and the efficacy of our actions will depend on how many other funds follow a similar path. Of course, we are not privy to the thinking of other funds who lend their stock.”

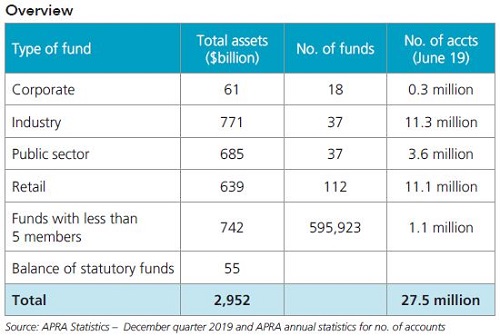

The table below from the Association of Superannuation Funds of Australia (ASFA) shows that of the almost $3 trillion in super, industry funds hold the largest asset segment, at $771 billion in December 2019. Domestic and international equities make up almost 50% of the asset allocation of institutional super funds.

Major Unisuper holdings

Pearce is not shy to take large positions in Australian listed companies. Unisuper’s holdings of companies on the ASX have traditionally been available to prime brokers which specialise in stock lending, and here are their Top 10 positions on the ASX:

- Transurban Group

- Sydney Airport

- ASX

- APA

- Scentre Group

- Woolworths

- GPT

- BHP

- Commonwealth Bank

- Macquarie Group

The availability and cost of shares for shorting varies, and Pearce’s decision will place further pressure on the supply of borrowing capacity.

Member movement to cash stemmed

In his latest video update to Unisuper’s 450,000 members, Pearce admits there has been substantial switching from growth options to cash. He made the presentation to ensure members know the implications of their move. He told me:

“The main objective (of the video) was to stem the flow of switching from our members and I’m told by our call centre that it has definitely had an impact.”

His 15-minute video to Unisuper members is linked below (note it was filmed on 11 March 2020 so some of the numbers are not quite up to date):

Investment market update – March 2020 from UniSuper on Vimeo.

On managing member redemptions, he says:

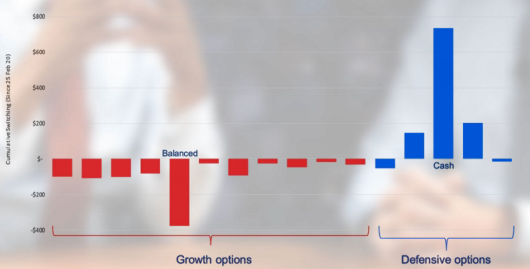

“On the graph in front of you, we have the switching behaviour of members over the recent past. What have we seen? To date, about $1.3 billion of money flowing out of our growth options into our defensive options. You can see the big ones there - big outflow from the Balanced option, big inflow to the Cash option."

Unisuper member switching (25 February to 10 March 2020)

Pearce then explains Unisuper has not needed to sell stocks to manage these switches:

“A switch out of a growth option is effectively a redemption. A member is effectively asking you for cash. At UniSuper, because of our high levels of liquidity, we don't have to do anything in the market. We can simply fund that through our own cash levels. It's a very fortunate position because it means that we have not had to sell into a distressed market.”

Other messages in the video

Pearce argues that accumulation members with a long time before they retire have nothing to worry about in the latest market fall.

Some notable statements include:

“We also have to bear in mind that we've had 10 consecutive positive years. So it's almost the correction that we had to have.”

“So, despite the magnitude of the fall that we're seeing, given the diversification of the Balanced option, we’re still looking at a flattish result for the financial year. But who knows what's going to happen over the next few months.”

"The market is now pricing in a pretty severe recession and a long recession. But that's not the experience of previous types of epidemics or pandemics."

"I think there are two pre-conditions that have to be met to see a turning point. The first one is that we have to see evidence of market capitulation. That is, those investors that have borrowed too much, those investors that have to hedge portfolios, the program traders, and people who are generally worried for their own health and are panicking out of things. I think we've seen evidence that that condition has been satisfied. The second condition, of course, and most importantly, we have to go past the point of peak infections."

The concluding advice to members

Pearce’s final message to his members makes a distinction between accumulation and retirement:

“Accumulation members with a long time before they retire—this is absolutely nothing to worry about. In fact, in a paradoxical sort of way, we've got to welcome these corrections. Because what you're doing is you're effectively buying assets at cheaper prices. And the last thing an accumulation member needs is to keep on buying assets at higher and higher prices.”

“But what about retirees or pre-retirees? … Our Balanced option post the GFC took about three years to recover all of its losses. It recovered 50% of its losses in as low as seven months. So when you think about yourself as a retiree, you're obviously not having to sell everything to fund your lifestyle, it's usually a very small component. As a diversified portfolio, we expect a reasonably quick recovery as well. So I think that's reassuring.”

Graham Hand is Managing Editor of Firstlinks. The video and content are reproduced with permission. The web channel is provided by UniSuper Management Pty Ltd. Trustee: UniSuper Limited. This article is general information and does not consider the circumstances of any investor.